Question: Operating Margin Define: Analyze: Return on Assets Define: Analyze: Current Asset Turnover Define: Analyze:Please review this example for guidance. Example: Total Asset Turnover Define: Total

Operating Margin

Define:

Analyze:

Return on Assets

Define:

Analyze:

Current Asset Turnover

Define:

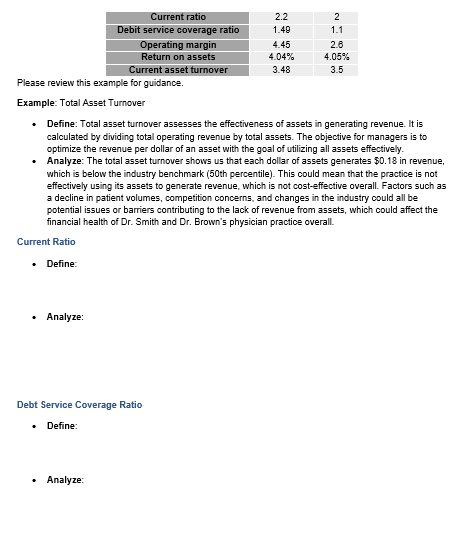

Analyze:Please review this example for guidance.

Example: Total Asset Turnover

Define: Total asset turnover assesses the effectiveness of assets in generating revenue. It is

calculated by dividing total operating revenue by total assets. The objective for managers is to

optimize the revenue per dollar of an asset with the goal of utilizing all assets effectively.

Analyze: The total asset turnover shows us that each dollar of assets generates $ in revenue,

which is below the industry benchmark th percentile This could mean that the practice is not

effectively using its assets to generate revenue, which is not costeffective overall. Factors such as

a decline in patient volumes, competition concerns, and changes in the industry could all be

potential issues or barriers contributing to the lack of revenue from assets, which could affect the

financial health of Dr Smith and Dr Brown's physician practice overall.

Current Ratio

Define:

Analyze:

Debt Service Coverage Ratio

Define:

Analyze:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock