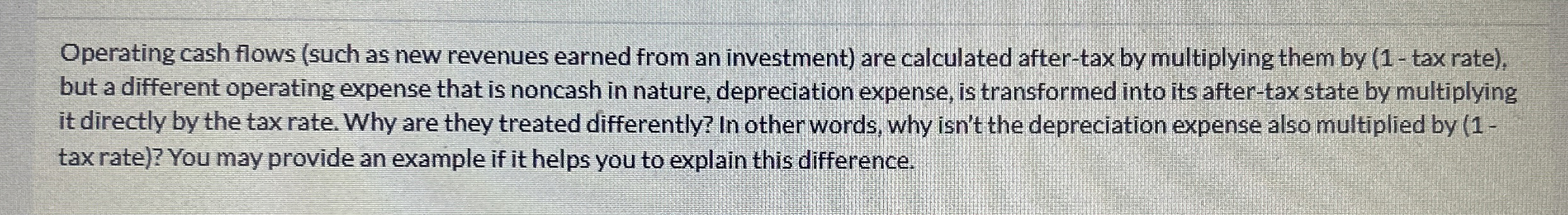

Question: Operating cash flows ( such as new revenues earned from an investment ) are calculated after - tax by multiplying them by ( 1 -

Operating cash flows such as new revenues earned from an investment are calculated aftertax by multiplying them by tax rate

but a different operating expense that is noncash in nature, depreciation expense, is transformed into its aftertax state by multiplying

it directly by the tax rate. Why are they treated differently? In other words, why isn't the depreciation expense also multiplied by

tax rate You may provide an example if it helps you to explain this difference.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock