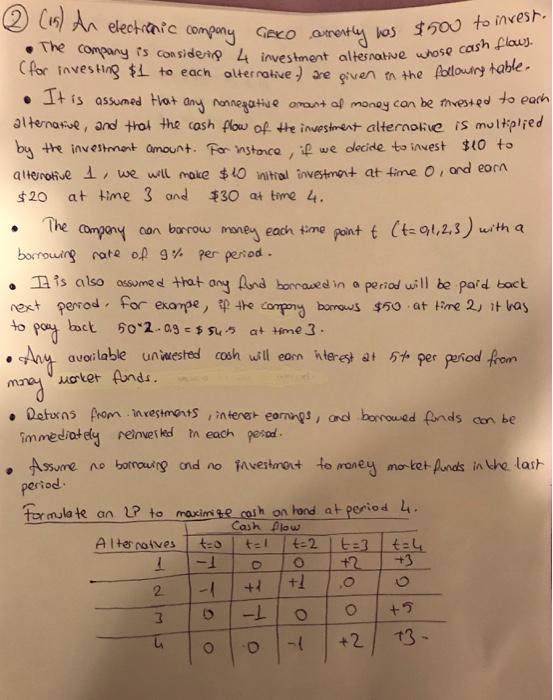

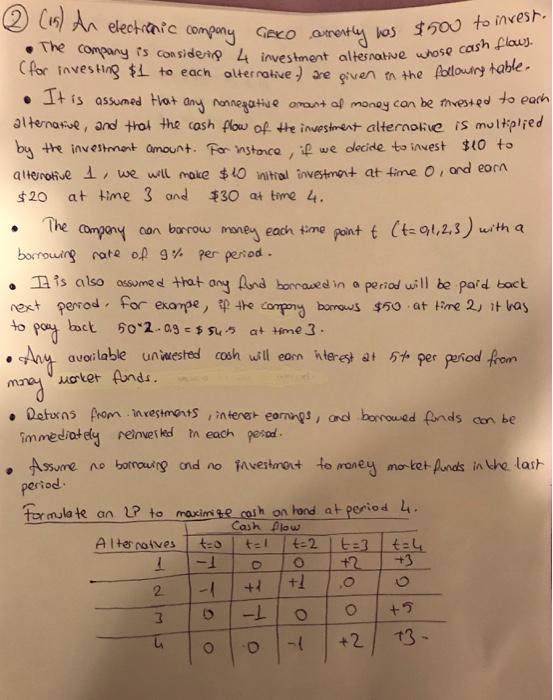

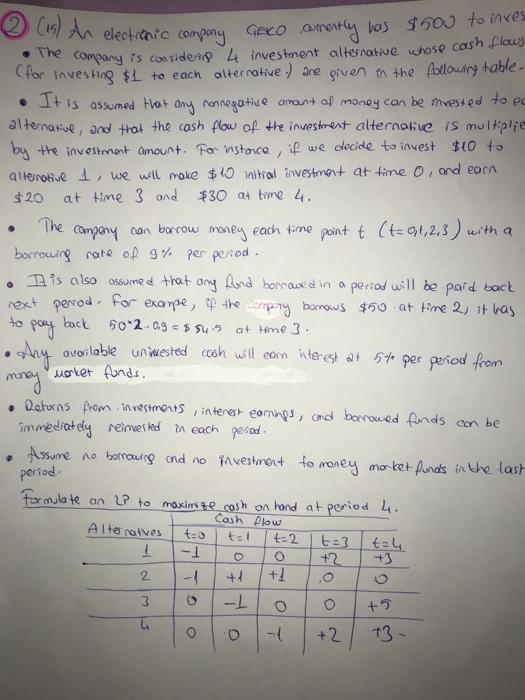

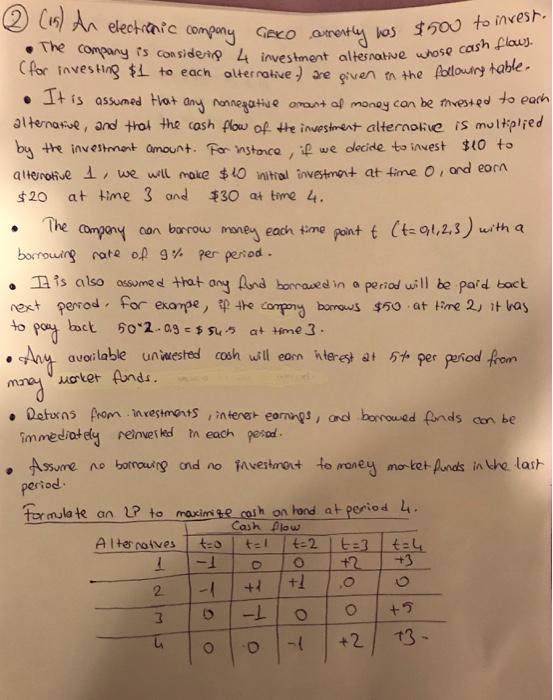

Question: Operations Research $. . 2 (15) An electronic compony GECO amently has $500 to invest. The company is considering 4 investment alternate whose cash flows.

Operations Research

$. . 2 (15) An electronic compony GECO amently has $500 to invest. The company is considering 4 investment alternate whose cash flows. Cfor investing $1 to each alternative, are given in the following table It is assumed that any non negative amount of money can be invested to each alternative, and that the cash flow of the investment alternakve is multiplied by the investment amount. For instance, if we decide to invest $10 to alternative 1, we will make $10 initial investment at time o, ond corn $20 at time 3 and $30 at time 4. The company con borrow money each time point t (ta 91,2,3) with a borrowing rate of 9% per period. . I is also assumed that any fund borrowed in a period will be paid back next perrod, for example, if the compory bornows $50 at time 2, it has to pay back 50-2 ag = $sus at time 3. Any available uniwested cosh will com interest at 5to per period from Market funds. money Deturns from investments interest earnings, and borrowed funds can be immediately reinvested in each posod. Assume no borrowing and no investment to money mortet funds in the last period Formulate an LP to maximize cash on hand at period 4. Cash flow Alternatives t=0 tel t-2 to t=4 1 O 2 - 1 + 2 + O O . -1 +5 O +2 $20 Coul An electronic company Geco amostly has $500 to inves The company is considering 4 investment alternative whose cash flows (for investing $1 to each alternative) are given in the following table. It is assumed Hat any nonnegative amount of money can be invested to po alternative, and that the cash flow of the investment alternative is multiplie by the investment amount. For instance, if we decide to invest $10 to alternative 1, we will make $ 10 nitial investment at time o, and earn at time 3 and $30 at time 4. The company can borrow money each time point t (t= 0,1,2,3) with a borrowing rate of 9% per period. . I is also assumed that any fond borraced in a period will be paid back next penrod, for example, if the compory barnows $50 at time 2, it has to back pay 50*2.09 - $ $45 at home 3. thy available uniwested coch will com interest at sto per period from money market funds, Returns from investments interest eanings and borrowed funds con be. immediately reinvested in each perod. Assume no borrowing and no investment to money market funds in the last period Formulate an LP to maximize cash on hand at period 4. Cash flow Alternatives tao t=2 1 t=4 O +2 +3 2 -1 +1 3 0 o tel t3 N +1 +5 O - +2 73