Question: operations research questions please answer showing the solution Three mutually exclusive alternatives with capital investment and internal rate of return (IRR) values as follows: A

operations research questions

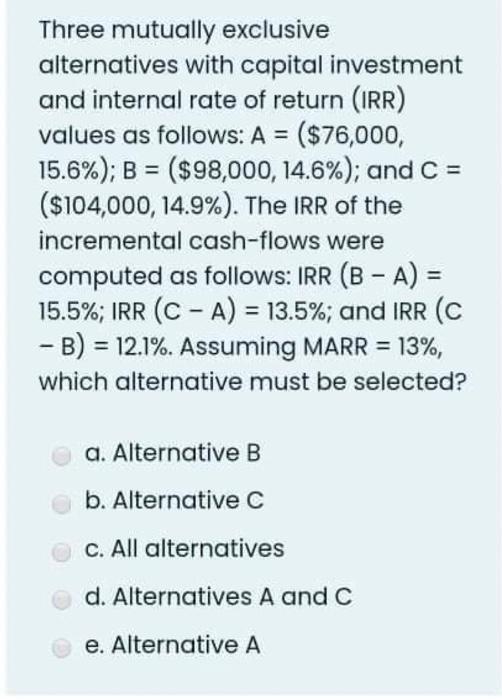

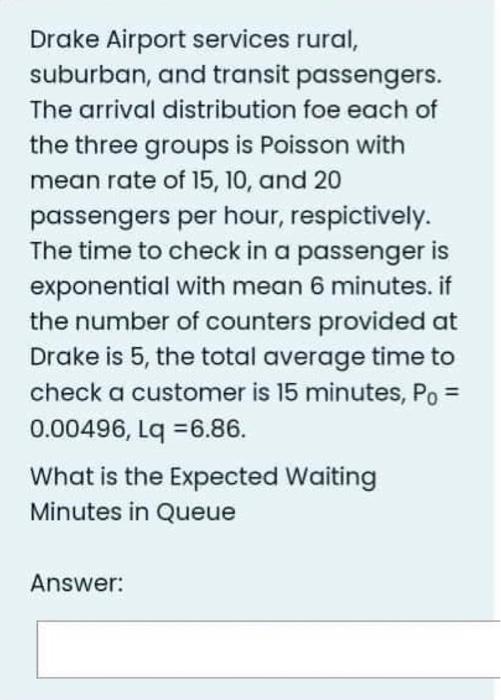

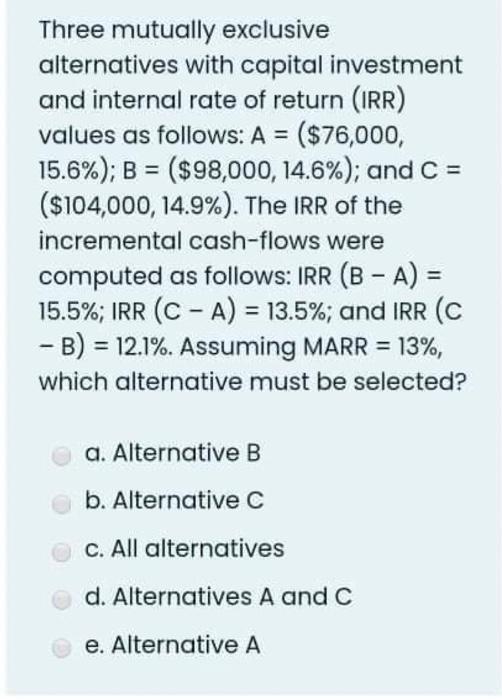

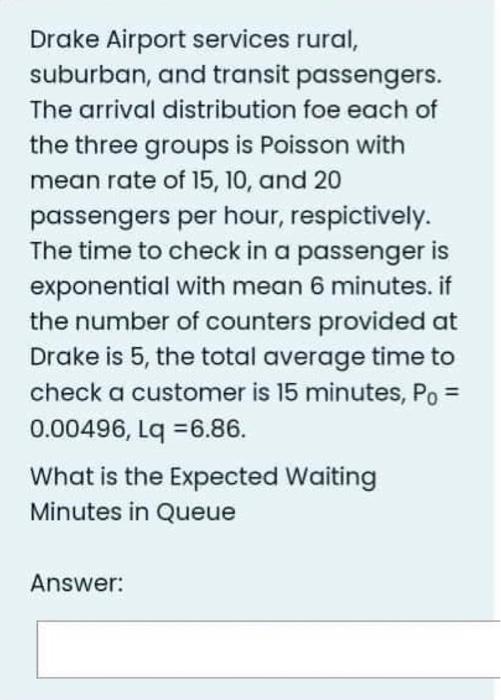

Three mutually exclusive alternatives with capital investment and internal rate of return (IRR) values as follows: A = ($76,000, 15.6%); B = ($98,000, 14.6%); and C = ($104,000, 14.9%). The IRR of the incremental cash-flows were computed as follows: IRR (B - A) = 15.5%; IRR (C - A) = 13.5%; and IRR (C -B) = 12.1%. Assuming MARR = 13%, which alternative must be selected? - a. Alternative B . B b. Alternative C C. All alternatives d. Alternatives A and C e. Alternative A Drake Airport services rural, suburban, and transit passengers. The arrival distribution foe each of the three groups is Poisson with mean rate of 15, 10, and 20 passengers per hour, respictively. The time to check in a passenger is exponential with mean 6 minutes. if the number of counters provided at Drake is 5, the total average time to check a customer is 15 minutes, Po = 0.00496, Lq =6.86. What is the Expected Waiting Minutes in Queue Answer: Changing priority rules will affect the waiting times of the customers Select one: True False Always, if the queue in the queuing system empty, the facility becomes idle until a new customer crrives. Select one: True False A priority rule selects the best customer to be served Select one: True False

please answer showing the solution

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock