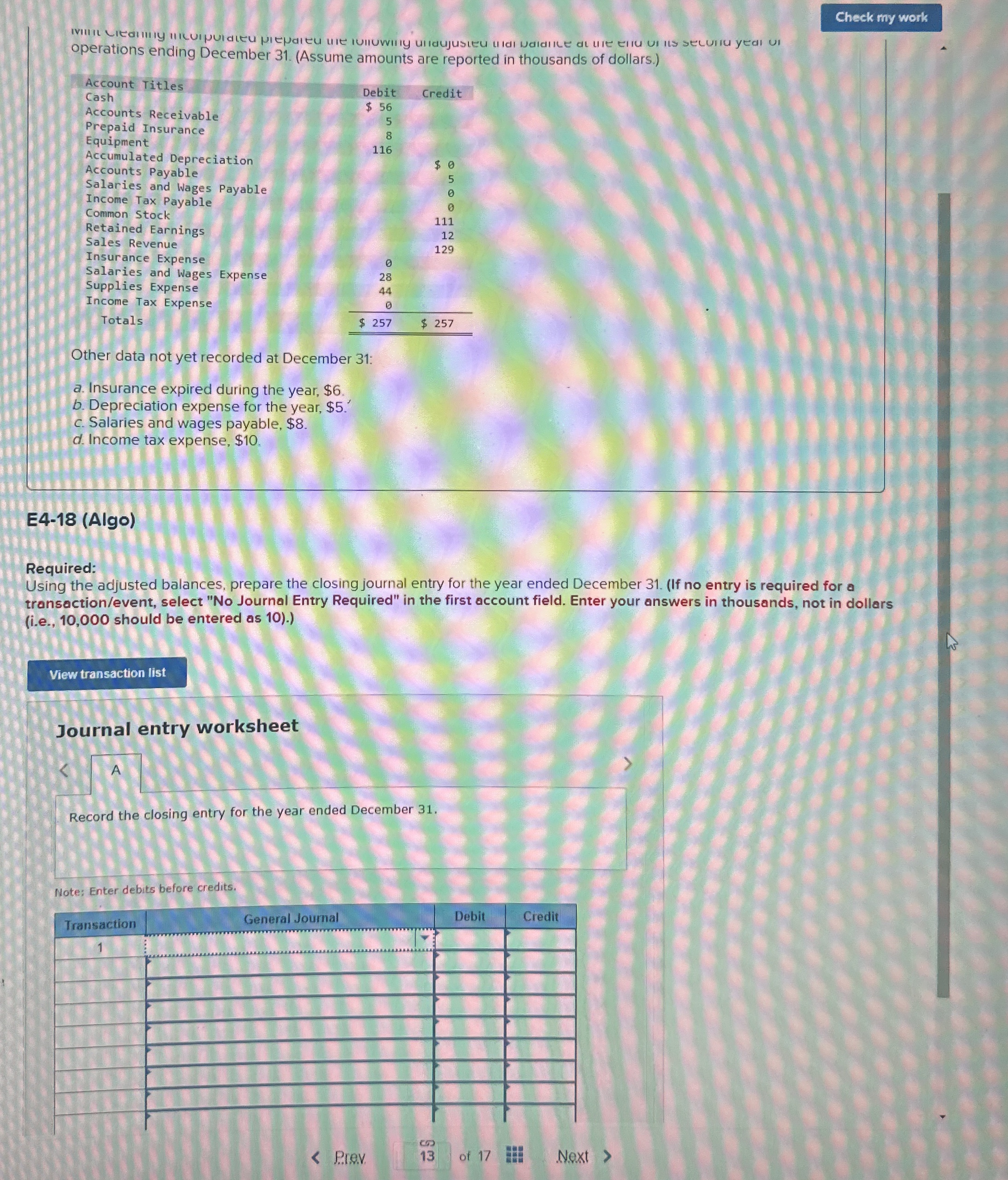

Question: operations ending December 3 1 . ( Assume amounts are reported in thousands of dollars. ) Other data not yet recorded at December 3 1

operations ending December Assume amounts are reported in thousands of dollars.

Other data not yet recorded at December :

a Insurance expired during the year, $

b Depreciation expense for the year, $

c Salaries and wages payable, $

d Income tax expense, $

EAlgo

Required:

Using the adjusted balances, prepare the closing journal entry for the year ended December If no entry is required for a

transactionevent select No Journal Entry Required" in the first account field. Enter your answers in thousands, not in dollars

ie should be entered as

Journal entry worksheet

A

Record the closing entry for the year ended December

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock