Question: OPER 3 1 2 - Supply Chain Management - Fall 2 0 2 3 Homework 4 Student number: 0 1 4 6 3 6 Due

OPER Supply Chain

Management Fall

Homework

Student number:

Due by lanuary :

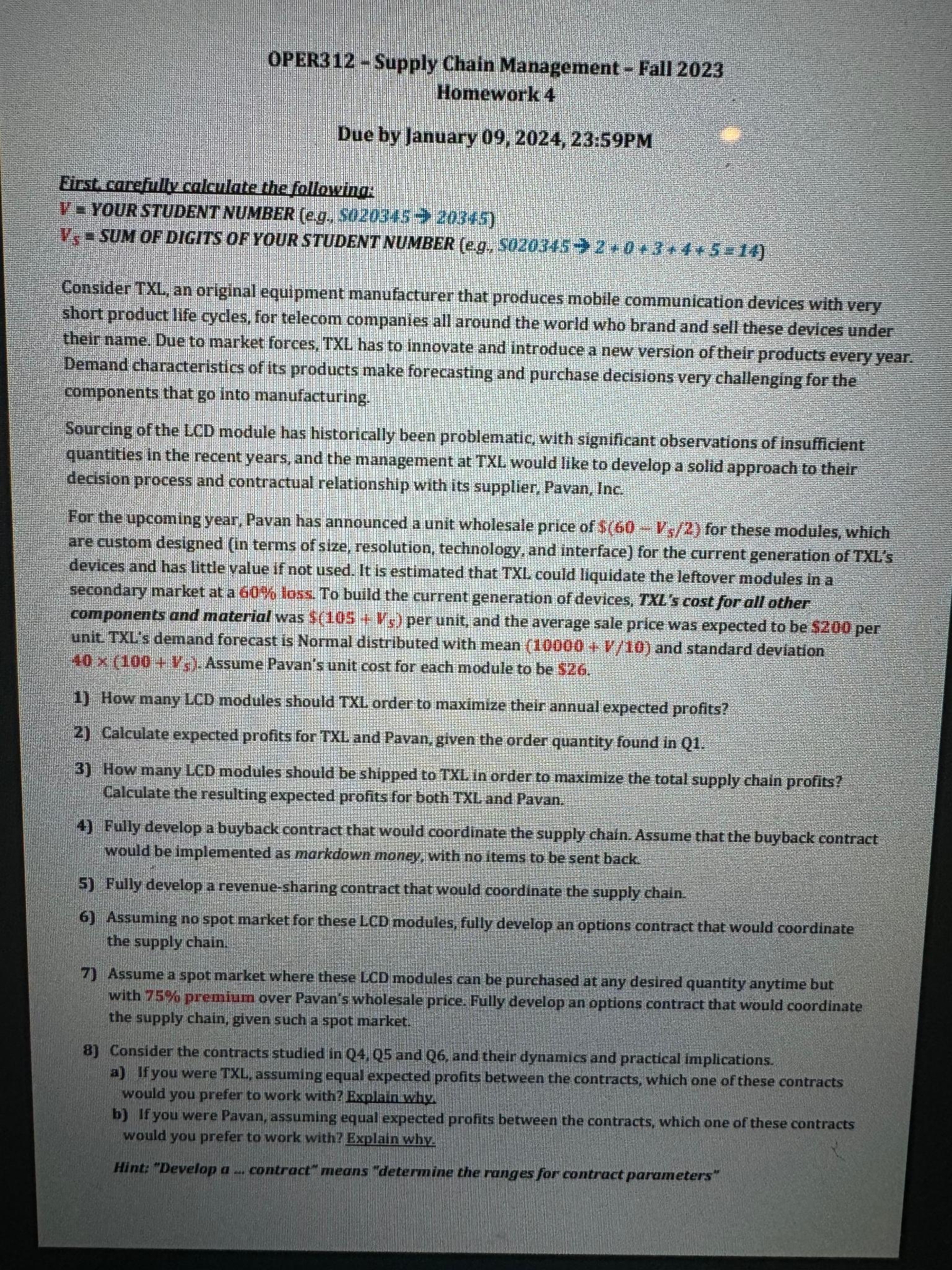

Eirst carefully calculate the following:

YOUR STUDENT NUMBER eg So

SUM OF DIGITS OF YOUR STUDENT NUMBER eg sozosis z

Consider TXL an original equipment manufacturer that produces mobile communication devices with very short product life cycles, for telecom companies all around the world who brand and sell these devices under their name. Due to market forces, TXL has to innovate and introduce a new version of their products every year. Demand characteristics of its products make forecasting and purchase decisions very challenging for the components that go into manufacturing.

Sourcing of the LCD module has historically been problematic, with significant observations of insufficient quantities in the recent years, and the management at TXL would like to develop a solid approach to their decision process and contractual relationship with its supplier, Pavan, Inc:

For the upcoming year, Pavan has announced a unit wholesale price of for these modules, which are custom designed in terms of size, resolution, technology, and interface for the current generation of TXLs devices and has little value if not used. It is estimated that TXL could liquidate the leftover modules in a secondary market at a loss. To build the current generation of devices, s cost for all other components and material was $ per unit, and the average sale price was expected to be $ per unit TXLs demand forecast is Normal distributed with mean and standard deviation Assume Pavan's unit cost for each module to be $

How many LCD modules should TXL order to maximize their annual expected profits?

Calculate expected profits for TXL and Pavan, given the order quantity found in

How many LCD modules should be shipped to TXL in order to maximize the total supply chain profits? Calculate the resulting expected profits for both TXL and Pavan.

Fully develop a buyback contract that would coordinate the supply chain. Assume that the buyback contract would be implemented as morkdown money, with no items to be sent back.

Fully develop a revenuesharing contract that would coordinate the supply chain.

Assuming no spot market for these LCD modules, fully develop an options contract that would coordinate the supply chain.

Assume a spot market where these LCD modules can be purchased at any desired quantity anytime but with premium over Pavan's wholesale price. Fully develop an options contract that would coordinate the supply chain, given such a spot market.

Consider the contracts studied in and and their dynamics and practical implications.

a If you were TXL assuming equal expected profits between the contracts, which one of these contracts would you prefer to work with? Explain why.

b If you were Pavan, assuming equal expected profits between the contracts, which one of these contracts would you prefer to work with? Explain why.

Hint: "Develop a contract" means "determine the ranges for contract parameters"

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock