Question: option 1 is not the right answer Question 11 (1 point) Assume Shandra, an unmarried taxpayer who is a landlord, sells an apartment building for

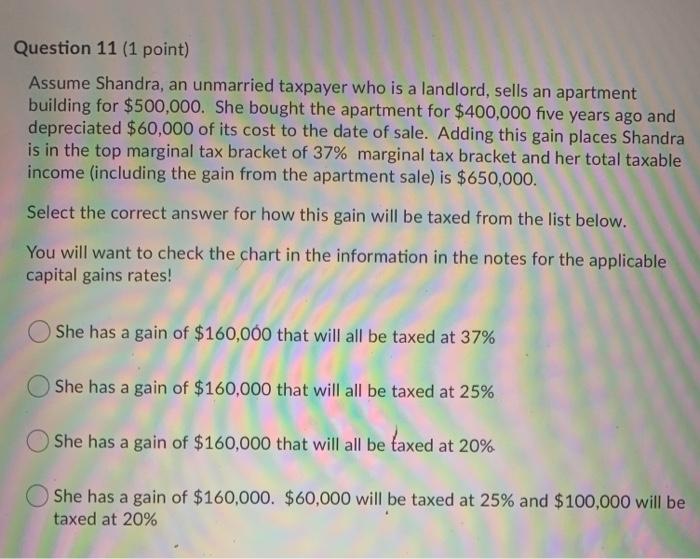

Question 11 (1 point) Assume Shandra, an unmarried taxpayer who is a landlord, sells an apartment building for $500,000. She bought the apartment for $400,000 five years ago and depreciated $60,000 of its cost to the date of sale. Adding this gain places Shandra is in the top marginal tax bracket of 37% marginal tax bracket and her total taxable income (including the gain from the apartment sale) is $650,000. Select the correct answer for how this gain will be taxed from the list below. You will want to check the chart in the information in the notes for the applicable capital gains rates! She has a gain of $160,000 that will all be taxed at 37% She has a gain of $160,000 that will all be taxed at 25% She has a gain of $160,000 that will all be taxed at 20% She has a gain of $160,000. $60,000 will be taxed at 25% and $100,000 will be taxed at 20%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts