Question: Operating Cash Flows (Direct Method) Using the information below, calculate the cash flow from operating activities using the direct method. Show a related cash flow

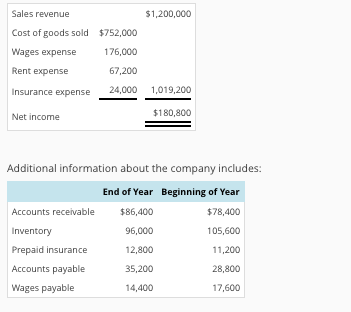

Operating Cash Flows (Direct Method) Using the information below, calculate the cash flow from operating activities using the direct method. Show a related cash flow for each revenue and expense. The Lincoln Company owns no plant assets and had the following income statement for the year:

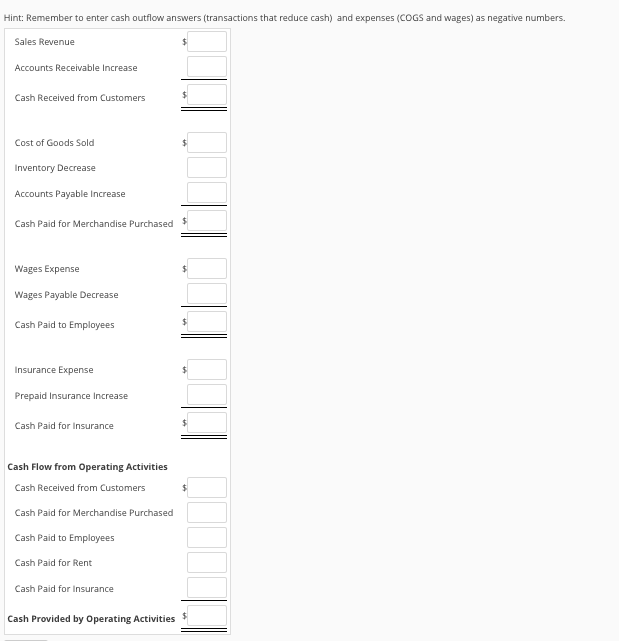

Sales revenue Cost of goods sold Wages expense Rent expense Insurance expense Net income $1,200,000 $752,000 176,000 67,200 24,000 1,019,200 $180,800 Additional information about the company includes: Accounts receivable Inventory Prepaid insurance Accounts payable Wages payable End of Year $86,400 96,000 12,800 35,200 14,400 Beginning of Year $78,400 105,600 11,200 28,800 17,600 Hint: Remember to enter cash outflow answers (transactions that reduce cash) and expenses (COGS and wages) as negative numbers. Sales Revenue Accounts Receivable Increase Cash Received from Customers Cost of Goods Sold Inventory Decrease Accounts Payable Increase Cash Paid for Merchandise Purchased Wages Expense Wages Payable Decrease Cash Paid to Employees Insurance Expense Prepaid Insurance Increase Cash Paid for Insurance Cash Flow from Operating Activities Cash Received from Customers Cash Paid for Merchandise Purchased Cash Paid to Employees Cash Paid for Rent Cash Paid for Insurance Cash Provided by Operating Activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts