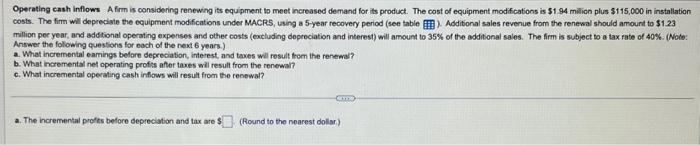

Question: Operating eash inflows A frm is considering renewing its equipment to meet incroased demand for its product. The cost of equipment modifications is $1.94 milion

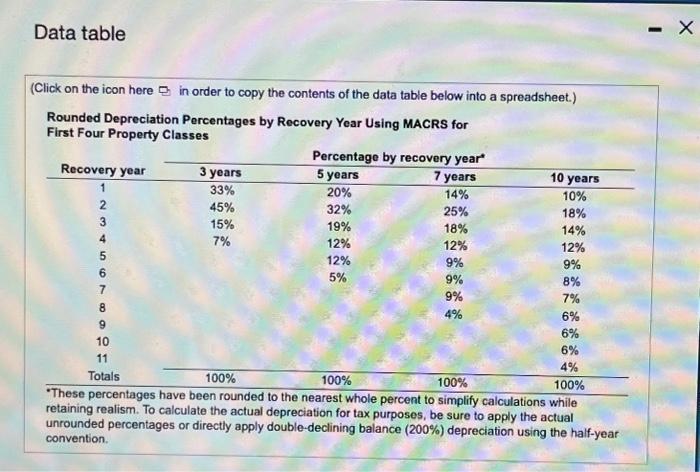

Operating eash inflows A frm is considering renewing its equipment to meet incroased demand for its product. The cost of equipment modifications is $1.94 milion plus $115,000 in installation costs. The fimm wil deprecigte the equipment modifications under MACRS, using a 5 -year recovery period (see table \&. Additional sales revenue from the renewal should amount to $1.23 million per year, and addtional operating expenses and other costs (excluding dopreciation and interest) will amount to 35% of the additional sales. The firm is subject to a tax fate of 40%. (Note: Arswer the following questions for eoch of the next 6 years.) a. What incremental eamings belore depreciation, interest, and taxes well rosult fom the renewa? b. What incremental net operating profis attor taxes will resull from the renewal? c. What incremental operating cash irfows will result from the renewal? a. The incremental profts before depreciation and tax are 4 (Round to the nearest dollar) Data table (Click on the icon here in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes moe pciveriuges nave veen rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts