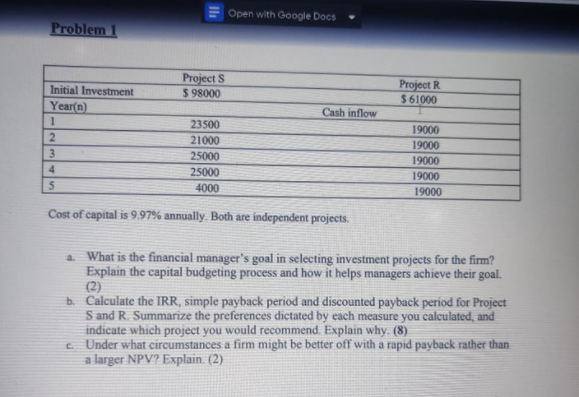

Question: Open with Google Docs Problem 1 Projects $ 98000 Project R $ 61000 Cash inflow Initial Investment Year(n) 1 2 3 4 5 23500 21000

Open with Google Docs Problem 1 Projects $ 98000 Project R $ 61000 Cash inflow Initial Investment Year(n) 1 2 3 4 5 23500 21000 25000 25000 4000 19000 19000 19000 19000 19000 Cost of capital is 9.97% annually. Both are independent projects. What is the financial manager's goal in selecting investment projects for the firm? Explain the capital budgeting process and how it helps managers achieve their goal. b. Calculate the IRR, simple payback period and discounted payback period for Project S and R. Summarize the preferences dictated by each measure you calculated, and indicate which project you would recommend. Explain why. (8) Under what circumstances a firm might be better off with a rapid payback rather than a larger NPV? Explain. (2)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts