Question: Operating income ( Note 1 ) $ 3 1 2 , 0 0 0 Profit on the sale of excess land ( Note 2 )

Operating income Note $

Profit on the sale of excess land Note

Royalty income Note

Retailing income

Interest on os accounts receivable in retailing business

Recapture of CCA Note

Advertising agency loss

Foreign Business income in Canada Note

Rental income Note

Taxable capital gains Note from active assets

Allowable cap lossessale of depreciable machinerynote

Interest income from fiveyear bonds

Dividend from Wholly owned sudsidiary Note noneligible

Dividend from from taxable Can corp ownershipeligible

Foreign nonbusiness income in Cdn $ Note

Division B net income for tax purposes $

The corporation has permanent establishments in Ontario and New York in the United States. Its gross revenue and salary and wages information is as follows: Ontario New York US Gross revenue $ $ Salaries and wages

The land had been held for approximately years. It had been held vacant so that the plant can expand in the future. Plans changed when an unsocilated offer was made by a supplier to buy the land on June

The royalty income had been determined to be property income.

The recapture resulted from the sale of some fixtures used in the retailing business.

The rental income was derived from leasing the entire space on a fiveyear lease in an unused warehouse. Assignment Taxation Summer SCS

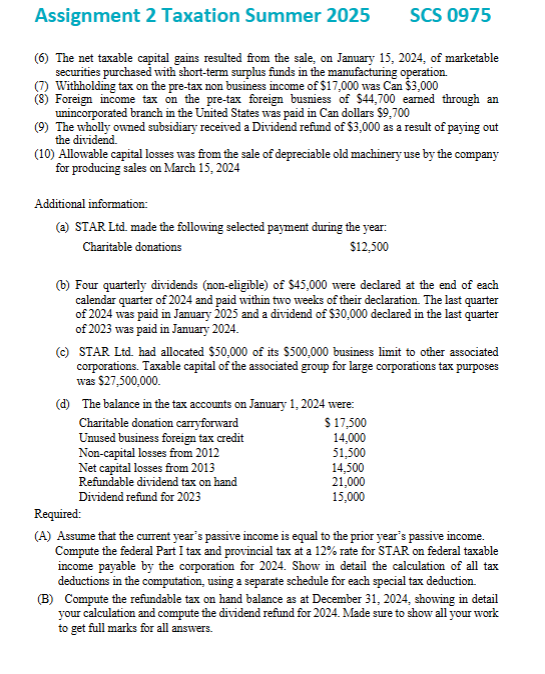

The net taxable capital gains resulted from the sale, on January of marketable securities purchased with shortterm surplus funds in the manufacturing operation.

Withholding tax on the pretax non business income of $ was Can $

Foreign income tax on the pretax foreign busniess of $ earned through an unincorporated branch in the United States was paid in Can dollars $

The wholly owned subsidiary received a Dividend refund of $ as a result of paying out the dividend

Allowable capital losses was from the sale of depreciable old machinery use by the company for producing sales on March

a STAR Ltd made the following selected payment during the year: Charitable donations $

b Four quarterly dividends noneligible of $ were declared at the end of each calendar quarter of and paid within two weeks of their declaration. The last quarter of was paid in January and a dividend of $ declared in the last quarter of was paid in January

c STAR Ltd had allocated $ of its $ business limit to other associated corps, taxable capital mill

d The balance in the tax accounts on January were: Charitable donation carryforward $ Unused business foreign tax credit Noncapital losses from Net capital losses from Refundable dividend tax on hand Dividend refund for

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock