Question: OPERATIONS MANAGEMENT ASSIGNMENTEach question carries TEN marks 1. Mention the current trends in Operations Management 2. Mention the various technologies used in Operations Management 3.

OPERATIONS MANAGEMENT

ASSIGNMENTEach question carries TEN marks

1. Mention the current trends in Operations Management

2. Mention the various technologies used in Operations Management

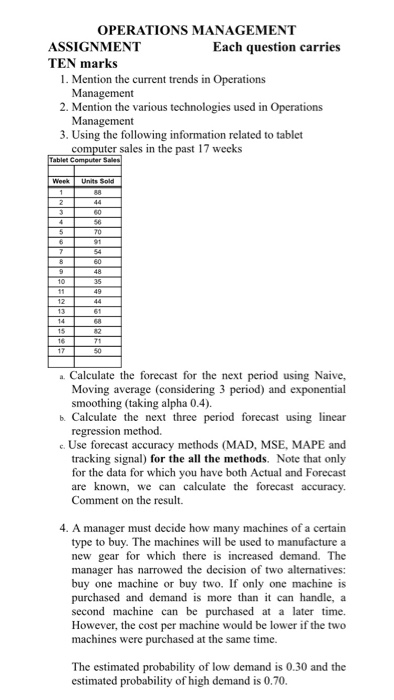

3. Using the following information related to tablet computer sales in the past 17 weeks

Tablet Computer Sales

Week

Units Sold

1

88

2

44

3

60

4

56

5

70

6

91

7

54

8

60

9

48

10

35

11

49

12

44

13

61

14

68

15

82

16

71

17

50

a. Calculate the forecast for the next period using Naive, Moving average (considering 3 period) and exponential smoothing (taking alpha 0.4).

b. Calculate the next three period forecast using linear regression method.

c. Use forecast accuracy methods (MAD, MSE, MAPE and tracking signal) for the all the methods. Note that only for the data for which you have both Actual and Forecast are known, we can calculate the forecast accuracy. Comment on the result.

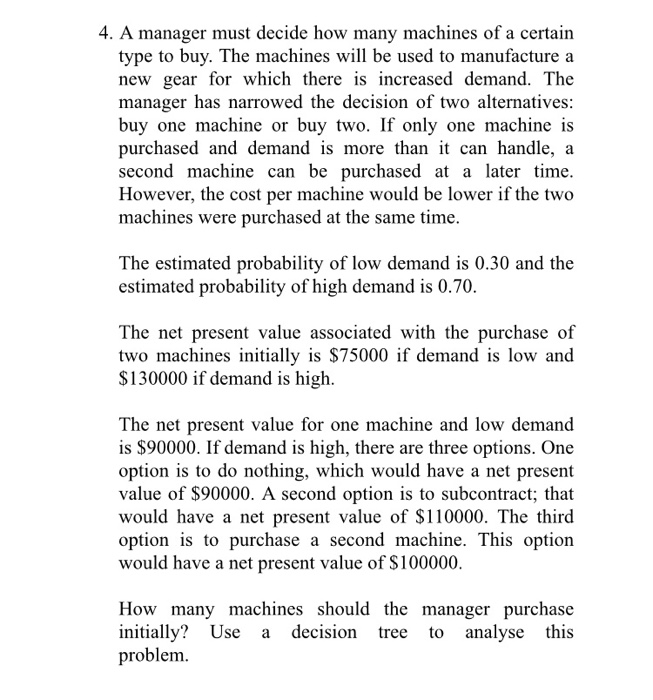

4. A manager must decide how many machines of a certain type to buy. The machines will be used to manufacture a new gear for which there is increased demand. The manager has narrowed the decision of two alternatives: buy one machine or buy two. If only one machine is purchased and demand is more than it can handle, a second machine can be purchased at a later time. However, the cost per machine would be lower if the two machines were purchased at the same time.

The estimated probability of low demand is 0.30 and the estimated probability of high demand is 0.70.

The net present value associated with the purchase of two machines initially is $75000 if demand is low and $130000 if demand is high.

The net present value for one machine and low demand is $90000. If demand is high, there are three options. One option is to do nothing, which would have a net present value of $90000. A second option is to subcontract; that would have a net present value of $110000. The third option is to purchase a second machine. This option would have a net present value of $100000.

How many machines should the manager purchase initially? Use a decision tree to analyse this problem.

I have attached below images

OPERATIONS MANAGEMENT ASSIGNMENT Each question carries TEN marks 1. Mention the current trends in Operations Management 2. Mention the various technologies used in Operations Management 3. Using the following information related to tablet computer sales in the past 17 weeks Tablet Computer Sales Week Units Sold 8888888888 a. Calculate the forecast for the next period using Naive, Moving average (considering 3 period) and exponential smoothing (taking alpha 0.4). b. Calculate the next three period forecast using linear regression method. c. Use forecast accuracy methods (MAD, MSE, MAPE and tracking signal) for the all the methods. Note that only for the data for which you have both Actual and Forecast are known, we can calculate the forecast accuracy. Comment on the result. 4. A manager must decide how many machines of a certain type to buy. The machines will be used to manufacture a new gear for which there is increased demand. The manager has narrowed the decision of two alternatives: buy one machine or buy two. If only one machine is purchased and demand is more than it can handle, a second machine can be purchased at a later time. However, the cost per machine would be lower if the two machines were purchased at the same time. The estimated probability of low demand is 0.30 and the estimated probability of high demand is 0.70. 4. A manager must decide how many machines of a certain type to buy. The machines will be used to manufacture a new gear for which there is increased demand. The manager has narrowed the decision of two alternatives: buy one machine or buy two. If only one machine is purchased and demand is more than it can handle, a second machine can be purchased at a later time. However, the cost per machine would be lower if the two machines were purchased at the same time. The estimated probability of low demand is 0.30 and the estimated probability of high demand is 0.70. The net present value associated with the purchase of two machines initially is $75000 if demand is low and $130000 if demand is high. The net present value for one machine and low demand is $90000. If demand is high, there are three options. One option is to do nothing, which would have a net present value of $90000. A second option is to subcontract; that would have a net present value of $110000. The third option is to purchase a second machine. This option would have a net present value of $100000. How many machines should the manager purchase initially? Use a decision tree to analyse this problem. OPERATIONS MANAGEMENT ASSIGNMENT Each question carries TEN marks 1. Mention the current trends in Operations Management 2. Mention the various technologies used in Operations Management 3. Using the following information related to tablet computer sales in the past 17 weeks Tablet Computer Sales Week Units Sold 8888888888 a. Calculate the forecast for the next period using Naive, Moving average (considering 3 period) and exponential smoothing (taking alpha 0.4). b. Calculate the next three period forecast using linear regression method. c. Use forecast accuracy methods (MAD, MSE, MAPE and tracking signal) for the all the methods. Note that only for the data for which you have both Actual and Forecast are known, we can calculate the forecast accuracy. Comment on the result. 4. A manager must decide how many machines of a certain type to buy. The machines will be used to manufacture a new gear for which there is increased demand. The manager has narrowed the decision of two alternatives: buy one machine or buy two. If only one machine is purchased and demand is more than it can handle, a second machine can be purchased at a later time. However, the cost per machine would be lower if the two machines were purchased at the same time. The estimated probability of low demand is 0.30 and the estimated probability of high demand is 0.70. 4. A manager must decide how many machines of a certain type to buy. The machines will be used to manufacture a new gear for which there is increased demand. The manager has narrowed the decision of two alternatives: buy one machine or buy two. If only one machine is purchased and demand is more than it can handle, a second machine can be purchased at a later time. However, the cost per machine would be lower if the two machines were purchased at the same time. The estimated probability of low demand is 0.30 and the estimated probability of high demand is 0.70. The net present value associated with the purchase of two machines initially is $75000 if demand is low and $130000 if demand is high. The net present value for one machine and low demand is $90000. If demand is high, there are three options. One option is to do nothing, which would have a net present value of $90000. A second option is to subcontract; that would have a net present value of $110000. The third option is to purchase a second machine. This option would have a net present value of $100000. How many machines should the manager purchase initially? Use a decision tree to analyse this