Question: Option 1:direct labor hours, an input unit level cost driver direct labor hours, an output unit level cost driver machine hours ,an output unit level

Option 1:direct labor hours, an input unit level cost driver

Option 1:direct labor hours, an input unit level cost driver

direct labor hours, an output unit level cost driver

machine hours ,an output unit level cost driver

machine hours ,an input unit level cost driver

units sold, an output unit level cost driver

units sold, an input unit level cost drive

option 2:more direct labor hours or more machine hours or more units sold

option 3 greater or lesser

option 4: use the same number of direct labor hours

use the same number of machine hours

use twice number of direct labor hours

use twice the number of machine hours

sold the same number of units

sold twice the number of units

option 5: a larger

a smaller

the same

Option 6: less intensive

more intensive

similar

Option 7: much higher

much lower

the same

Option8: not very

quite

Option 9:overcosted

undercosted

Option 10: less

more

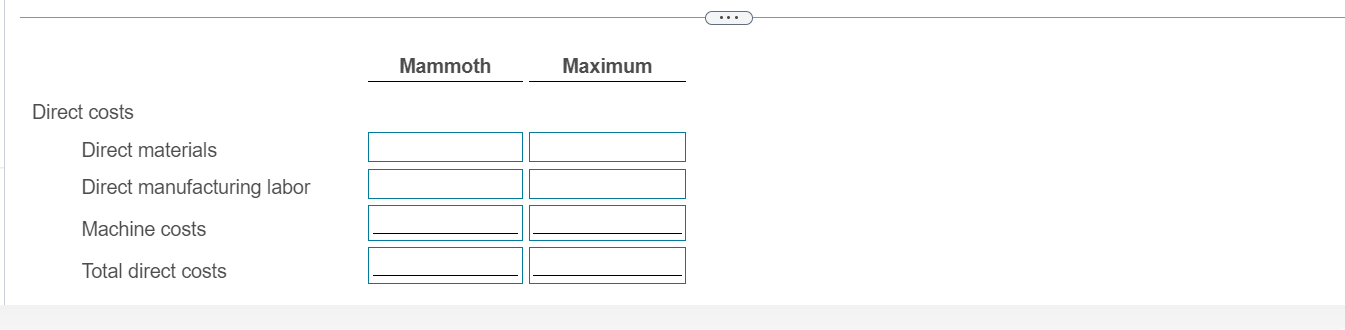

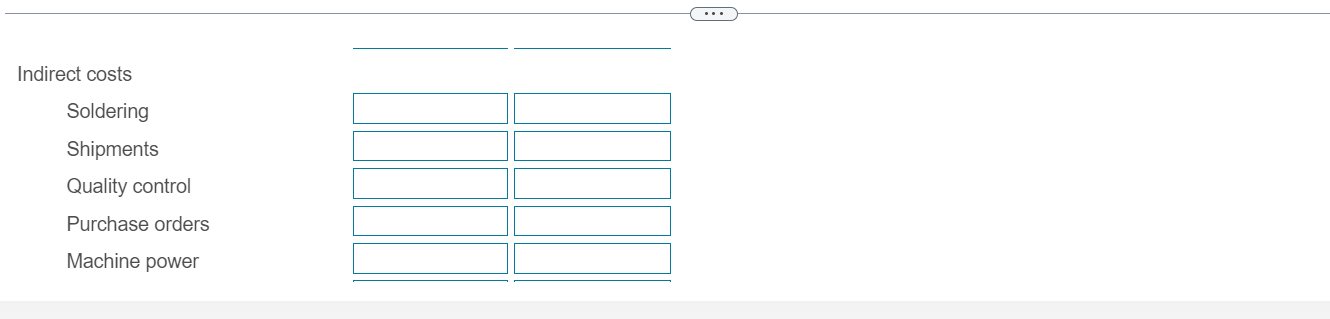

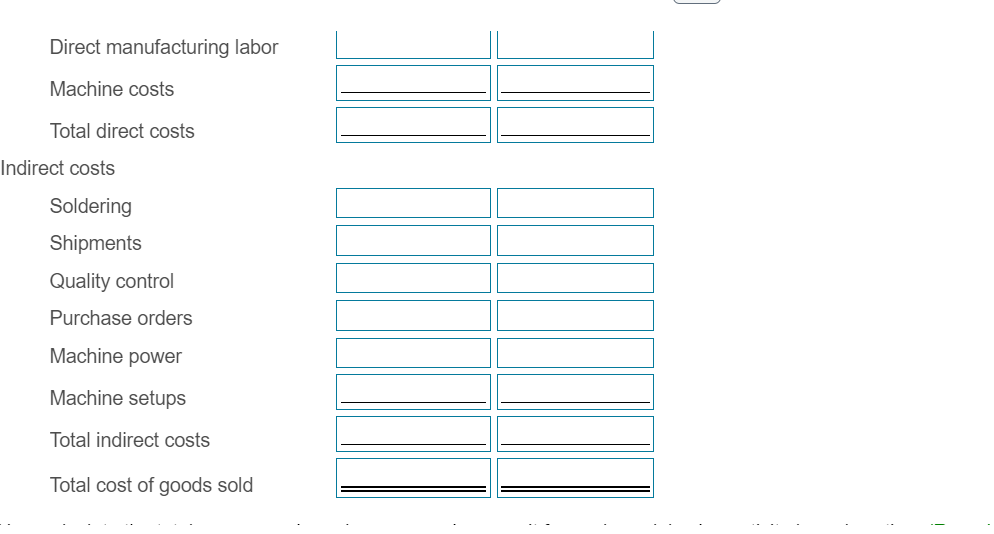

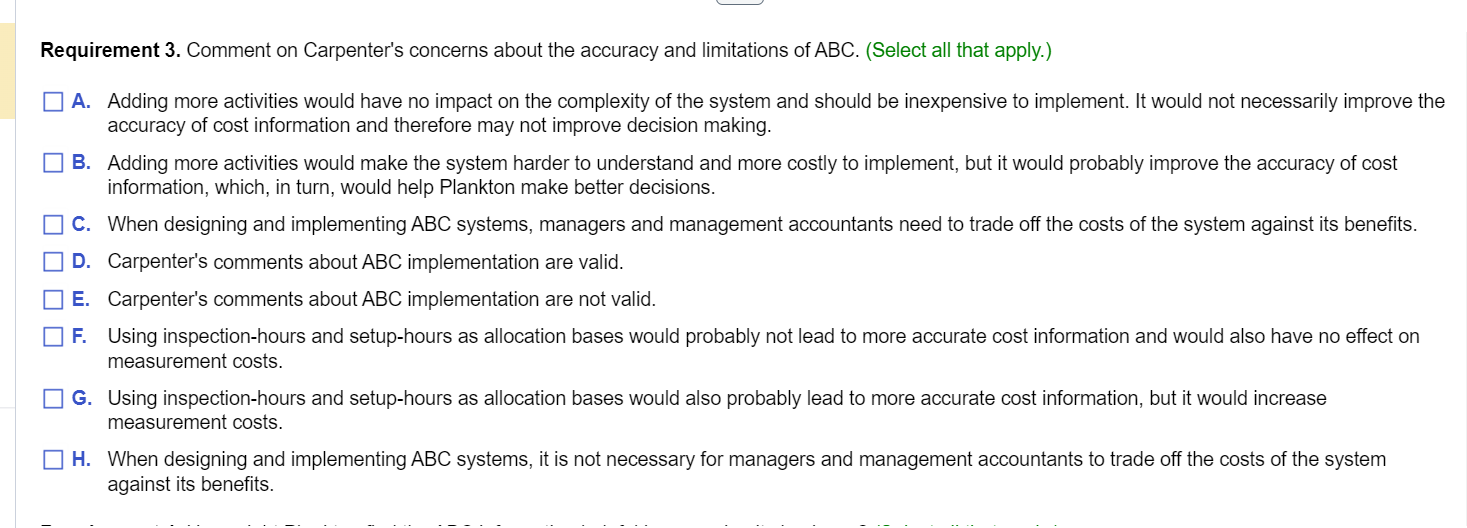

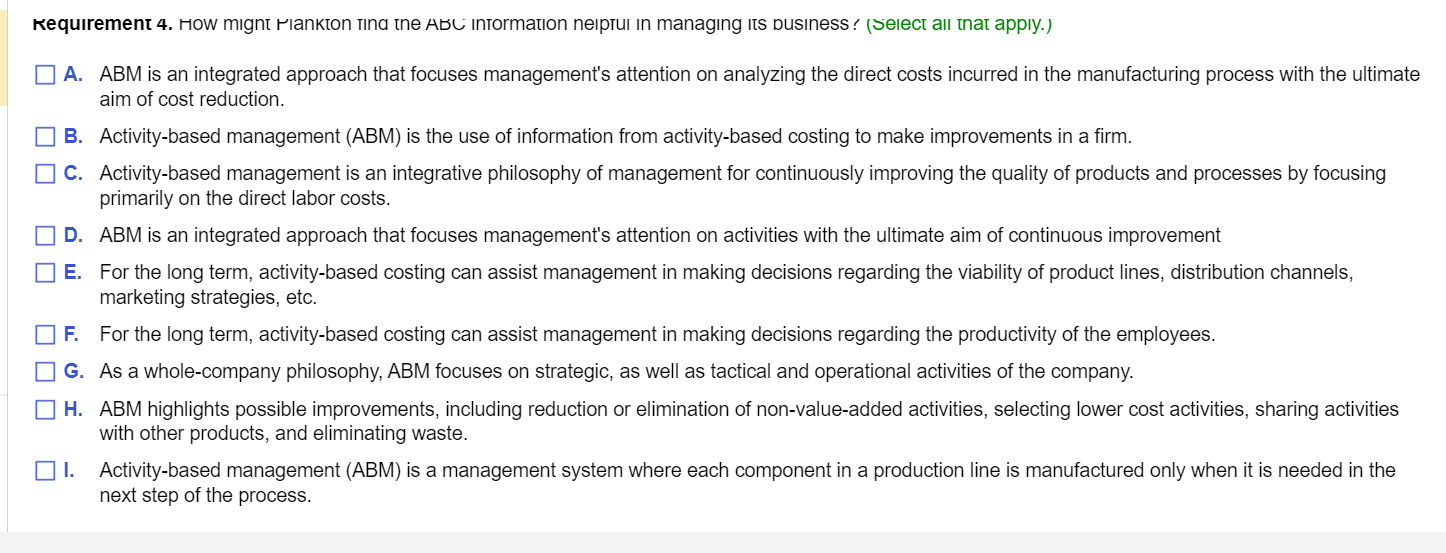

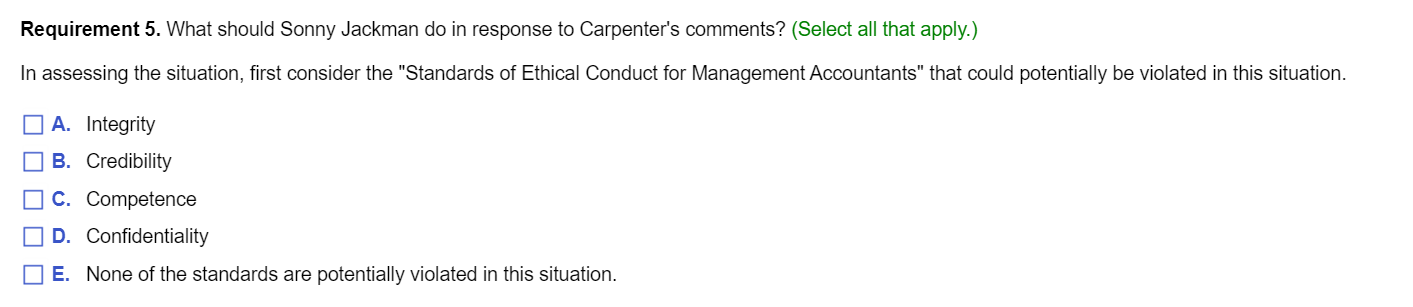

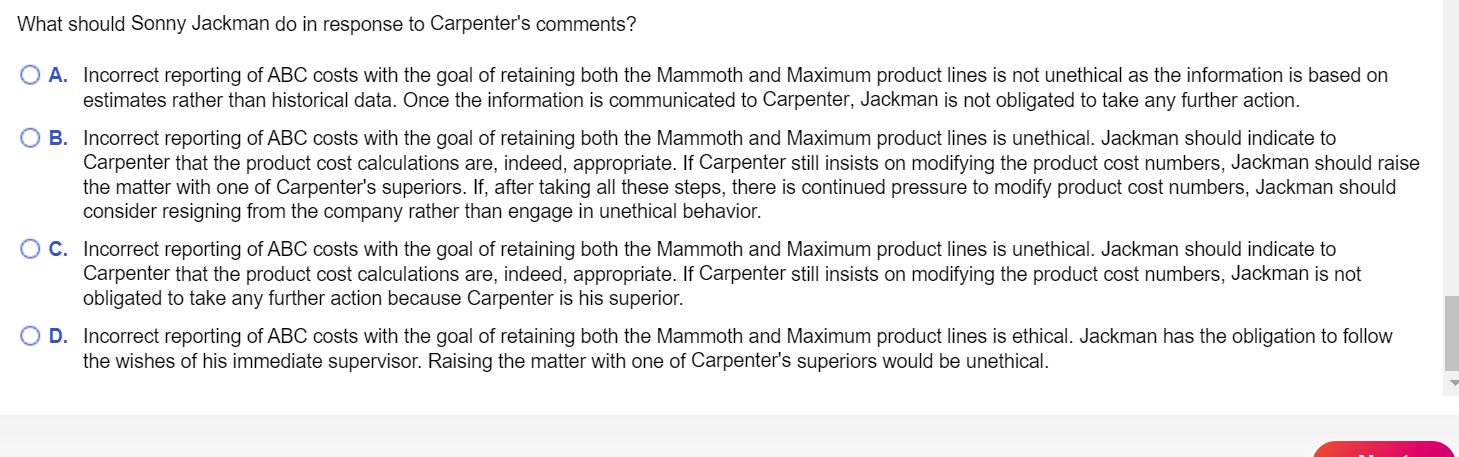

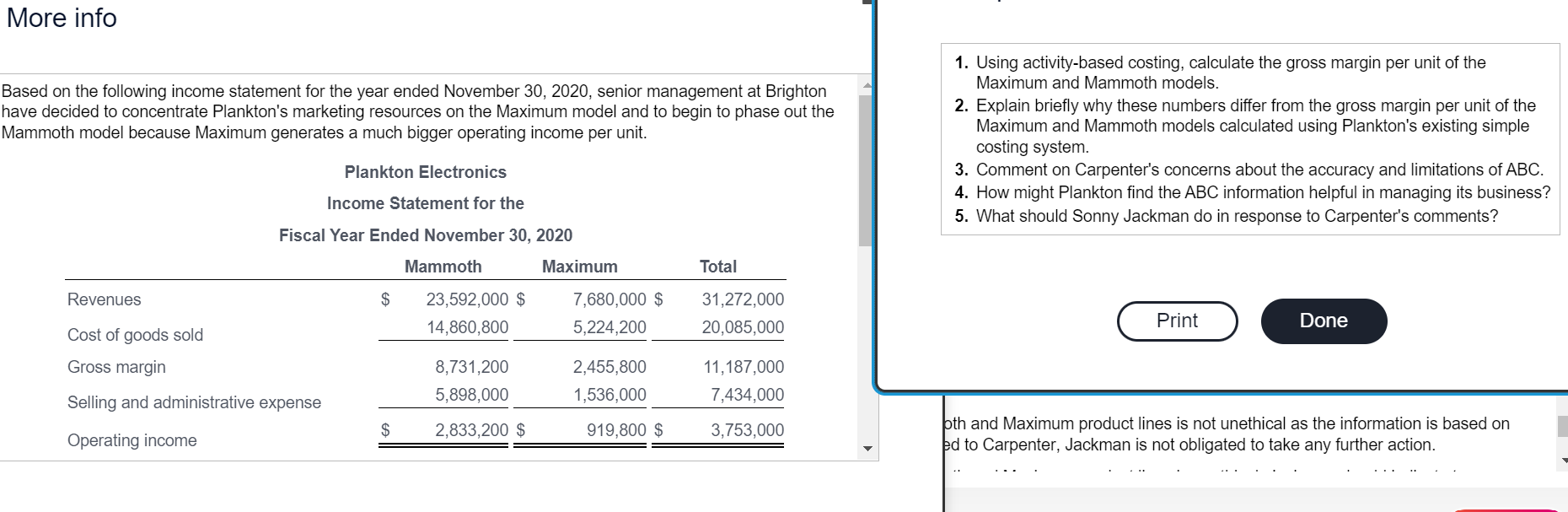

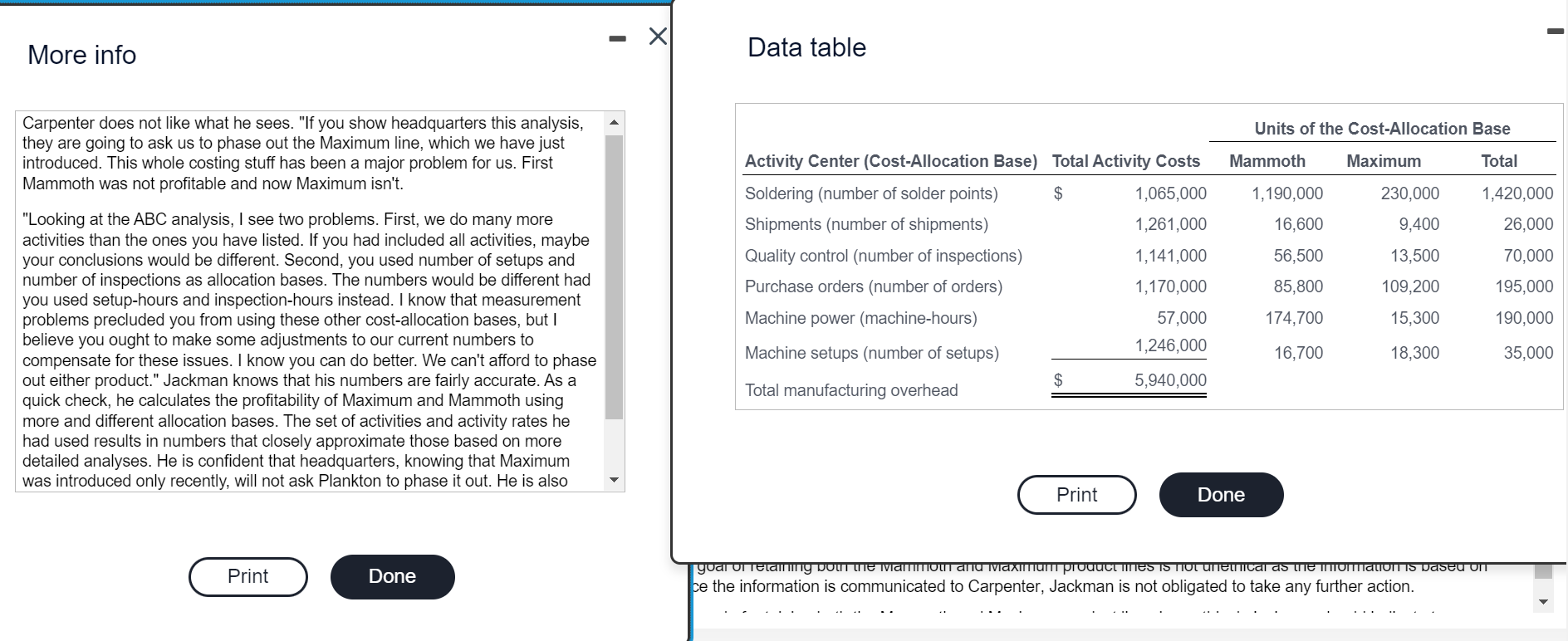

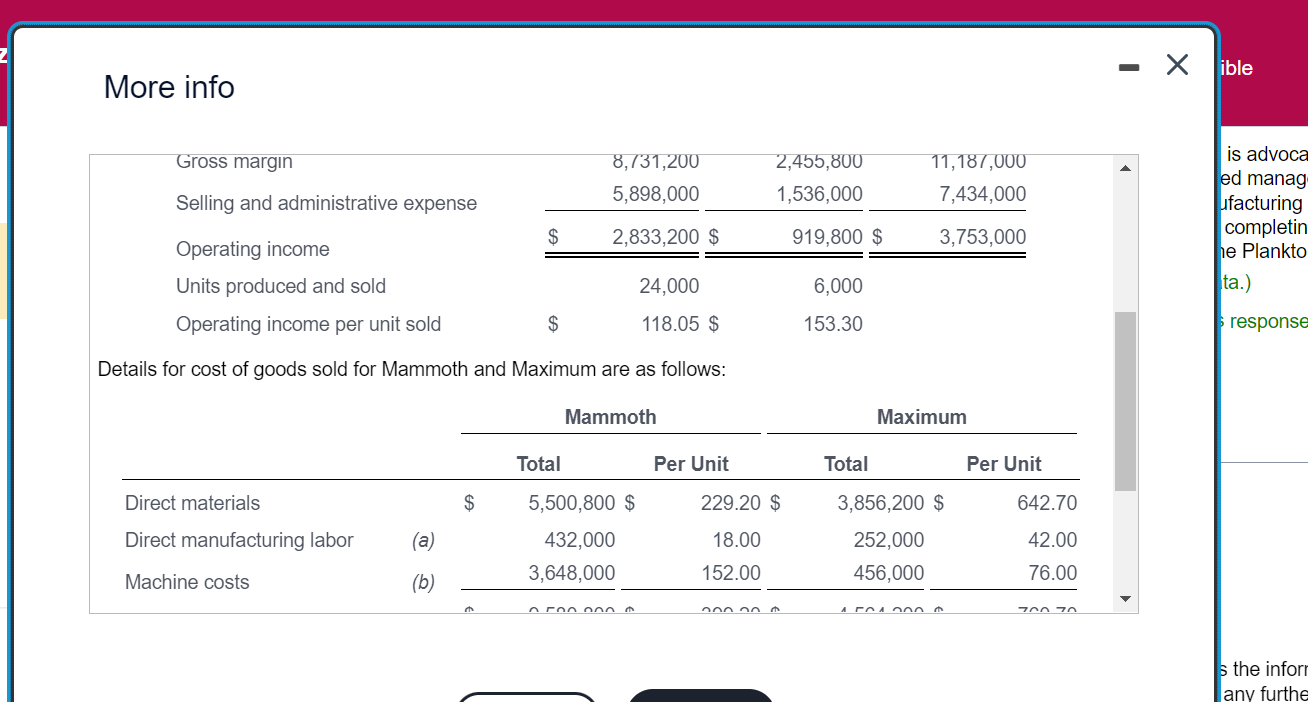

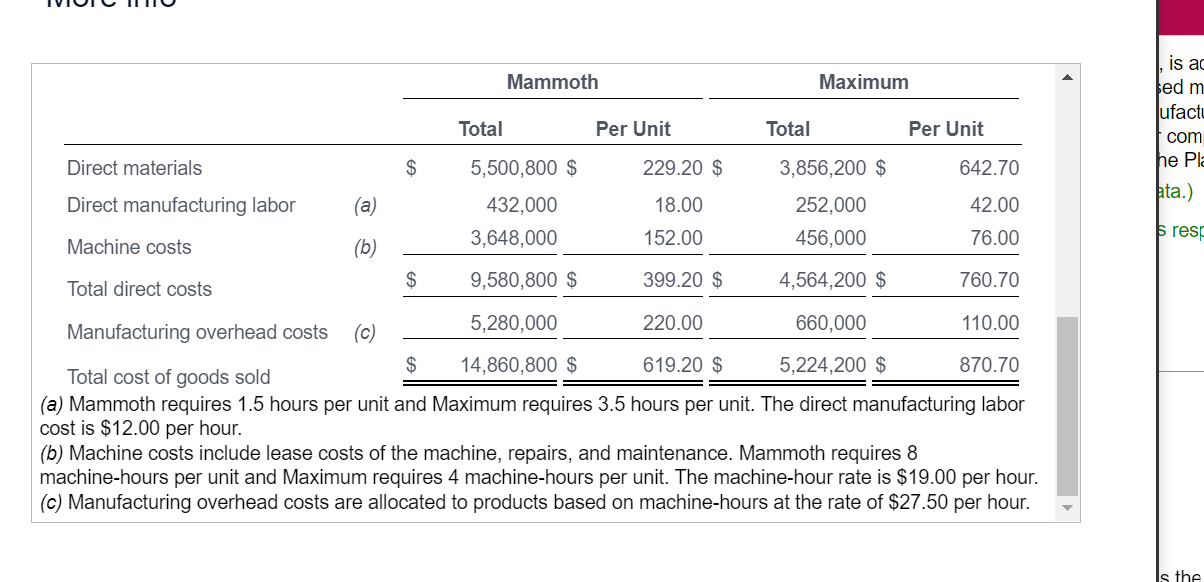

Requirement 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. Begin by calculating the total cost of goods sold for each model. (Round intermediary calculations to the nearest cent.) Direct costs Direct materials Direct manufacturing labor Machine costs Total direct costs Indirect costs Soldering Shipments Quality control Purchase orders Machine power Direct manufacturing labor Machine costs Total direct costs \begin{tabular}{l|} \hline \\ \hline \\ \hline \end{tabular} Indirect costs Soldering Shipments Quality control Purchase orders Total cost of goods sold Requirement 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Plankton's existing cimnlo nnctinn cictom Requirement 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Plankton's existing simple costing system. Plankton's simple costing system allocates all manufacturing overhead other than machine costs on the basis of Requirement 3. Comment on Carpenter's concerns about the accuracy and limitations of ABC. (Select all that apply.) A. Adding more activities would have no impact on the complexity of the system and should be inexpensive to implement. It would not necessarily improve the accuracy of cost information and therefore may not improve decision making. B. Adding more activities would make the system harder to understand and more costly to implement, but it would probably improve the accuracy of cost information, which, in turn, would help Plankton make better decisions. C. When designing and implementing ABC systems, managers and management accountants need to trade off the costs of the system against its benefits. D. Carpenter's comments about ABC implementation are valid. E. Carpenter's comments about ABC implementation are not valid. F. Using inspection-hours and setup-hours as allocation bases would probably not lead to more accurate cost information and would also have no effect on measurement costs. G. Using inspection-hours and setup-hours as allocation bases would also probably lead to more accurate cost information, but it would increase measurement costs. H. When designing and implementing ABC systems, it is not necessary for managers and management accountants to trade off the costs of the system against its benefits. Kequirement 4. How mgnt rlankion tna the AbL ntormaton nepru in managng Its busness! (elect all that appy.) A. ABM is an integrated approach that focuses management's attention on analyzing the direct costs incurred in the manufacting process with the ultimate aim of cost reduction. B. Activity-based management (ABM) is the use of information from activity-based costing to make improvements in a firm. primarily on the direct labor costs. D. ABM is an integrated approach that focuses management's attention on activities with the ultimate aim of continuous improvement E. For the long term, activity-based costing can assist management in making decisions regarding the viability of product lines, marketing strategies, etc. F. For the long term, activity-based costing can assist management in making decisions regarding the productivity of the empentione G. As a whole-company philosophy, ABM focuses on strategic, as well as tactical and operational activities of the company. H. ABM highlights possible improvements, including reduction or elimination of non-value-added activities, selecting lower cost activities, sharing activities with other products, and eliminating waste. next step of the process. Requirement 5. What should Sonny Jackman do in response to Carpenter's comments? (Select all that apply.) In assessing the situation, first consider the "Standards of Ethical Conduct for Management Accountants" that could potentially be violated in this situation. A. Integrity B. Credibility C. Competence D. Confidentiality E. None of the standards are potentially violated in this situation. What should Sonny Jackman do in response to Carpenter's comments? A. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is not unethical as the information is based on estimates rather than historical data. Once the information is communicated to Carpenter, Jackman is not obligated to take any further action. B. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is unethical. Jackman should indicate to Carpenter that the product cost calculations are, indeed, appropriate. If Carpenter still insists on modifying the product cost numbers, Jackman should raise the matter with one of Carpenter's superiors. If, after taking all these steps, there is continued pressure to modify product cost numbers, Jackman should consider resigning from the company rather than engage in unethical behavior. C. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is unethical. Jackman should indicate to Carpenter that the product cost calculations are, indeed, appropriate. If Carpenter still insists on modifying the product cost numbers, Jackman is not obligated to take any further action because Carpenter is his superior. D. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is ethical. Jackman has the obligation to follow the wishes of his immediate supervisor. Raising the matter with one of Carpenter's superiors would be unethical. 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. Based on the following income statement for the year ended November 30,2020 , senior management at Brighton 2. Explain briefly why these numbers differ from the gross margin per unit of the have decided to concentrate Plankton's marketing resources on the Maximum model and to begin to phase out the Maximum and Mammoth models calculated using Plankton's existing simple Mammoth model because Maximum generates a much bigger operating income per unit. costing system. 3. Comment on Carpenter's concerns about the accuracy and limitations of ABC. 4. How might Plankton find the ABC information helpful in managing its business? 5. What should Sonny Jackman do in response to Carpenter's comments? oth and Maximum product lines is not unethical as the information is based on ed to Carpenter, Jackman is not obligated to take any further action. More info Data table Carpenter does not like what he sees. "If you show headquarters this analysis, they are going to ask us to phase out the Maximum line, which we have just introduced. This whole costing stuff has been a major problem for us. First Mammoth was not profitable and now Maximum isn't. "Looking at the ABC analysis, I see two problems. First, we do many more activities than the ones you have listed. If you had included all activities, maybe your conclusions would be different. Second, you used number of setups and number of inspections as allocation bases. The numbers would be different had you used setup-hours and inspection-hours instead. I know that measurement problems precluded you from using these other cost-allocation bases, but I believe you ought to make some adjustments to our current numbers to compensate for these issues. I know you can do better. We can't afford to phase out either product." Jackman knows that his numbers are fairly accurate. As a quick check, he calculates the profitability of Maximum and Mammoth using more and different allocation bases. The set of activities and activity rates he had used results in numbers that closely approximate those based on more detailed analyses. He is confident that headquarters, knowing that Maximum was introduced only recently, will not ask Plankton to phase it out. He is also More info is advoca ed manag Ifacturing completin ta.) response Details for cost of goods sold for Mammoth and Maximum are as follows: (a) Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. The direct manufacturing labor cost is $12.00 per hour. (b) Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine-hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.00 per hour. (c) Manufacturing overhead costs are allocated to products based on machine-hours at the rate of $27.50 per hour. Requirement 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. Begin by calculating the total cost of goods sold for each model. (Round intermediary calculations to the nearest cent.) Direct costs Direct materials Direct manufacturing labor Machine costs Total direct costs Indirect costs Soldering Shipments Quality control Purchase orders Machine power Direct manufacturing labor Machine costs Total direct costs \begin{tabular}{l|} \hline \\ \hline \\ \hline \end{tabular} Indirect costs Soldering Shipments Quality control Purchase orders Total cost of goods sold Requirement 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Plankton's existing cimnlo nnctinn cictom Requirement 2. Explain briefly why these numbers differ from the gross margin per unit of the Maximum and Mammoth models calculated using Plankton's existing simple costing system. Plankton's simple costing system allocates all manufacturing overhead other than machine costs on the basis of Requirement 3. Comment on Carpenter's concerns about the accuracy and limitations of ABC. (Select all that apply.) A. Adding more activities would have no impact on the complexity of the system and should be inexpensive to implement. It would not necessarily improve the accuracy of cost information and therefore may not improve decision making. B. Adding more activities would make the system harder to understand and more costly to implement, but it would probably improve the accuracy of cost information, which, in turn, would help Plankton make better decisions. C. When designing and implementing ABC systems, managers and management accountants need to trade off the costs of the system against its benefits. D. Carpenter's comments about ABC implementation are valid. E. Carpenter's comments about ABC implementation are not valid. F. Using inspection-hours and setup-hours as allocation bases would probably not lead to more accurate cost information and would also have no effect on measurement costs. G. Using inspection-hours and setup-hours as allocation bases would also probably lead to more accurate cost information, but it would increase measurement costs. H. When designing and implementing ABC systems, it is not necessary for managers and management accountants to trade off the costs of the system against its benefits. Kequirement 4. How mgnt rlankion tna the AbL ntormaton nepru in managng Its busness! (elect all that appy.) A. ABM is an integrated approach that focuses management's attention on analyzing the direct costs incurred in the manufacting process with the ultimate aim of cost reduction. B. Activity-based management (ABM) is the use of information from activity-based costing to make improvements in a firm. primarily on the direct labor costs. D. ABM is an integrated approach that focuses management's attention on activities with the ultimate aim of continuous improvement E. For the long term, activity-based costing can assist management in making decisions regarding the viability of product lines, marketing strategies, etc. F. For the long term, activity-based costing can assist management in making decisions regarding the productivity of the empentione G. As a whole-company philosophy, ABM focuses on strategic, as well as tactical and operational activities of the company. H. ABM highlights possible improvements, including reduction or elimination of non-value-added activities, selecting lower cost activities, sharing activities with other products, and eliminating waste. next step of the process. Requirement 5. What should Sonny Jackman do in response to Carpenter's comments? (Select all that apply.) In assessing the situation, first consider the "Standards of Ethical Conduct for Management Accountants" that could potentially be violated in this situation. A. Integrity B. Credibility C. Competence D. Confidentiality E. None of the standards are potentially violated in this situation. What should Sonny Jackman do in response to Carpenter's comments? A. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is not unethical as the information is based on estimates rather than historical data. Once the information is communicated to Carpenter, Jackman is not obligated to take any further action. B. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is unethical. Jackman should indicate to Carpenter that the product cost calculations are, indeed, appropriate. If Carpenter still insists on modifying the product cost numbers, Jackman should raise the matter with one of Carpenter's superiors. If, after taking all these steps, there is continued pressure to modify product cost numbers, Jackman should consider resigning from the company rather than engage in unethical behavior. C. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is unethical. Jackman should indicate to Carpenter that the product cost calculations are, indeed, appropriate. If Carpenter still insists on modifying the product cost numbers, Jackman is not obligated to take any further action because Carpenter is his superior. D. Incorrect reporting of ABC costs with the goal of retaining both the Mammoth and Maximum product lines is ethical. Jackman has the obligation to follow the wishes of his immediate supervisor. Raising the matter with one of Carpenter's superiors would be unethical. 1. Using activity-based costing, calculate the gross margin per unit of the Maximum and Mammoth models. Based on the following income statement for the year ended November 30,2020 , senior management at Brighton 2. Explain briefly why these numbers differ from the gross margin per unit of the have decided to concentrate Plankton's marketing resources on the Maximum model and to begin to phase out the Maximum and Mammoth models calculated using Plankton's existing simple Mammoth model because Maximum generates a much bigger operating income per unit. costing system. 3. Comment on Carpenter's concerns about the accuracy and limitations of ABC. 4. How might Plankton find the ABC information helpful in managing its business? 5. What should Sonny Jackman do in response to Carpenter's comments? oth and Maximum product lines is not unethical as the information is based on ed to Carpenter, Jackman is not obligated to take any further action. More info Data table Carpenter does not like what he sees. "If you show headquarters this analysis, they are going to ask us to phase out the Maximum line, which we have just introduced. This whole costing stuff has been a major problem for us. First Mammoth was not profitable and now Maximum isn't. "Looking at the ABC analysis, I see two problems. First, we do many more activities than the ones you have listed. If you had included all activities, maybe your conclusions would be different. Second, you used number of setups and number of inspections as allocation bases. The numbers would be different had you used setup-hours and inspection-hours instead. I know that measurement problems precluded you from using these other cost-allocation bases, but I believe you ought to make some adjustments to our current numbers to compensate for these issues. I know you can do better. We can't afford to phase out either product." Jackman knows that his numbers are fairly accurate. As a quick check, he calculates the profitability of Maximum and Mammoth using more and different allocation bases. The set of activities and activity rates he had used results in numbers that closely approximate those based on more detailed analyses. He is confident that headquarters, knowing that Maximum was introduced only recently, will not ask Plankton to phase it out. He is also More info is advoca ed manag Ifacturing completin ta.) response Details for cost of goods sold for Mammoth and Maximum are as follows: (a) Mammoth requires 1.5 hours per unit and Maximum requires 3.5 hours per unit. The direct manufacturing labor cost is $12.00 per hour. (b) Machine costs include lease costs of the machine, repairs, and maintenance. Mammoth requires 8 machine-hours per unit and Maximum requires 4 machine-hours per unit. The machine-hour rate is $19.00 per hour. (c) Manufacturing overhead costs are allocated to products based on machine-hours at the rate of $27.50 per hour

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts