Question: Optimize portfolio with 3 assets using Markowitz Portfolio model Please show steps and formulas, I have no idea how to do these. Funds Management Department.

Optimize portfolio with 3 assets using Markowitz Portfolio model

Please show steps and formulas, I have no idea how to do these.

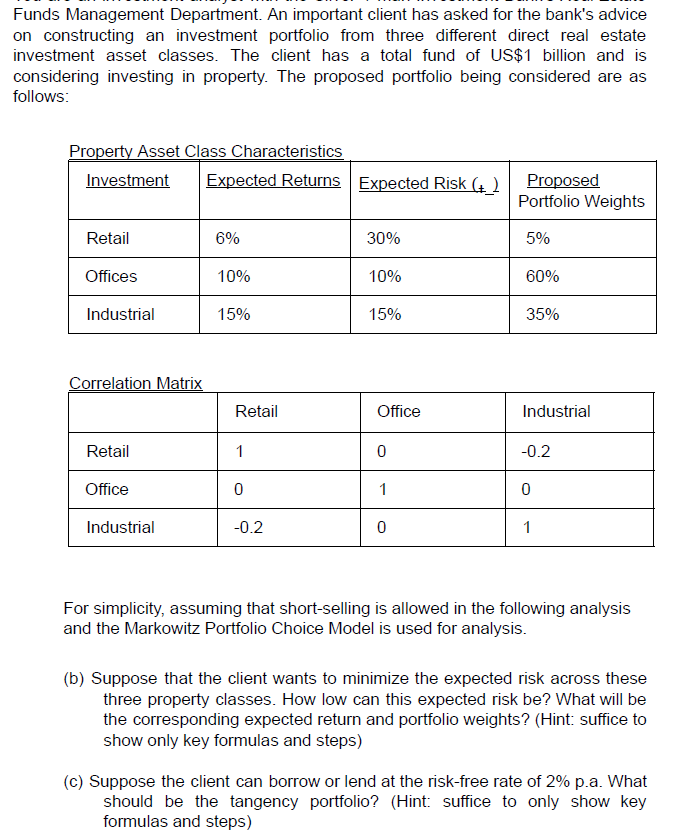

Funds Management Department. An important client has asked for the bank's advice on constructing an investment portfolio from three different direct real estate investment asset classes. The client has a total fund of US$1 billion and is considering investing in property. The proposed portfolio being considered are as follows: Property Asset Class Characteristics Investment Expected Returns Expected Risk (+_) Proposed Portfolio Weights Retail 6% 30% 5% Offices 10% 10% 60% Industrial 15% 15% 35% Correlation Matrix Retail Office Industrial Retail 1 0 -0.2 Office 0 1 0 Industrial -0.2 0 1 For simplicity, assuming that short-selling is allowed in the following analysis and the Markowitz Portfolio Choice Model is used for analysis. (b) Suppose that the client wants to minimize the expected risk across these three property classes. How low can this expected risk be? What will be the corresponding expected return and portfolio weights? (Hint: suffice to show only key formulas and steps) (C) Suppose the client can borrow or lend at the risk-free rate of 2% p.a. What should be the tangency portfolio? (Hint: suffice to only show key formulas and steps) Funds Management Department. An important client has asked for the bank's advice on constructing an investment portfolio from three different direct real estate investment asset classes. The client has a total fund of US$1 billion and is considering investing in property. The proposed portfolio being considered are as follows: Property Asset Class Characteristics Investment Expected Returns Expected Risk (+_) Proposed Portfolio Weights Retail 6% 30% 5% Offices 10% 10% 60% Industrial 15% 15% 35% Correlation Matrix Retail Office Industrial Retail 1 0 -0.2 Office 0 1 0 Industrial -0.2 0 1 For simplicity, assuming that short-selling is allowed in the following analysis and the Markowitz Portfolio Choice Model is used for analysis. (b) Suppose that the client wants to minimize the expected risk across these three property classes. How low can this expected risk be? What will be the corresponding expected return and portfolio weights? (Hint: suffice to show only key formulas and steps) (C) Suppose the client can borrow or lend at the risk-free rate of 2% p.a. What should be the tangency portfolio? (Hint: suffice to only show key formulas and steps)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts