Question: Operating Leverage: *Hutcheon Tool & Dye's current business model supports the following set of data: Fixed costs = $255,000; variable costs = $22; selling

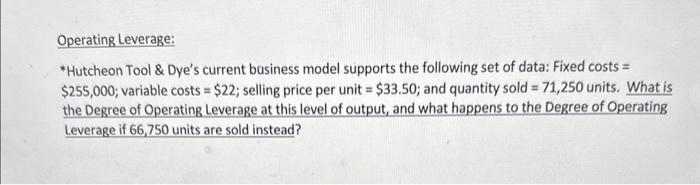

Operating Leverage: *Hutcheon Tool & Dye's current business model supports the following set of data: Fixed costs = $255,000; variable costs = $22; selling price per unit = $33.50; and quantity sold = 71,250 units. What is the Degree of Operating Leverage at this level of output, and what happens to the Degree of Operating Leverage if 66,750 units are sold instead?

Step by Step Solution

3.49 Rating (152 Votes )

There are 3 Steps involved in it

The Degree of Operating Leverage DOL can be calculated using the following formula DOL Contribution ... View full answer

Get step-by-step solutions from verified subject matter experts