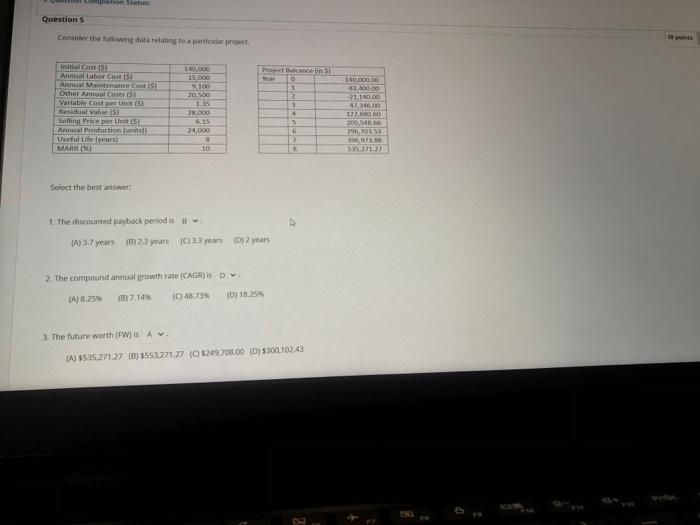

Question: opion status Question 5 Consider the following data relating to a particular project 100 150 al cost 15 Antial Labor Cout 13 Ann Martenance Cent)

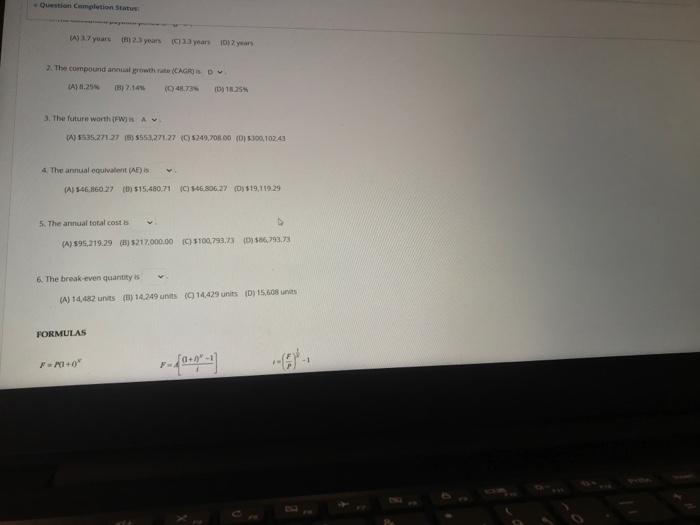

opion status Question 5 Consider the following data relating to a particular project 100 150 al cost 15 Antial Labor Cout 13 Ann Martenance Cent) Other Annual Costs (5) Variable cost per un Residual Values Selling Price per Unit Annual Production units Useful Life Ivars MARR Pendance in Year 1 2 3 250 1:15 28.000 140,000.00 7,800.00 1.140.00 17,516.00 122.00 2014 2015 971 24 000 10 Select the best answer 1. The discounted payback periodis (A) 3.7 years (B) 2.3 years 1923 years 2 years 2. The compound annual growth rate (CAGRID (A) 8.25 18) 7.14 104833 (D) 10.25% The future worth (FW SA (AJ5535.271.27 (3)5553.271.27 (5249.70.00 (0) $300.102.43 Question completion Status Aya 25 years as 1012 2. The compound and growth (CAGRIS DU A) 4.25 B.14 10a730 015 3. The future worth (FWA A35535,271 27 53.271275249.70R00 (0) $100.1024 4 The annual equivalent (A) 5:46.160.27 $15,480,71 146.806 2 O 19,119.29 5. The annual total cost (A) 595,219.29 217,000.00 C) 5100,793,3586.793.73 6. The break-even quantity is (A) 14,482 units (H) 14.249 units (14,423 units) 15,608 FORMULAS o' opion status Question 5 Consider the following data relating to a particular project 100 150 al cost 15 Antial Labor Cout 13 Ann Martenance Cent) Other Annual Costs (5) Variable cost per un Residual Values Selling Price per Unit Annual Production units Useful Life Ivars MARR Pendance in Year 1 2 3 250 1:15 28.000 140,000.00 7,800.00 1.140.00 17,516.00 122.00 2014 2015 971 24 000 10 Select the best answer 1. The discounted payback periodis (A) 3.7 years (B) 2.3 years 1923 years 2 years 2. The compound annual growth rate (CAGRID (A) 8.25 18) 7.14 104833 (D) 10.25% The future worth (FW SA (AJ5535.271.27 (3)5553.271.27 (5249.70.00 (0) $300.102.43 Question completion Status Aya 25 years as 1012 2. The compound and growth (CAGRIS DU A) 4.25 B.14 10a730 015 3. The future worth (FWA A35535,271 27 53.271275249.70R00 (0) $100.1024 4 The annual equivalent (A) 5:46.160.27 $15,480,71 146.806 2 O 19,119.29 5. The annual total cost (A) 595,219.29 217,000.00 C) 5100,793,3586.793.73 6. The break-even quantity is (A) 14,482 units (H) 14.249 units (14,423 units) 15,608 FORMULAS o

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts