Question: Operating leverage Obj. 5 - Compute the break-even point for a company selling more than one product, the operating leverage, and the margin of safety.Beck

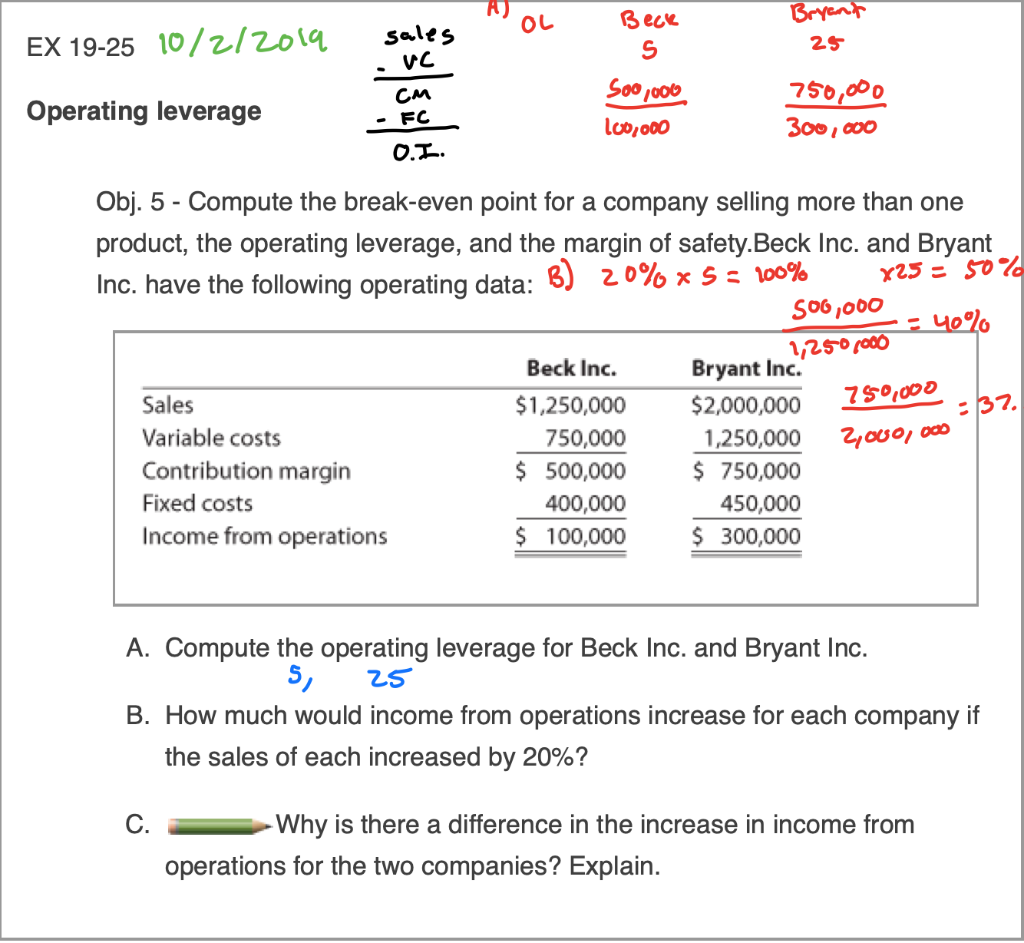

Operating leverage Obj. 5 - Compute the break-even point for a company selling more than one product, the operating leverage, and the margin of safety.Beck Inc. and Bryant Inc. have the following operating data: A. Compute the operating leverage for Beck Inc. and Bryant Inc. B. How much would income from operations increase for each company if the sales of each increased by 20%? C. Why is there a difference in the increase in income from operations for the two companies? Explain.

Beck Bryant EX 19-25 10/2/2019 sales 25 vc CM Operating leverage Soo,000 100,000 750,000 300,000 O. I. Obj. 5 - Compute the break-even point for a company selling more than one product, the operating leverage, and the margin of safety.Beck Inc. and Bryant Inc. have the following operating data: B) 20% * 5 = 100% x25 - sold 506,000 -40% -:37. Sales Variable costs Contribution margin Fixed costs Income from operations Beck Inc. $1,250,000 750,000 $ 500,000 400,000 $ 100,000 1,2507000 Bryant Inc.' $2,000,000 750,000 1,250,000 2,00o,000 $ 750,000 450,000 $ 300,000 A. Compute the operating leverage for Beck Inc. and Bryant Inc. s, 25 B. How much would income from operations increase for each company if the sales of each increased by 20%? C. Why is there a difference in the increase in income from operations for the two companies? Explain

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts