Question: OPERATIONS MANAGEMENT I ONLY NEED HELP WITH QUESTION (D) BECAUSE I ALREADY HAVE SOLUTIONS FOR THE REST OF THE QUESTIONS This Solution is given by

OPERATIONS MANAGEMENT

I ONLY NEED HELP WITH QUESTION (D) BECAUSE I ALREADY HAVE SOLUTIONS FOR THE REST OF THE QUESTIONS

This Solution is given by mr.vini disodia ji . So let's start the solution according to the question we are given that information is

SOLUTION :-

(a)

(b)

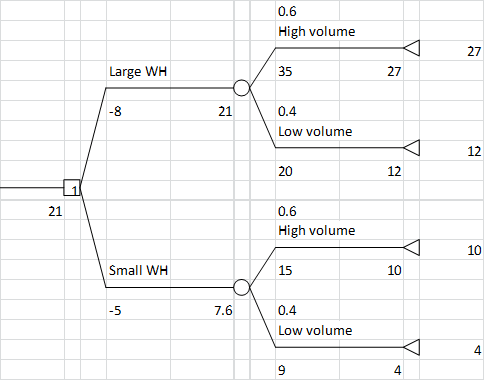

First, define some events for writing ease:

H = Actual high volume L = Actual low volume

IH = Predicted high volume by the experts IL = Predicted low volume by the experts

The priors are P(H) = 0.6 ad P(L) = 0.4 and the conditionals are P(IH | H) = 0.75 and P(IL | L) = 0.90.

Using Baye's rule, find the posterior probabilities as follows:

| IH | |||||||

| Prior | Conditional | Joint | Posterior | ||||

| P(H) | 0.6 | P(IH|H) | 0.75 | P(H) x P(IH|H) | 0.45 | P(H|IH) | 0.918 |

| P(L) | 0.4 | P(IH|L) | 0.1 | P(B) x P(IH|L) | 0.04 | P(L|IH) | 0.082 |

| Total | 1 | P(IH) = | 0.49 | 1 | |||

| IL | |||||||

| Prior | Conditional | Joint | Posterior | ||||

| P(H) | 0.6 | P(IL|H) | 0.25 | P(H) x P(IL|H) | 0.15 | P(H|IL) | 0.294 |

| P(L) | 0.4 | P(IL|L) | 0.9 | P(B) x P(IL|L) | 0.36 | P(L|IL) | 0.706 |

| Total | 1 | P(IL) = | 0.51 | 1 |

Now re-construct the decision tree as follows:

(c)

The best decision is to not to go for any expert opinion and stick to the solution of part-a

So,

Expected value of sample information = 0 (sample information has no value)

Expected value with perfect information = Max(35-8, 15-5)*0.6 + Max(20-8, 9-5)*0.4 = 21

Expected value without perfect information is max. EMV = 21

So, EVPI = 21 - 21 = 0

(d) I need help with question (d)

Based on your analysis, provide a corresponding risk profile for the optimal decision strategy????

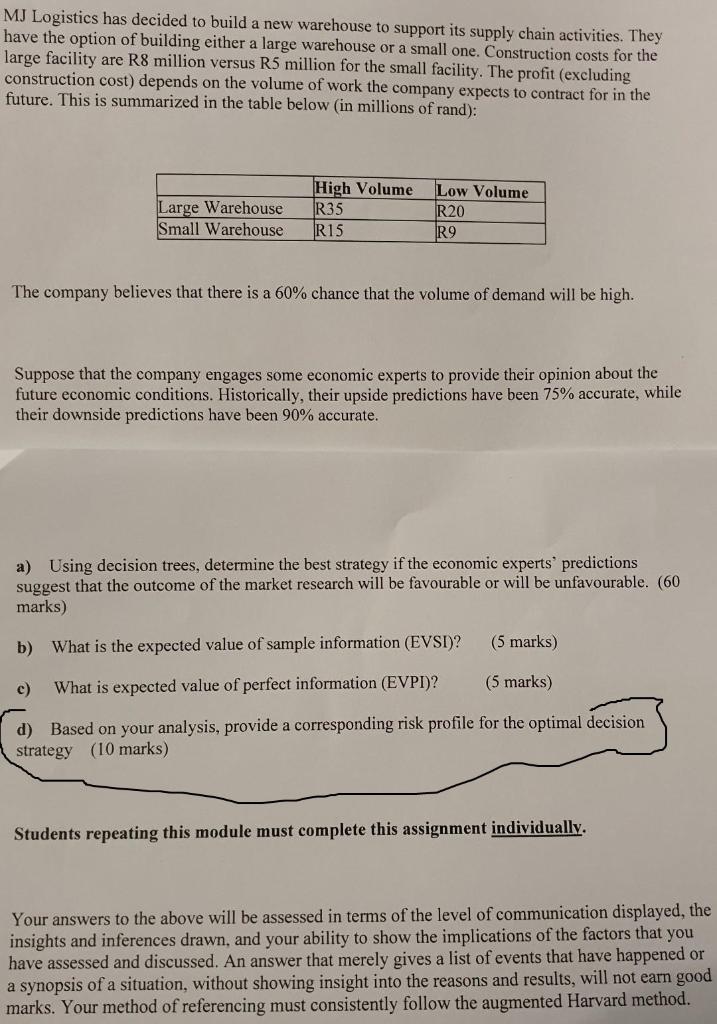

MJ Logistics has decided to build a new warehouse to support its supply chain activities. They have the option of building either a large warehouse or a small one. Construction costs for the large facility are R8 million versus R5 million for the small facility. The profit (excluding construction cost) depends on the volume of work the company expects to contract for in the future. This is summarized in the table below in millions of rand): Large Warehouse Small Warehouse High Volume R35 R15 Low Volume R20 R9 The company believes that there is a 60% chance that the volume of demand will be high. Suppose that the company engages some economic experts to provide their opinion about the future economic conditions. Historically, their upside predictions have been 75% accurate, while their downside predictions have been 90% accurate. a) Using decision trees, determine the best strategy if the economic experts' predictions suggest that the outcome of the market research will be favourable or will be unfavourable. (60 marks) b) What is the expected value of sample information (EVSI)? (5 marks) c) What is expected value of perfect information (EVPI)? (5 marks) d) Based on your analysis, provide a corresponding risk profile for the optimal decision strategy (10 marks) Students repeating this module must complete this assignment individually. Your answers to the above will be assessed in terms of the level of communication displayed, the insights and inferences drawn, and your ability to show the implications of the factors that you have assessed and discussed. An answer that merely gives a list of events that have happened or a synopsis of a situation, without showing insight into the reasons and results, will not earn good marks. Your method of referencing must consistently follow the augmented Harvard method. 0.6 High volume 27 Large WH 35 27 -8 21 0.4 Low volume 12 20 12 21 0.6 High volume 10 Small WH 15 10 -5 7.6 0.4 Low volume 4 9 4 0.918 H 27 Large WH 35 27 -8 25.77 0.082 L 12 0.49 IH 20 12 0 25.77 0.918 H 10 Small WH 15 10 -5 9.508 0.082 L 4 Take expert opinion 9 4 0 20.9964 0.294 H 27 Large WH 35 27 -8 16.41 0.706 12 0.51 IL 20 12 21 16.41 0.294 H 21 10 Small WH 15 10 -5 5.764 0.706 4 9 4 Do not take 21 21 21Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts