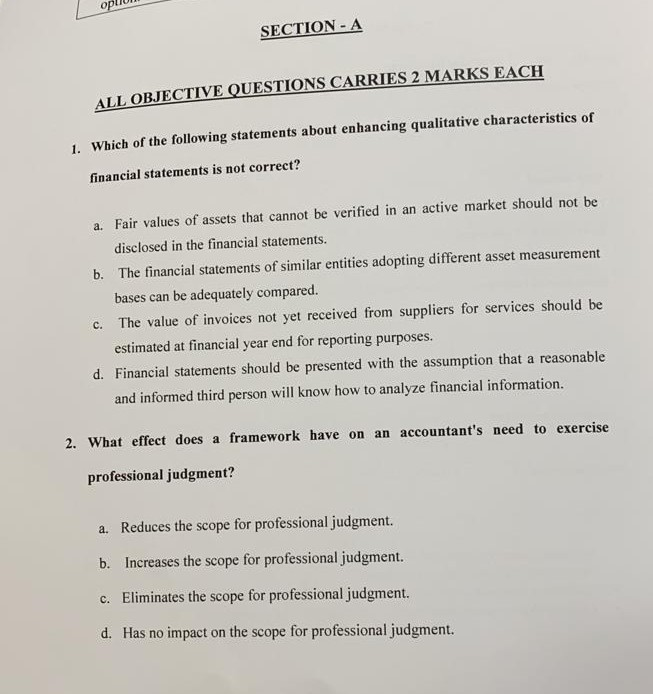

Question: oplin SECTION - A ALL OBJECTIVE QUESTIONS CARRIES 2 MARKS EACH 1. Which of the following statements about enhancing qualitative characteristics of financial statements is

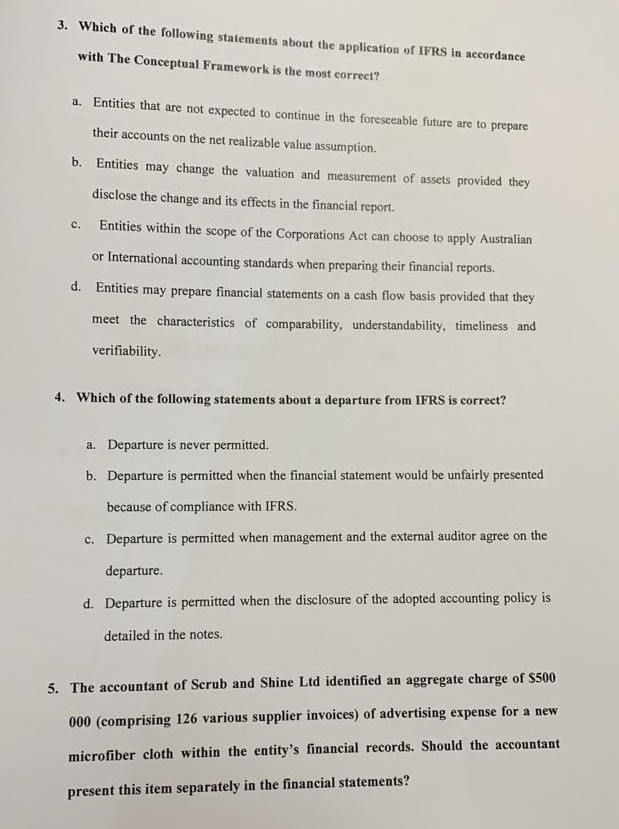

oplin SECTION - A ALL OBJECTIVE QUESTIONS CARRIES 2 MARKS EACH 1. Which of the following statements about enhancing qualitative characteristics of financial statements is not correct? a. Fair values of assets that cannot be verified in an active market should not be disclosed in the financial statements. b. The financial statements of similar entities adopting different asset measurement bases can be adequately compared. c. The value of invoices not yet received from suppliers for services should be estimated at financial year end for reporting purposes. d. Financial statements should be presented with the assumption that a reasonable and informed third person will know how to analyze financial information. 2. What effect does a framework have on an accountant's need to exercise professional judgment? a. Reduces the scope for professional judgment. b. Increases the scope for professional judgment. c. Eliminates the scope for professional judgment. d. Has no impact on the scope for professional judgment. 3. Which of the following statements about the application of IFRS in accordance with The Conceptual Framework is the most correct? a. Entities that are not expected to continue in the foreseeable future are to prepare their accounts on the net realizable value assumption. b. Entities may change the valuation and measurement of assets provided they disclose the change and its effects in the financial report. c. Entities within the scope of the Corporations Act can choose to apply Australian or International accounting standards when preparing their financial reports. d. Entities may prepare financial statements on a cash flow basis provided that they meet the characteristics of comparability, understandability, timeliness and verifiability. 4. Which of the following statements about a departure from IFRS is correct? a. Departure is never permitted. b. Departure is permitted when the financial statement would be unfairly presented because of compliance with IFRS. c. Departure is permitted when management and the external auditor agree on the departure. d. Departure is permitted when the disclosure of the adopted accounting policy is detailed in the notes. 5. The accountant of Scrub and Shine Ltd identified an aggregate charge of $500 000 (comprising 126 various supplier invoices) of advertising expense for a new microfiber cloth within the entity's financial records. Should the accountant present this item separately in the financial statements

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock