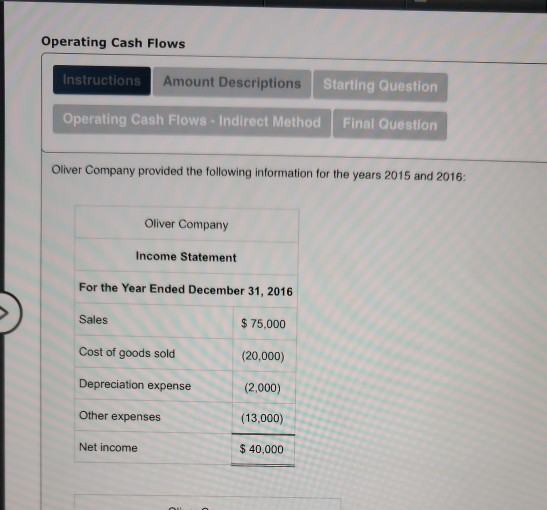

Question: Operating Cash Flows ructions Amount Descri ptions Starting Question Operating Cash Flows-Indirect Method Final Question Oliver Company provided the following information for the years 2015

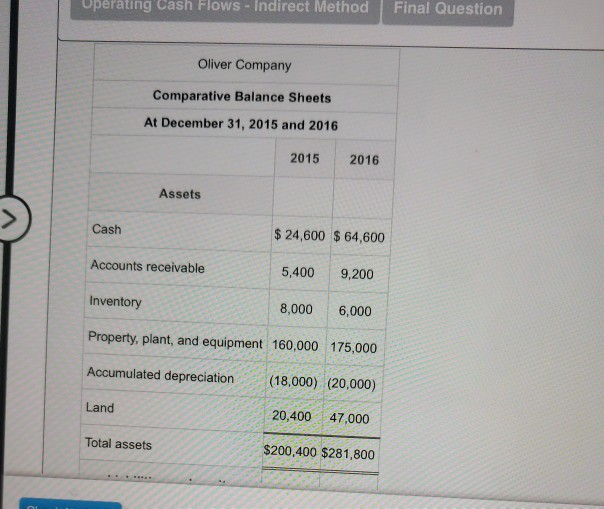

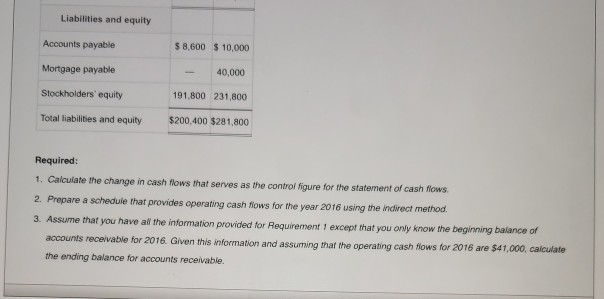

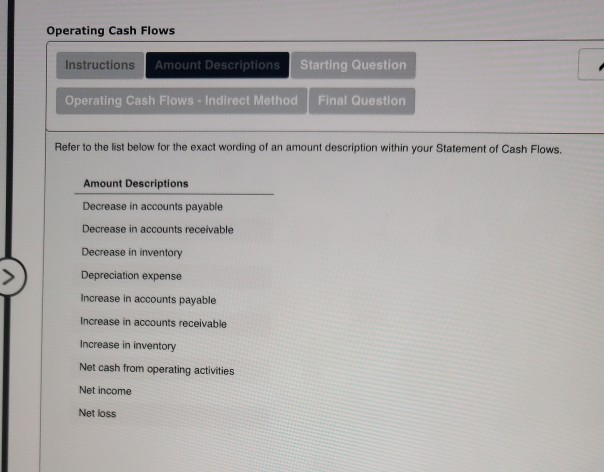

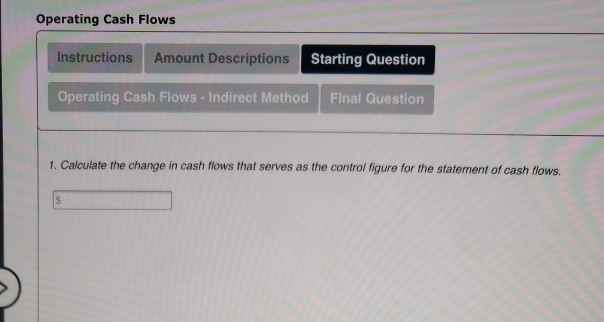

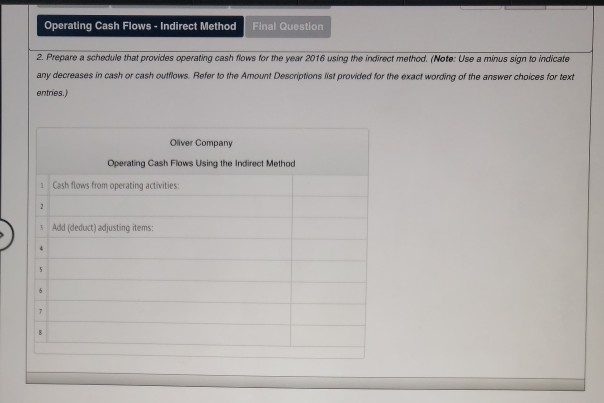

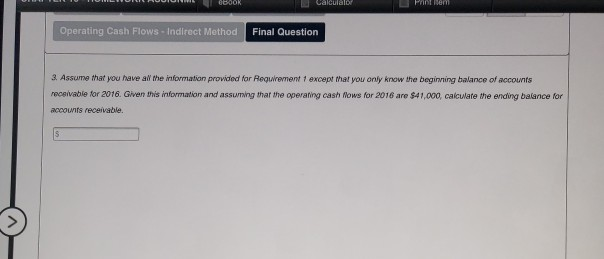

Operating Cash Flows ructions Amount Descri ptions Starting Question Operating Cash Flows-Indirect Method Final Question Oliver Company provided the following information for the years 2015 and 2016: Oliver Company Income Statement For the Year Ended December 31, 2016 Sales Cost of goods sold Depreciation expense Other expenses $75,000 (20,000) (2,000) (13,000) $ 40,000 Net income Uperating Cash Flows-Indirect Method Final Question Oliver Company Comparative Balance Sheets At December 31, 2015 and 2016 2015 2016 Assets $ 24,600 $ 64,600 5,400 9,200 8,000 6,000 Cash Accounts receivable Inventory Property, plant, and equipment 160,000 175,000 Accumulated depreciation18,000) (20,000) Land Total assets 20,400 47,000 $200,400 $281,800 Liabilities and equity Accounts payable Mortgage payable Stockholders' equity Total liabilites and equity $200,400 $281,800 $ 8,600 $ 10,000 40,000 191.800 231,800 Required: 1. Calculate the change in cash flows that serves as the control figure for the statement of cash flows 2. Prepare a schedule that provides operating cash flows for the year 2016 using the indirect method 3. Assume that you have all the information provided for Requirement 1 except that you only know the beginning balance of accounts receivable for 2016. Given this information and assuming that the operating cash flows for 2016 are $41,000, the ending balance for accounts receivable. Operating Cash Flows Instructions Amount Descriptions int Descriptions Starting Question Operating Cash Flows-Indirect Method Final Question Refer to the list below for the exact wording of an amount description within your Statement of Cash Flows Amount Descriptions Decrease in accounts payable Decrease in accounts receivable Decrease in inventory Depreciation expense Increase in accounts payable Increase in accounts receivable Increase in inventory Net cash from operating activities Net income Net loss Operating Cash Flows- Indirect Method Final Question 2. Prepare a schedule that provides operating cash flows for the year 2016 using the indirect method. (Note: Use a minus sign to indicate any decreases in cash or cash outflows. Refer to the Amount Descriptions list provided for the exact wordwing of the answer choices for text entries.) Oliver Company Operating Cash Flows Using the Indirect Method 1 Cash flows from operating activities s Add (deduct) adjusting items: Operating Cash Flows- Indirect Method Final Question 3. Assume that you have athe information provided for Regarement 1 except that you only know the beginning balance of accounts roceivable for 2016. Given this information and assuming that the operating cash Nows for 2016 are $41,000, cakcuwate the ending bakance for accounrs receivabie

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts