Question: Open with Google Docs Question 5 Mr. Choo commenced his employment with Realistic Sdn. Bhd. on 1.1.2020 at a monthly salary of RM7,760. His employer

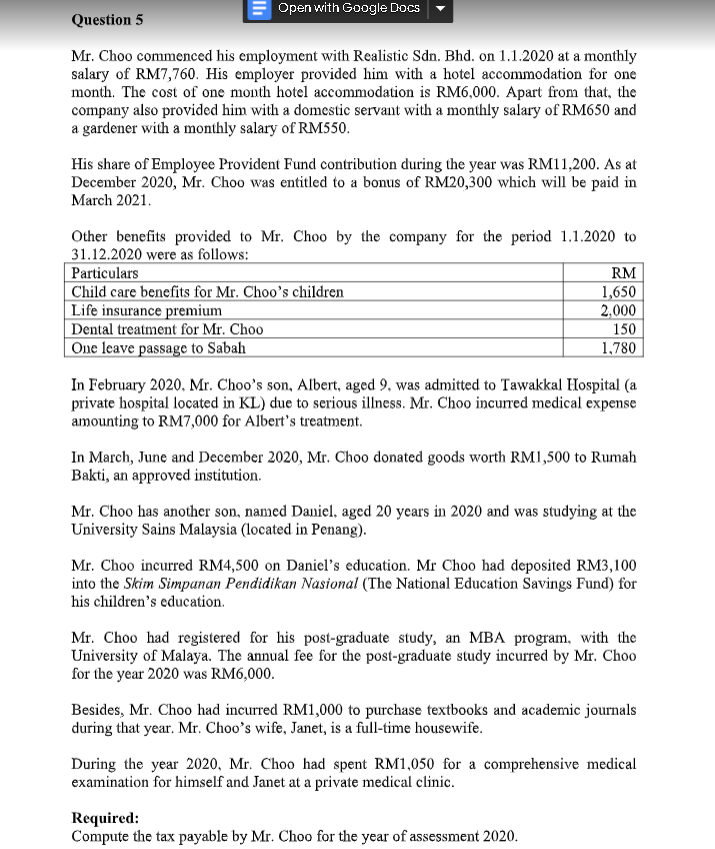

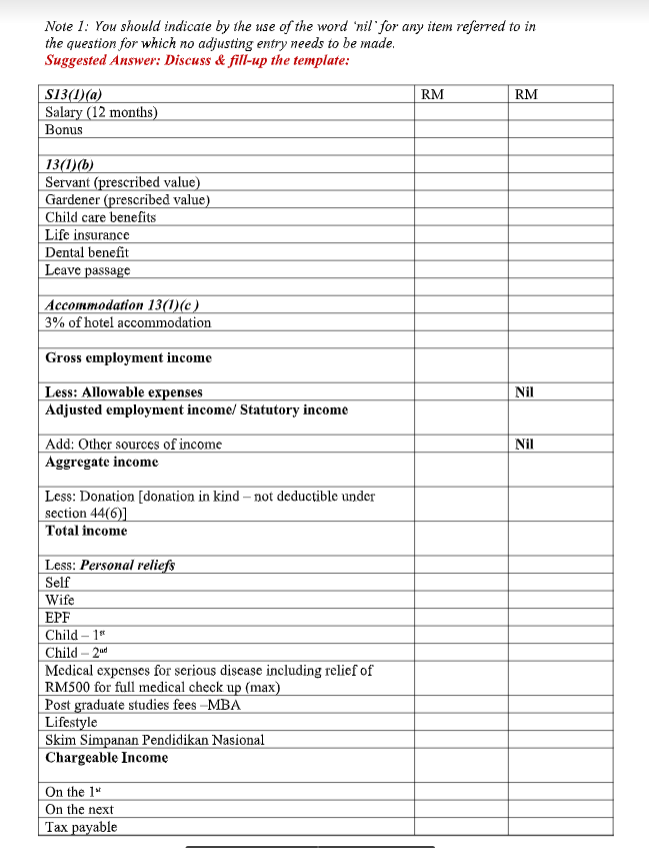

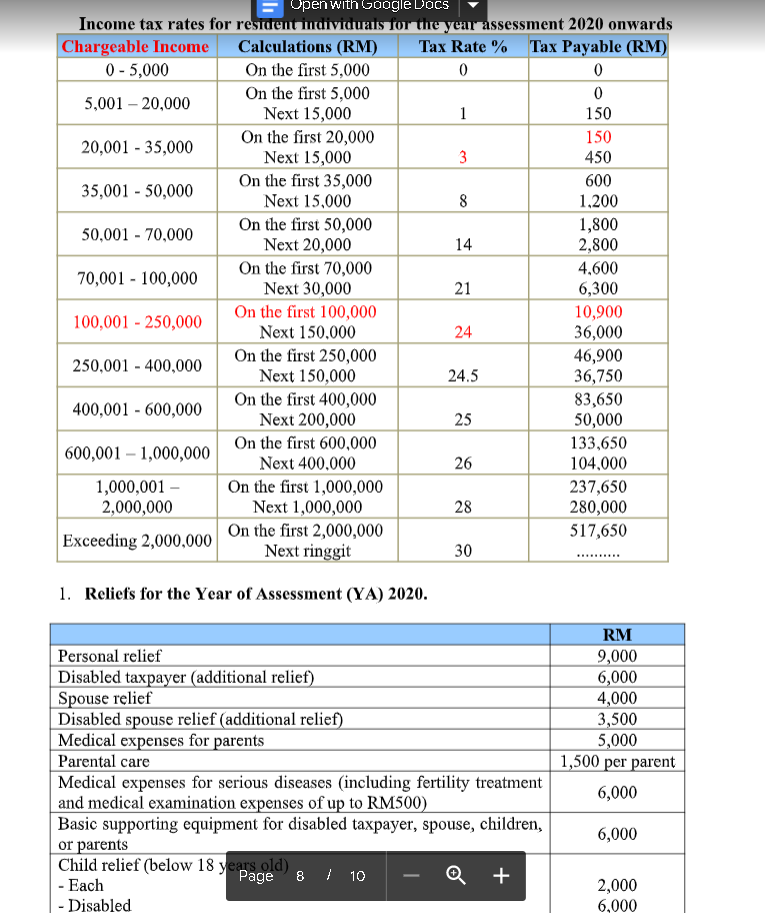

Open with Google Docs Question 5 Mr. Choo commenced his employment with Realistic Sdn. Bhd. on 1.1.2020 at a monthly salary of RM7,760. His employer provided him with a hotel accommodation for one month. The cost of one month hotel accommodation is RM6,000. Apart from that, the company also provided him with a domestic servant with a monthly salary of RM650 and a gardener with a monthly salary of RM550. His share of Employee Provident Fund contribution during the year was RM11,200. As at December 2020, Mr. Choo was entitled to a bonus of RM20,300 which will be paid in March 2021 Other benefits provided to Mr. Choo by the company for the period 1.1.2020 to 31.12.2020 were as follows: Particulars RM Child care benefits for Mr. Choo's children 1,650 Life insurance premium 2.000 Dental treatment for Mr. Choo 150 One leave passage to Sabah 1,780 In February 2020. Mr. Choo's son, Albert, aged 9, was admitted to Tawakkal Hospital (a private hospital located in KL) due to serious illness. Mr. Choo incurred medical expense amounting to RM7,000 for Albert's treatment In March, June and December 2020, Mr. Choo donated goods worth RM1,500 to Rumah Bakti, an approved institution. Mr. Choo has another son, named Daniel, aged 20 years in 2020 and was studying at the University Sains Malaysia (located in Penang). Mr. Choo incurred RM4,500 on Daniel's education. Mr Choo had deposited RM3,100 into the Skim Simpanan Pendidikan Nasional (The National Education Savings Fund) for his children's education. Mr. Choo had registered for his post-graduate study, an MBA program, with the University of Malaya. The annual fee for the post-graduate study incurred by Mr. Choo for the year 2020 was RM6,000. Besides, Mr. Choo had incurred RM1,000 to purchase textbooks and academic journals during that year. Mr. Choo's wife, Janet, is a full-time housewife. During the year 2020, Mr. Choo had spent RM1,050 for a comprehensive medical examination for himself and Janet at a private medical clinic. Required: Compute the tax payable by Mr. Choo for the year of assessment 2020. Note 1: You should indicate by the use of the word 'nil for any item referred to in the question for which no adjusting entry needs to be made. Suggested Answer: Discuss & fill-up the template: RM RM S13(1)(a) Salary (12 months) Bonus 13(1)(6) Servant (prescribed value) Gardener (prescribed value) Child care benefits Life insurance Dental benefit Leave passage Accommodation 130(c) 3% of hotel accommodation Gross employment income Less: Allowable expenses Adjusted employment income/ Statutory income Nil Nil Add: Other sources of income Aggregate income Less: Donation (donation in kind - not deductible under section 446) Total income Less: Personal reliefs Self Wife EPF Child-1" Child - 2 Medical expenses for serious disease including relief of RM500 for full medical check up (max) Post graduate studies fees MBA Lifestyle Skim Simpanan Pendidikan Nasional Chargeable Income On the 1* On the next Tax payable 3 - Open with Google Docs Income tax rates for resident Muiviuuais for the year assessment 2020 onwards Chargeable Income Calculations (RM) Tax Rate % Tax Payable (RM) 0 - 5,000 On the first 5,000 0 0 5,001 - 20,000 On the first 5,000 0 Next 15,000 1 150 On the first 20,000 150 20,001 - 35,000 Next 15,000 3 450 35,001 - 50,000 600 On the first 35,000 Next 15,000 8 1.200 On the first 50,000 1,800 50,001 - 70,000 Next 20,000 14 2,800 On the first 70,000 4,600 70,001 - 100,000 Next 30,000 21 6,300 On the first 100,000 10,900 100,001 - 250,000 Next 150.000 24 36,000 On the first 250,000 46,900 250,001 - 400,000 Next 150,000 24.5 36,750 On the first 400,000 400,001 - 600,000 83,650 Next 200,000 25 50,000 600,001 - 1,000,000 On the first 600,000 133,650 Next 400.000 26 104.000 1,000,001 - On the first 1,000,000 237,650 2,000,000 Next 1,000,000 28 280,000 On the first 2,000,000 Exceeding 2,000,000 517,650 Next ringgit 30 1. Reliefs for the Year of Assessment (YA) 2020. Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) Page 8 / 10 + - Each - Disabled RM 9,000 6,000 4,000 3,500 5,000 1,500 per parent 6,000 6,000 2,000 6,000 8,000 14,000 8,000 3,000 4,000 Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical/education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense - purchase of computer, smartphone, or tablet not for business use from 1* June 2020 to 31* December 2020 Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions from 15 March 2020. 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 2. Rebates for the Year of Assessment (YA) 2020. RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400 Open with Google Docs Question 5 Mr. Choo commenced his employment with Realistic Sdn. Bhd. on 1.1.2020 at a monthly salary of RM7,760. His employer provided him with a hotel accommodation for one month. The cost of one month hotel accommodation is RM6,000. Apart from that, the company also provided him with a domestic servant with a monthly salary of RM650 and a gardener with a monthly salary of RM550. His share of Employee Provident Fund contribution during the year was RM11,200. As at December 2020, Mr. Choo was entitled to a bonus of RM20,300 which will be paid in March 2021 Other benefits provided to Mr. Choo by the company for the period 1.1.2020 to 31.12.2020 were as follows: Particulars RM Child care benefits for Mr. Choo's children 1,650 Life insurance premium 2.000 Dental treatment for Mr. Choo 150 One leave passage to Sabah 1,780 In February 2020. Mr. Choo's son, Albert, aged 9, was admitted to Tawakkal Hospital (a private hospital located in KL) due to serious illness. Mr. Choo incurred medical expense amounting to RM7,000 for Albert's treatment In March, June and December 2020, Mr. Choo donated goods worth RM1,500 to Rumah Bakti, an approved institution. Mr. Choo has another son, named Daniel, aged 20 years in 2020 and was studying at the University Sains Malaysia (located in Penang). Mr. Choo incurred RM4,500 on Daniel's education. Mr Choo had deposited RM3,100 into the Skim Simpanan Pendidikan Nasional (The National Education Savings Fund) for his children's education. Mr. Choo had registered for his post-graduate study, an MBA program, with the University of Malaya. The annual fee for the post-graduate study incurred by Mr. Choo for the year 2020 was RM6,000. Besides, Mr. Choo had incurred RM1,000 to purchase textbooks and academic journals during that year. Mr. Choo's wife, Janet, is a full-time housewife. During the year 2020, Mr. Choo had spent RM1,050 for a comprehensive medical examination for himself and Janet at a private medical clinic. Required: Compute the tax payable by Mr. Choo for the year of assessment 2020. Note 1: You should indicate by the use of the word 'nil for any item referred to in the question for which no adjusting entry needs to be made. Suggested Answer: Discuss & fill-up the template: RM RM S13(1)(a) Salary (12 months) Bonus 13(1)(6) Servant (prescribed value) Gardener (prescribed value) Child care benefits Life insurance Dental benefit Leave passage Accommodation 130(c) 3% of hotel accommodation Gross employment income Less: Allowable expenses Adjusted employment income/ Statutory income Nil Nil Add: Other sources of income Aggregate income Less: Donation (donation in kind - not deductible under section 446) Total income Less: Personal reliefs Self Wife EPF Child-1" Child - 2 Medical expenses for serious disease including relief of RM500 for full medical check up (max) Post graduate studies fees MBA Lifestyle Skim Simpanan Pendidikan Nasional Chargeable Income On the 1* On the next Tax payable 3 - Open with Google Docs Income tax rates for resident Muiviuuais for the year assessment 2020 onwards Chargeable Income Calculations (RM) Tax Rate % Tax Payable (RM) 0 - 5,000 On the first 5,000 0 0 5,001 - 20,000 On the first 5,000 0 Next 15,000 1 150 On the first 20,000 150 20,001 - 35,000 Next 15,000 3 450 35,001 - 50,000 600 On the first 35,000 Next 15,000 8 1.200 On the first 50,000 1,800 50,001 - 70,000 Next 20,000 14 2,800 On the first 70,000 4,600 70,001 - 100,000 Next 30,000 21 6,300 On the first 100,000 10,900 100,001 - 250,000 Next 150.000 24 36,000 On the first 250,000 46,900 250,001 - 400,000 Next 150,000 24.5 36,750 On the first 400,000 400,001 - 600,000 83,650 Next 200,000 25 50,000 600,001 - 1,000,000 On the first 600,000 133,650 Next 400.000 26 104.000 1,000,001 - On the first 1,000,000 237,650 2,000,000 Next 1,000,000 28 280,000 On the first 2,000,000 Exceeding 2,000,000 517,650 Next ringgit 30 1. Reliefs for the Year of Assessment (YA) 2020. Personal relief Disabled taxpayer (additional relief) Spouse relief Disabled spouse relief (additional relief) Medical expenses for parents Parental care Medical expenses for serious diseases (including fertility treatment and medical examination expenses of up to RM500) Basic supporting equipment for disabled taxpayer, spouse, children, or parents Child relief (below 18 years old) Page 8 / 10 + - Each - Disabled RM 9,000 6,000 4,000 3,500 5,000 1,500 per parent 6,000 6,000 2,000 6,000 8,000 14,000 8,000 3,000 4,000 Child relief (over 18 years old and studying in higher learning institutions) - Each - Disabled Amount deposited into SSPN for child Premium on deferred annuity contract and private retirement scheme Employee contribution to Employees' Provident Fund (EPF) or approved provident fund Premium on life insurance - Public servants under pension scheme - Others Premium on medical/education insurance Employee's contribution to SOCSO scheme Education fees paid by taxpayer for his own self-improvement Lifestyle expenses Lifestyle expense - purchase of computer, smartphone, or tablet not for business use from 1* June 2020 to 31* December 2020 Breastfeeding equipment Fees paid to childcare centre and kindergarten Payment for accommodation at registered premises and entrance fee to tourist attractions from 15 March 2020. 7,000 3,000 3,000 250 7,000 2,500 2,500 1,000 3,000 1,000 2. Rebates for the Year of Assessment (YA) 2020. RM Chargeable income not exceeding RM35,000 - Individual - Additional relief when spouse relief is claimed 400 400

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts