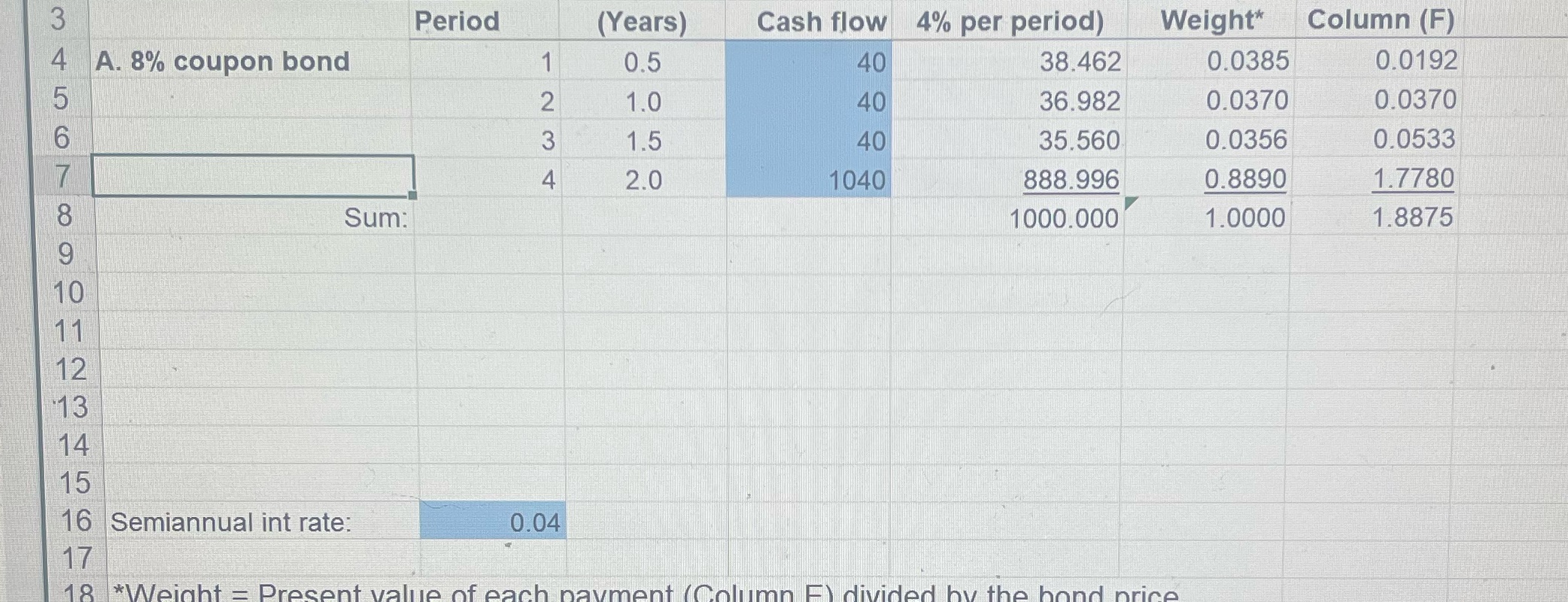

Question: Open theDuration Spreadsheet. This spreadsheet currently shows you how tocalculate the duration of a 2-year 8% semiannual coupon bond, YTM=8%. Note:spreadsheet 3.2 shows you the

Open the"Duration Spreadsheet". This spreadsheet currently shows you how tocalculate the duration of a 2-year 8% semiannual coupon bond, YTM=8%. Note:spreadsheet 3.2 shows you the formulas used in spreadsheet 3.1. Spreadsheet 3.3shows you the excel build-in function to calculate duration. For each part of thequestion, you must mark the final solution and provide the excel table (copy and pasteto the word file).A. (0.6) Modify the spreadsheet 3.1 of "Duration Spreadsheet" to calculate theduration of the 4-year 8% semiannual coupon bond, YTM=10%.B. (0.6) Verify your solution of part A) using spreadsheet 3.3. Hint: You can put anysettlement date and maturity date as long as the maturity matches the question.C. (0.6) Modify the spreadsheet 3.1 of "Duration Spreadsheet" to calculate theduration of the 4-year 8% annual coupon bond, YTM=10%.D. (0.6) Verify your solution of part C) using spreadsheet 3.3E. (0.7) Assume you will be paying $10,000 a year in tuition expenses at the end of thenext 2 years (i.e. $10,000 at end of the year 1, $10,000 at end of the year 2). Marketrate is 8%. Modify the spreadsheet 3.1 of "Duration Spreadsheet" to calculate theduration of your obligation? Hint: you can treat this obligation as a bond.

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts