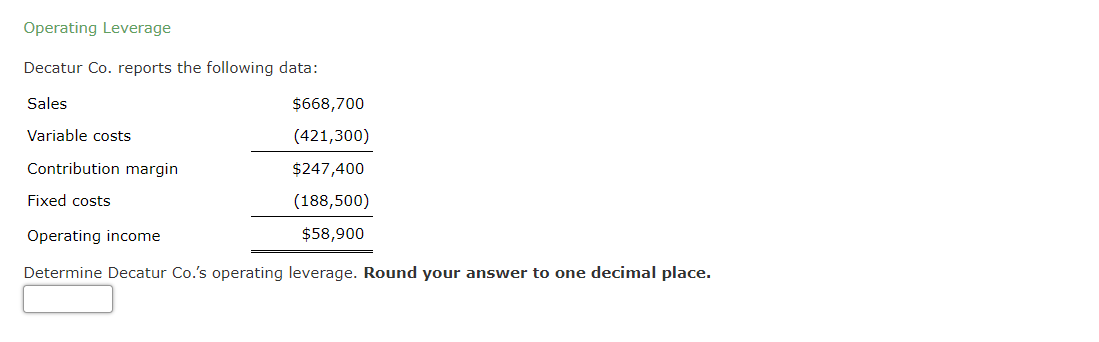

Question: Operating Leverage Decatur Co. reports the following data: Sales Variable costs $668,700 (421,300) $247,400 (188,500) Contribution margin Fixed costs Operating income $58,900 Determine Decatur Co.'s

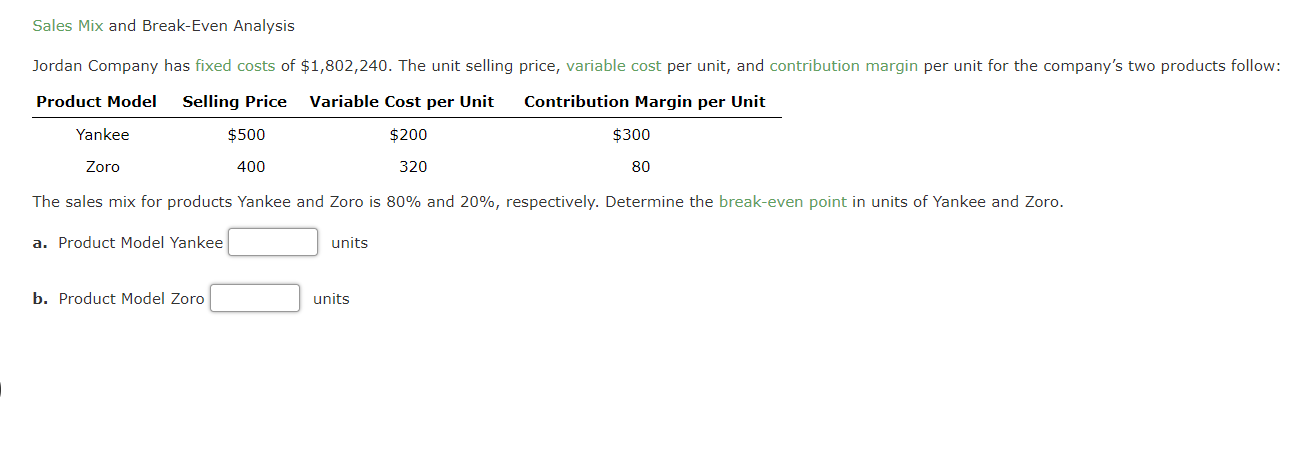

Operating Leverage Decatur Co. reports the following data: Sales Variable costs $668,700 (421,300) $247,400 (188,500) Contribution margin Fixed costs Operating income $58,900 Determine Decatur Co.'s operating leverage. Round your answer to one decimal place. Sales Mix and Break-Even Analysis Jordan Company has fixed costs of $1,802,240. The unit selling price, variable cost per unit, and contribution margin per unit for the company's two products follow: Product Model Selling Price Variable Cost per Unit Contribution Margin per Unit Yankee $500 $200 $300 Zoro 400 320 80 The sales mix for products Yankee and Zoro is 80% and 20%, respectively. Determine the break-even point in units of Yankee and Zoro. a. Product Model Yankee units b. Product Model Zoro units

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts