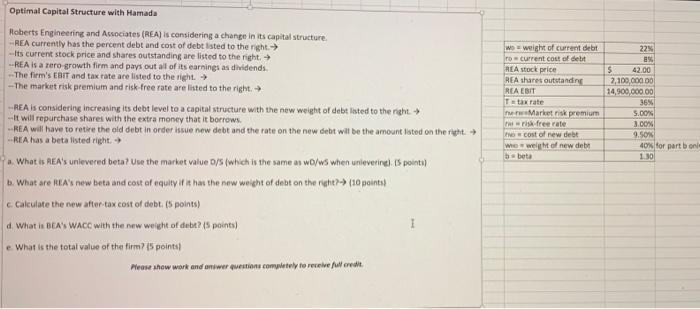

Question: Optimal Capital Structure with Hamada Roberts Engineering and Associates (REA) is considering a change in its capital structure REA currently has the percent debt and

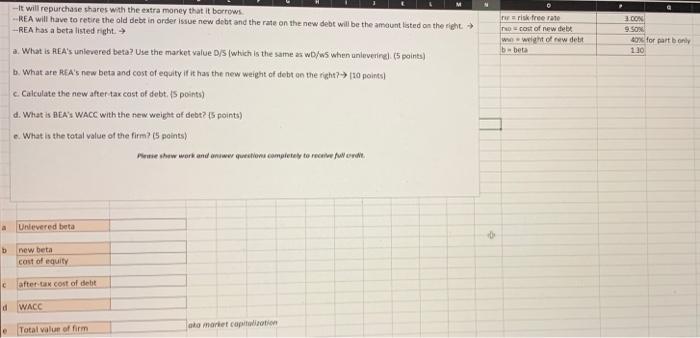

Optimal Capital Structure with Hamada Roberts Engineering and Associates (REA) is considering a change in its capital structure REA currently has the percent debt and cost of debt listed to the night --Its current stock price and shares outstanding are listed to the right --REA is a raro growth firm and pays out all of its earnings as dividends The firm's EBIT and tax rate are listed to the right -The market risk premium and risk free rate are listed to the right - REA is considering increasing its debt level to a capital structure with the new weight of debt isted to the right -It will repurchase shares with the extra money that it borrows -REA will have to retire the old debt in order issue new debt and the rate on the new debt will be the amount listed on the right -REA has a beta listed right What is REA's unlevered beta? Uue the market value D/S/Which is the same as w/w when unleverine). S points) b. What are REA's new beta and cost of equity if it has the new weight of debt on the right?-(10 points) c. Calculate the new after tax cost of debt. 5 points) What is BEA WACo with the new weight of debt? 5 points) I e. What is the total value of the firm? (5 points) Please show work and niwer questions com ly to receive full credit wo = weight of current debt current cost of debt REA stock price REA shares outstanding REA EBIT Totax rate new Market risk premium risk free rate Now cost of new debt We wel of new debt bbet 22 BS 5 42.00 2,100,000.00 14,900,000.00 36% 5.00 3.00% 9.50 40% for part bon 1:30 risk free mase cost of new debt ww weight of new dett bbet OON SESON for part only 130 --It will repurchase shares with the extra money that it borrows. REA will have to retire the old debt in order issue new debt and the rate on the new debt will be the amount listed on the right -REA has a beta listed right a. What is REA's unlevered beta? Use the market value D/S (which is the same as wb/ws when unlovertre) points) b. What are REA's new beta and cost of equity in it has the new weight of debt on the right? 10 points) Calculate the new after tar cast of debt. 5 points) d. What is BEA'S WACC with the new weight of debt? t5 points) .. What is the total value of the firm? (5 points) Preshew work and www.completely to rewo. Unlevered beta D new beta cost of equity C after a cost of debt d WACC e Total value of firm ako more caption

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts