Question: Operating Cash Flow: Next, we will take what we know about depreciation, and also what we know about EBIT and now put it all together

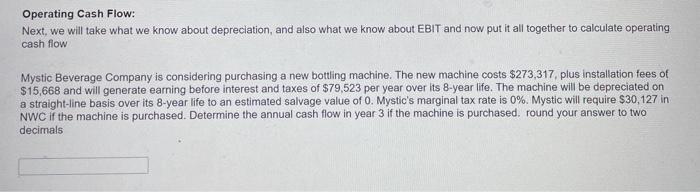

Operating Cash Flow: Next, we will take what we know about depreciation, and also what we know about EBIT and now put it all together to calculate operating cash flow Mystic Beverage Company is considering purchasing a new bottling machine. The new machine costs $273,317 plus installation fees of $15,668 and will generate earning before interest and taxes of $79,523 per year over its 8-year life. The machine will be depreciated on a straight-line basis over its 8-year life to an estimated salvage value of 0. Mystic's marginal tax rate is 0%. Mystic will require $30,127 in NWC if the machine is purchased. Determine the annual cash flow in year 3 if the machine is purchased, round your answer to two decimals

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts