Question: Operational research QUESTION 1: (20 marks) Mr. Naim, a manager of a company needs to decide whether to invest in a futsal area, a paintball

Operational research

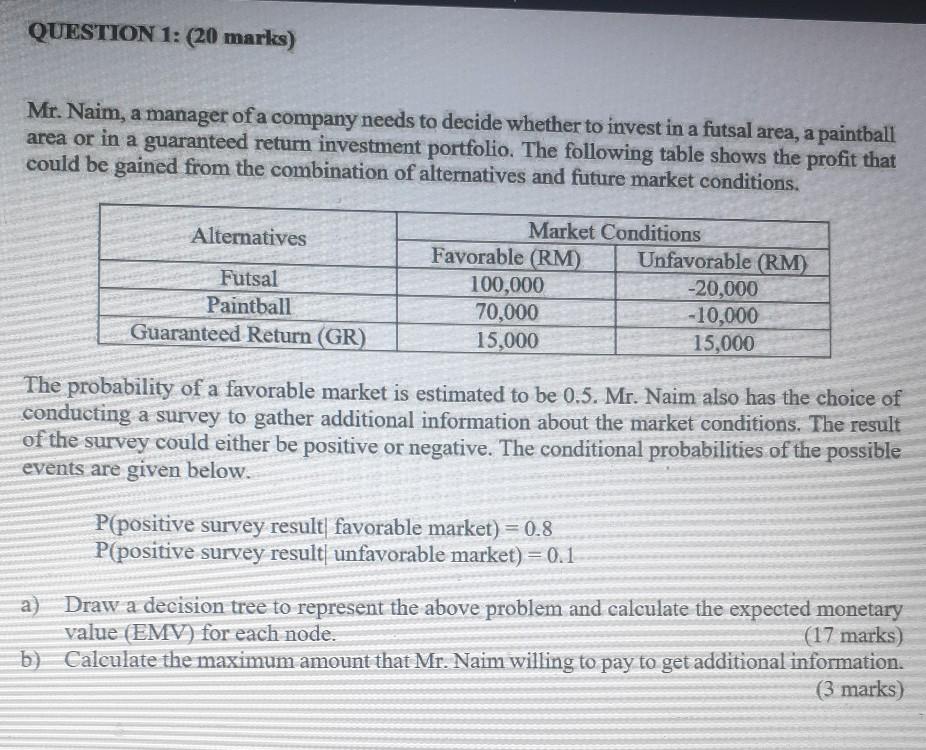

QUESTION 1: (20 marks) Mr. Naim, a manager of a company needs to decide whether to invest in a futsal area, a paintball area or in a guaranteed return investment portfolio. The following table shows the profit that could be gained from the combination of alternatives and future market conditions. Alternatives Futsal Paintball Guaranteed Return (GR) Market Conditions Favorable (RM) Unfavorable (RM) 100,000 -20,000 70,000 -10,000 15,000 15,000 The probability of a favorable market is estimated to be 0.5. Mr. Naim also has the choice of conducting a survey to gather additional information about the market conditions. The result of the survey could either be positive or negative. The conditional probabilities of the possible events are given below. P(positive survey result| favorable market) = 0.8 P(positive survey result| unfavorable market) = 0.1 a) Draw a decision tree to represent the above problem and calculate the expected monetary value (EMV) for each node. (17 marks) b) Calculate the maximum amount that Mr. Naim willing to pay to get additional informationStep by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock