Question: Operating leases differ from capital leases in that A. For a capital lease, the lessee records the lease payments as rent expense, but for an

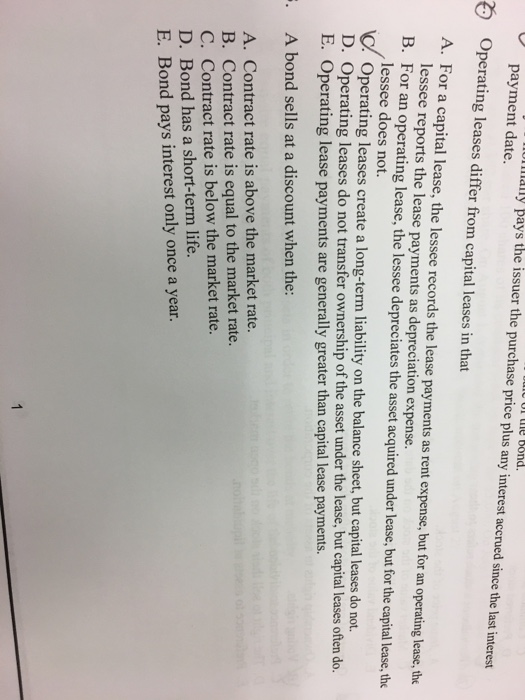

Operating leases differ from capital leases in that A. For a capital lease, the lessee records the lease payments as rent expense, but for an operating lease, the lessee reports the lease payments as depreciation expense. B. For an operating lease, the lessee depreciates the asset acquired under lease, but for the capital lease, the lessee does not. C. Operating leases create a long-term liability on the balance sheet, but capital leases do not. D. Operating leases do not transfer ownership of the asset under the lease, but capital leases often do. E. Operating lease payments are generally greater than capital lease payments. A bond sells at a discount when the: A. Contract rate is above the market rate. B. Contract rate is equal to the market rate. C. Contract rate is below the market rate. D. Bond has a short-term life. E. Bond pays interest only once a year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts