Question: = Open with Google Docs A) The company's current and can preparators Tassets B) The company's total current assets declined by 0.4%. C) The company's

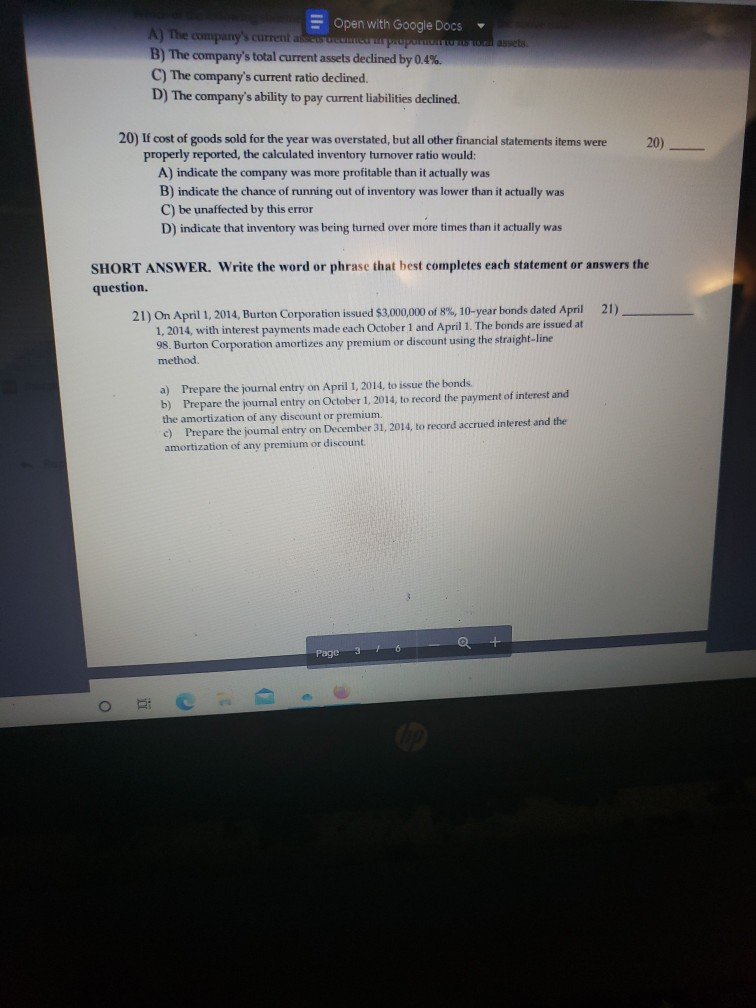

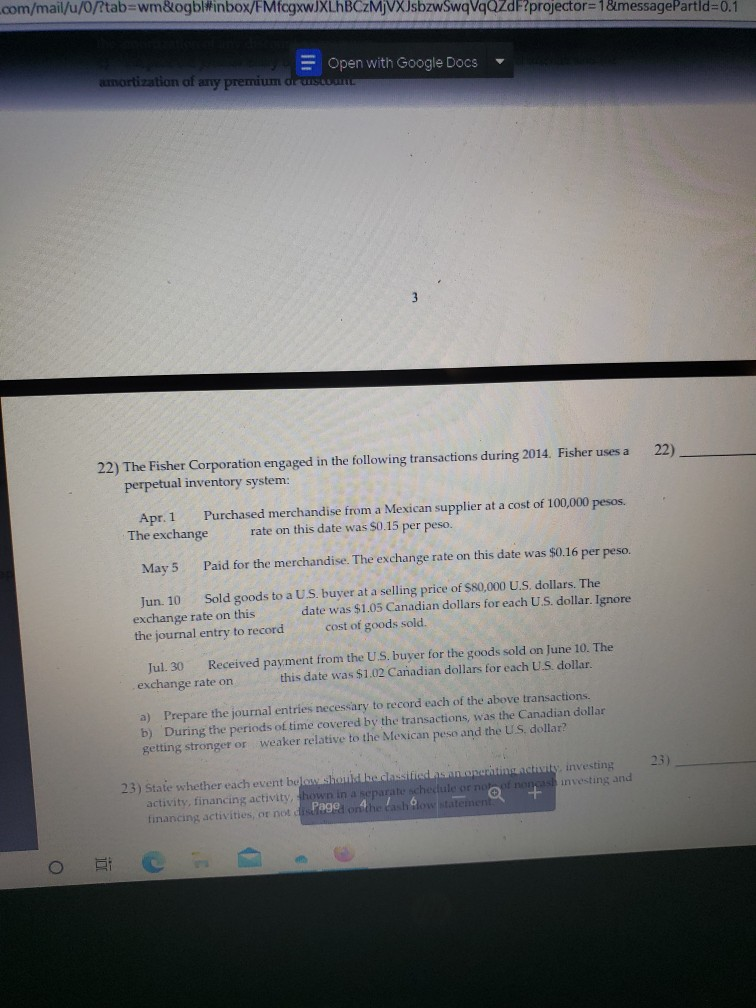

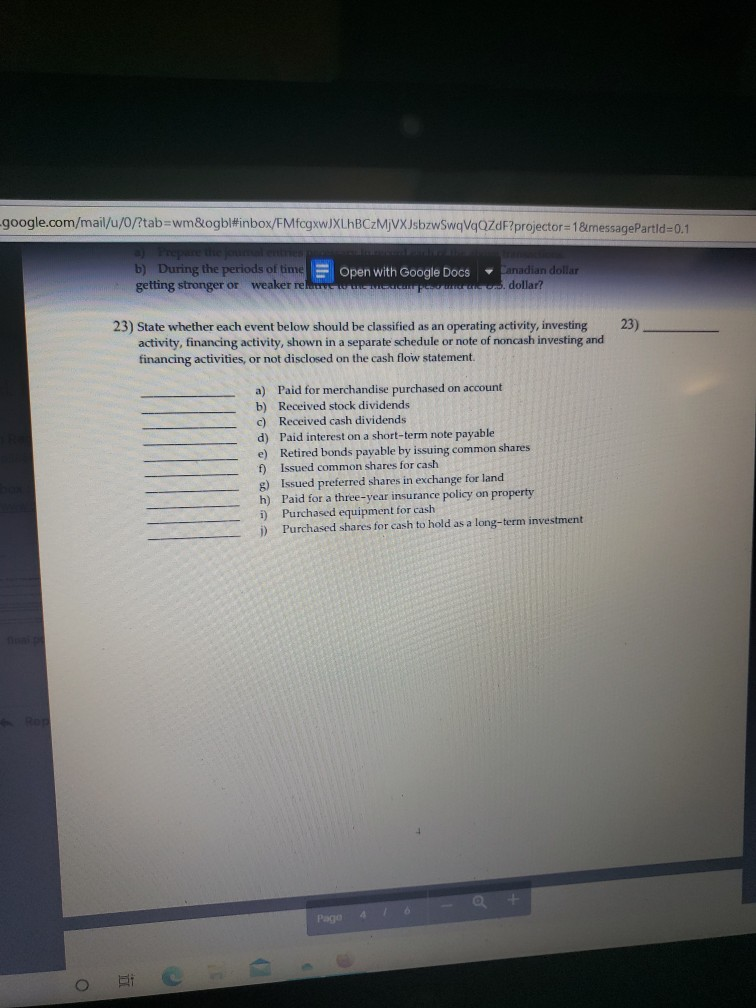

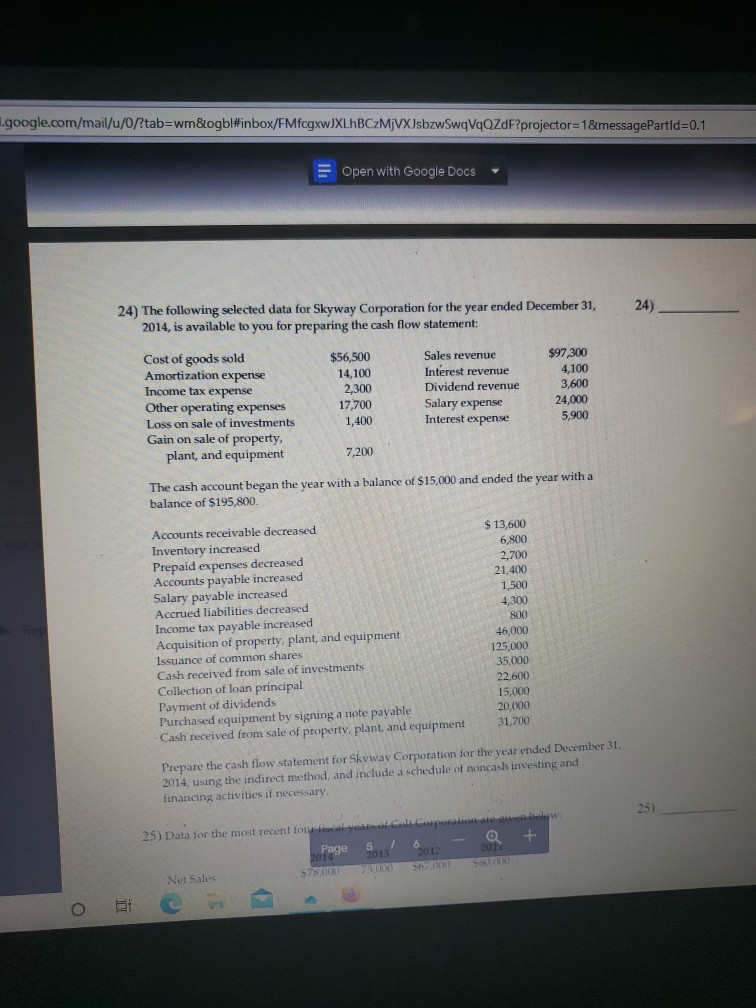

= Open with Google Docs A) The company's current and can preparators Tassets B) The company's total current assets declined by 0.4%. C) The company's current ratio declined. D) The company's ability to pay current liabilities declined. 20) 20) If cost of goods sold for the year was overstated, but all other financial statements items were properly reported the calculated inventory turnover ratio would: A) indicate the company was more profitable than it actually was B) indicate the chance of running out of inventory was lower than it actually was C) be unaffected by this error D) indicate that inventory was being turned over more times than it actually was SHORT ANSWER. Write the word or phrase that best completes each statement or answers the question. 21) On April 1, 2014, Burton Corporation issued $3,000,000 of 8%, 10-year bonds dated April 21) 1, 2014, with interest payments made each October 1 and April 1. The bonds are issued at 98. Burton Corporation amortizes any premium or discount using the straight-line method a) Prepare the journal entry on April 1, 2014, to issue the bonds. b) Prepare the journal entry on October 1, 2014, to record the payment of interest and the amortization of any discount or premium. c) Prepare the joumal entry on December 31, 2014, to record accrued interest and the amortization of any premium or discount .) com/mail/u/0/?tab=wm&ogblinbox/FMfcgxwJXLhBCzMjVXJsbzwSwqVqazdF?projector=1&messagePartid=0.1 = Open with Google Docs amortization of any premium Oradea 22) 22) The Fisher Corporation engaged in the following transactions during 2014. Fisher uses a perpetual inventory system: Purchased merchandise from a Mexican supplier at a cost of 100,000 pesos. The exchange rate on this date was $0.15 per peso. Apr. 1 May 5 Paid for the merchandise. The exchange rate on this date was $0.16 per peso. Jun. 10 Sold goods to a U.S. buyer at a selling price of $80,000 U.S. dollars. The exchange rate on this date was $1.05 Canadian dollars for each U.S. dollar. Ignore the journal entry to record cost of goods sold. Jul. 30 Received payment from the U.S. buyer for the goods sold on June 10. The exchange rate on this date was $1.02 Canadian dollars for each US dollar. a) Prepare the journal entries necessary to record each of the above transactions. b) During the periods of time covered by the transactions, was the Canadian dollar getting stronger or weaker relative to the Mexican peso and the US dollar? 23) 23) State whether each event below should be classificadas en continuativity, investing activity, financing activity, hown in a separate schedule on investing and + Page 6 financing activities, or not -google.com/mail/u/0/?tab=wm&ogbl#inbox/FMfcgxwJXLhBCzMjVXJsbzwSwqVqQzdf?projector=1&messagePartid=0.1 b) During the periods of time E Open with Google Docsanadian dollar getting stronger or weaker relep.dollar? 23) 23) State whether each event below should be classified as an operating activity, investing activity, financing activity, shown in a separate schedule or note of noncash investing and financing activities, or not disclosed on the cash flow statement. a) Paid for merchandise purchased on account b) Received stock dividends c) Received cash dividends d) Paid interest on a short-term note payable e) Retired bonds payable by issuing common shares f) Issued common shares for cash 8) Issued preferred shares in exchange for land h) Paid for a three-year insurance policy on property i) Purchased equipment for cash 1) Purchased shares for cash to hold as a long-term investment Pago BT o .google.com/mail/u/0/?tab=wm&ogbl#inbox/FMfcgxwJXLhBCzMjVXJsbzwSwqVqQZdF?projector=1&message Partid=0.1 = Open with Google Docs 24) 24) The following selected data for Skyway Corporation for the year ended December 31, 2014, is available to you for preparing the cash flow statement: Cost of goods sold Amortization expense Income tax expense Other operating expenses Loss on sale of investments Gain on sale of property, plant, and equipment $56,500 14,100 2.300 17,700 1,400 Sales revenue Interest revenue Dividend revenue Salary expense Interest expense $97,300 4,100 3,600 24,000 5,900 7,200 The cash account began the year with a balance of $15,000 and ended the year with a balance of $195,800. increased Income Accounts receivable decreased Inventory increased Prepaid expenses decreased Accounts payable Salary payable increased Accrued liabilities decreased tax payable increased Acquisition of property, plant, and equipment Issuance of common shares Cash received from sale of investments Collection of loan principal Payment of dividends Purchased equipment by signing a note payable Cash received from sale of property, plant, and equipment $ 13,600 6,800 2,700 21,400 1.500 4300 800 46,000 125,000 35,000 22,600 15,000 20.000 31,700 Prepare the cash flow statement for Skyway Corporation for the year ended December 31, 2014, using the indirect method, and include a schedule of noncash investing and financing activities if necessary 25) + 25) Data for the most recent foil Corpora Page 51 Net Sales 57800 25) Data for the most recent four fiscal years of Colt Corporation are given below: 25) Net Sales Cost of goods sold Gross margin Operating expenses Net income 2014 $78,000 33,000 45,000 25,000 20,000 2013 75,000 32,000 43,000 22,000 21,000 2012 $67,000 30,000 37,000 2011 $60,000 26,000 34,000 14,000 20,000 19,000 18,000 a) Prepare an analysis showing the trend percentages for the four-year period using 2007 as the base year. b) What do the trend percentages indicate regarding Colt Corporation's income statement data? Page 5 26) 26) Roth Corporation used the equity method to report the following transactions for the years 2013 and 2014: 2013 Feb, 2 $500,000 Purchased 40% of the voting common shares of Dunn Enterprises Inc. for This is a long-term investment giving Roth Corporation significant influence over the operations of Dunn Enterprises Inc. Oct. 15 Received $20,000 cash dividends on Dunn Enterprises Inc. common shares. Dec 31 Dunn Enterprises Inc. reported total income of $190,000 for the year ended December 31, 2013 2014 Jun 30 Dunn Enterprises Inc. reported total income of $40,000 for the six months ended June 30, 2014 30 Sold one-half of the Dunn Enterprises Inc. shares for $275,000 Prepare journal entries to record the above transactions. Page 6 / 6 - 1 i = Open with Google Docs A) The company's current and can preparators Tassets B) The company's total current assets declined by 0.4%. C) The company's current ratio declined. D) The company's ability to pay current liabilities declined. 20) 20) If cost of goods sold for the year was overstated, but all other financial statements items were properly reported the calculated inventory turnover ratio would: A) indicate the company was more profitable than it actually was B) indicate the chance of running out of inventory was lower than it actually was C) be unaffected by this error D) indicate that inventory was being turned over more times than it actually was SHORT ANSWER. Write the word or phrase that best completes each statement or answers the question. 21) On April 1, 2014, Burton Corporation issued $3,000,000 of 8%, 10-year bonds dated April 21) 1, 2014, with interest payments made each October 1 and April 1. The bonds are issued at 98. Burton Corporation amortizes any premium or discount using the straight-line method a) Prepare the journal entry on April 1, 2014, to issue the bonds. b) Prepare the journal entry on October 1, 2014, to record the payment of interest and the amortization of any discount or premium. c) Prepare the joumal entry on December 31, 2014, to record accrued interest and the amortization of any premium or discount .) com/mail/u/0/?tab=wm&ogblinbox/FMfcgxwJXLhBCzMjVXJsbzwSwqVqazdF?projector=1&messagePartid=0.1 = Open with Google Docs amortization of any premium Oradea 22) 22) The Fisher Corporation engaged in the following transactions during 2014. Fisher uses a perpetual inventory system: Purchased merchandise from a Mexican supplier at a cost of 100,000 pesos. The exchange rate on this date was $0.15 per peso. Apr. 1 May 5 Paid for the merchandise. The exchange rate on this date was $0.16 per peso. Jun. 10 Sold goods to a U.S. buyer at a selling price of $80,000 U.S. dollars. The exchange rate on this date was $1.05 Canadian dollars for each U.S. dollar. Ignore the journal entry to record cost of goods sold. Jul. 30 Received payment from the U.S. buyer for the goods sold on June 10. The exchange rate on this date was $1.02 Canadian dollars for each US dollar. a) Prepare the journal entries necessary to record each of the above transactions. b) During the periods of time covered by the transactions, was the Canadian dollar getting stronger or weaker relative to the Mexican peso and the US dollar? 23) 23) State whether each event below should be classificadas en continuativity, investing activity, financing activity, hown in a separate schedule on investing and + Page 6 financing activities, or not -google.com/mail/u/0/?tab=wm&ogbl#inbox/FMfcgxwJXLhBCzMjVXJsbzwSwqVqQzdf?projector=1&messagePartid=0.1 b) During the periods of time E Open with Google Docsanadian dollar getting stronger or weaker relep.dollar? 23) 23) State whether each event below should be classified as an operating activity, investing activity, financing activity, shown in a separate schedule or note of noncash investing and financing activities, or not disclosed on the cash flow statement. a) Paid for merchandise purchased on account b) Received stock dividends c) Received cash dividends d) Paid interest on a short-term note payable e) Retired bonds payable by issuing common shares f) Issued common shares for cash 8) Issued preferred shares in exchange for land h) Paid for a three-year insurance policy on property i) Purchased equipment for cash 1) Purchased shares for cash to hold as a long-term investment Pago BT o .google.com/mail/u/0/?tab=wm&ogbl#inbox/FMfcgxwJXLhBCzMjVXJsbzwSwqVqQZdF?projector=1&message Partid=0.1 = Open with Google Docs 24) 24) The following selected data for Skyway Corporation for the year ended December 31, 2014, is available to you for preparing the cash flow statement: Cost of goods sold Amortization expense Income tax expense Other operating expenses Loss on sale of investments Gain on sale of property, plant, and equipment $56,500 14,100 2.300 17,700 1,400 Sales revenue Interest revenue Dividend revenue Salary expense Interest expense $97,300 4,100 3,600 24,000 5,900 7,200 The cash account began the year with a balance of $15,000 and ended the year with a balance of $195,800. increased Income Accounts receivable decreased Inventory increased Prepaid expenses decreased Accounts payable Salary payable increased Accrued liabilities decreased tax payable increased Acquisition of property, plant, and equipment Issuance of common shares Cash received from sale of investments Collection of loan principal Payment of dividends Purchased equipment by signing a note payable Cash received from sale of property, plant, and equipment $ 13,600 6,800 2,700 21,400 1.500 4300 800 46,000 125,000 35,000 22,600 15,000 20.000 31,700 Prepare the cash flow statement for Skyway Corporation for the year ended December 31, 2014, using the indirect method, and include a schedule of noncash investing and financing activities if necessary 25) + 25) Data for the most recent foil Corpora Page 51 Net Sales 57800 25) Data for the most recent four fiscal years of Colt Corporation are given below: 25) Net Sales Cost of goods sold Gross margin Operating expenses Net income 2014 $78,000 33,000 45,000 25,000 20,000 2013 75,000 32,000 43,000 22,000 21,000 2012 $67,000 30,000 37,000 2011 $60,000 26,000 34,000 14,000 20,000 19,000 18,000 a) Prepare an analysis showing the trend percentages for the four-year period using 2007 as the base year. b) What do the trend percentages indicate regarding Colt Corporation's income statement data? Page 5 26) 26) Roth Corporation used the equity method to report the following transactions for the years 2013 and 2014: 2013 Feb, 2 $500,000 Purchased 40% of the voting common shares of Dunn Enterprises Inc. for This is a long-term investment giving Roth Corporation significant influence over the operations of Dunn Enterprises Inc. Oct. 15 Received $20,000 cash dividends on Dunn Enterprises Inc. common shares. Dec 31 Dunn Enterprises Inc. reported total income of $190,000 for the year ended December 31, 2013 2014 Jun 30 Dunn Enterprises Inc. reported total income of $40,000 for the six months ended June 30, 2014 30 Sold one-half of the Dunn Enterprises Inc. shares for $275,000 Prepare journal entries to record the above transactions. Page 6 / 6 - 1

Step by Step Solution

There are 3 Steps involved in it

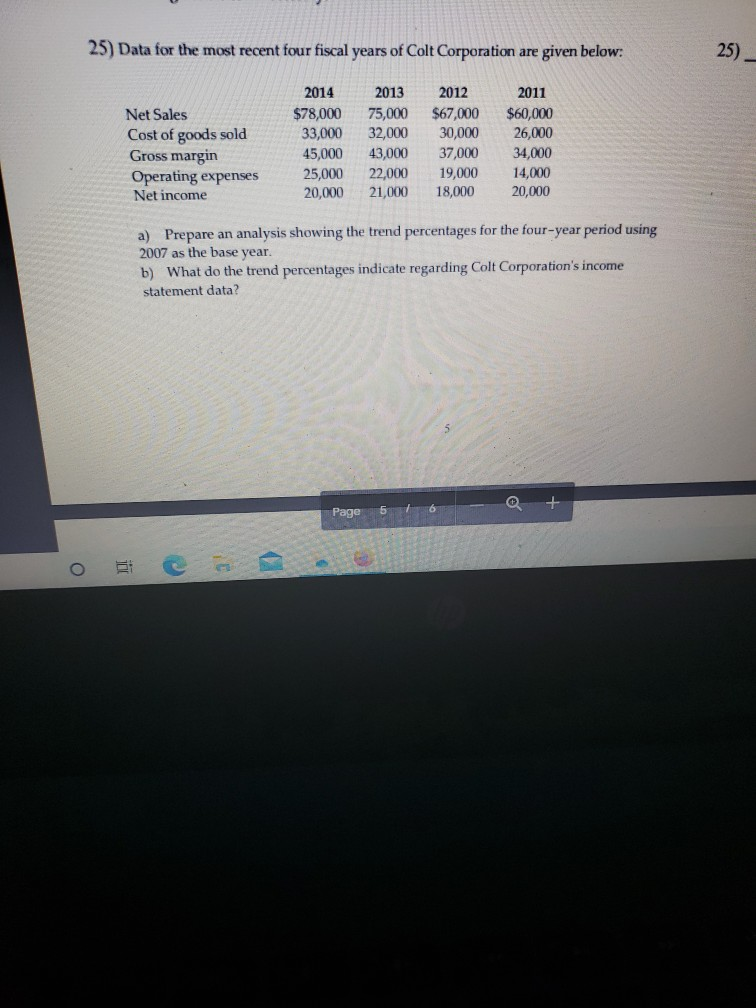

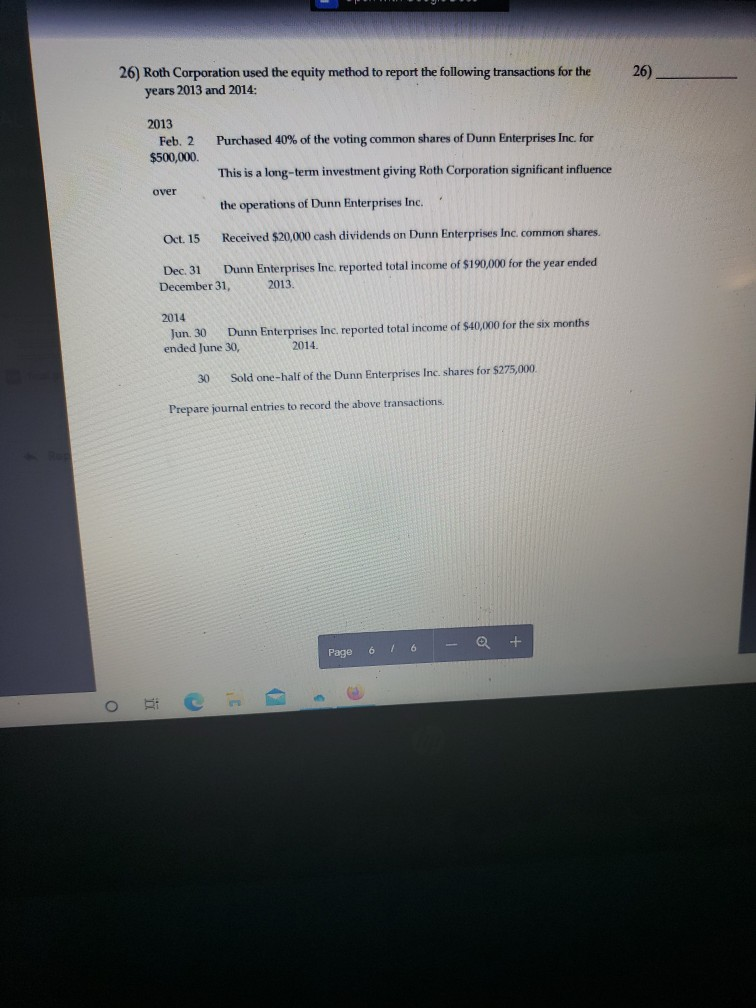

Get step-by-step solutions from verified subject matter experts