Question: Option A. Option B. Option C. Option D. D. suppose you are consiaerng two possidie Investment opportunities: a 1L-year Ireasury Dona ana a 1 -year,

Option A.

Option B.

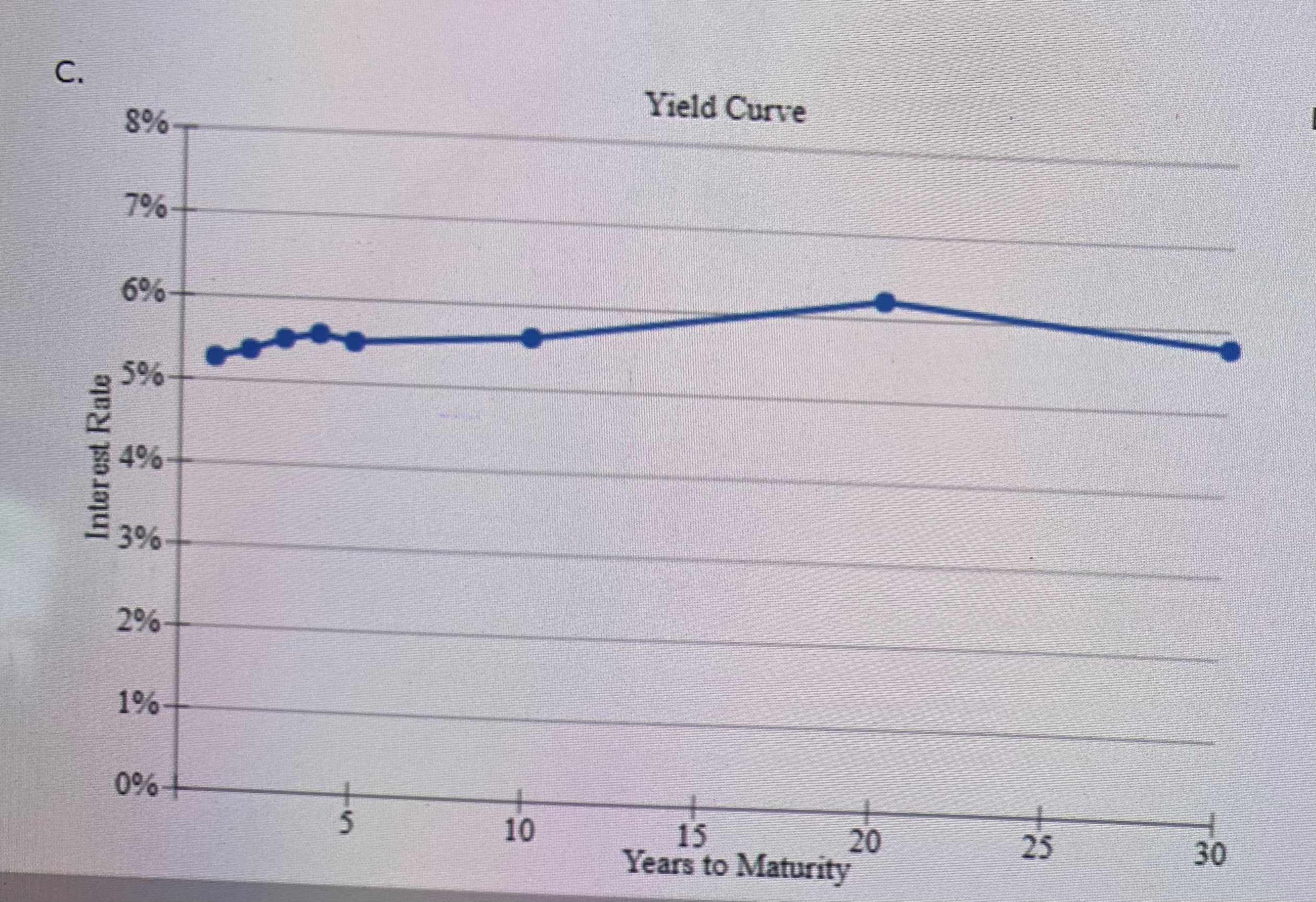

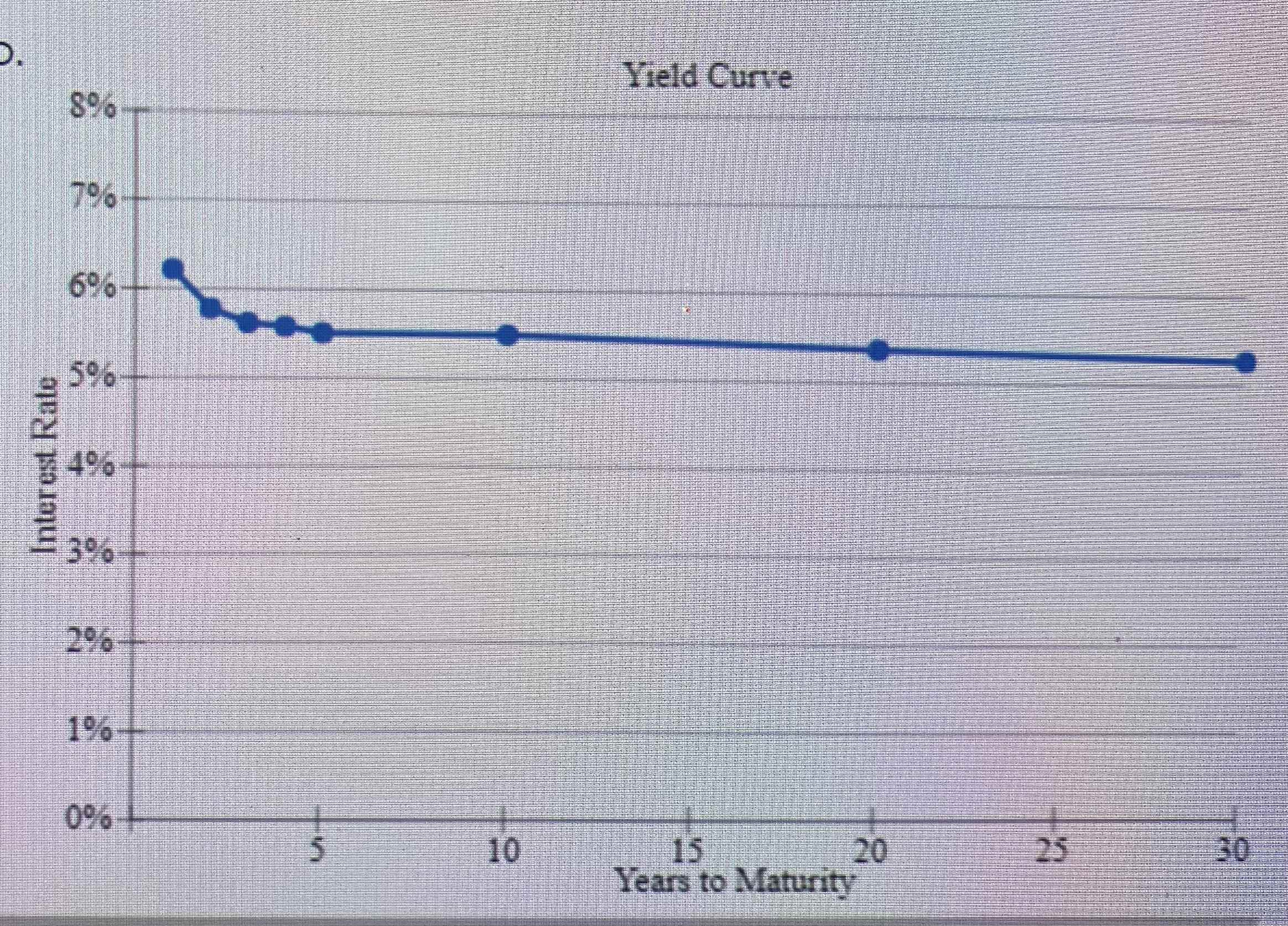

Option C.

Option D.

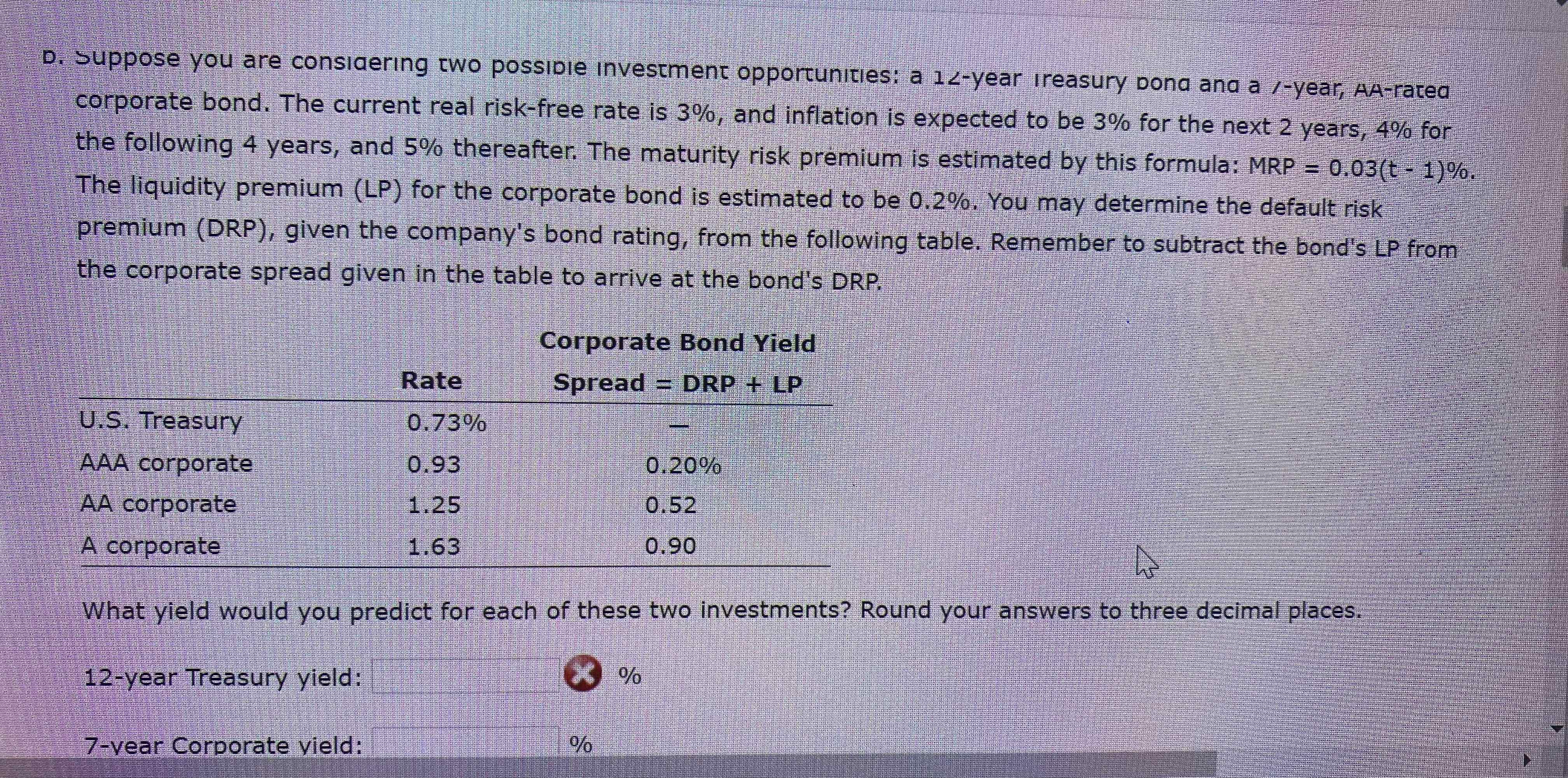

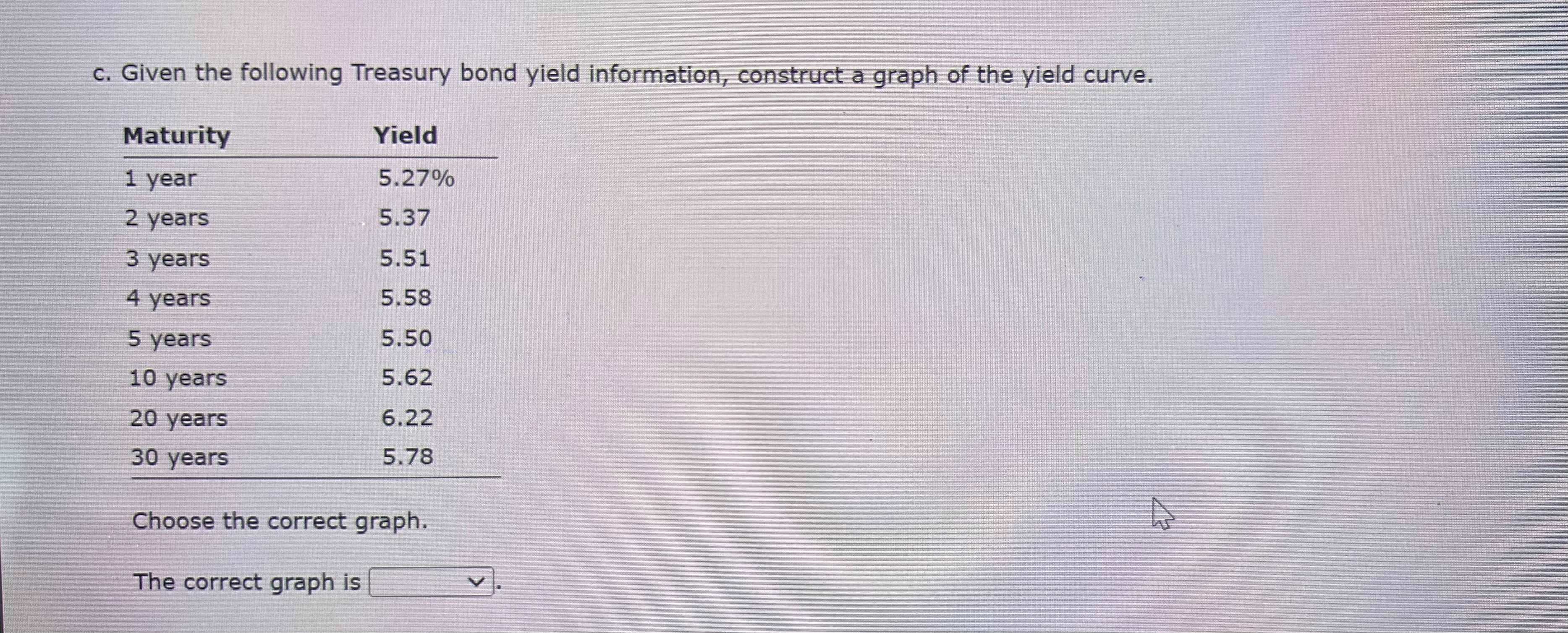

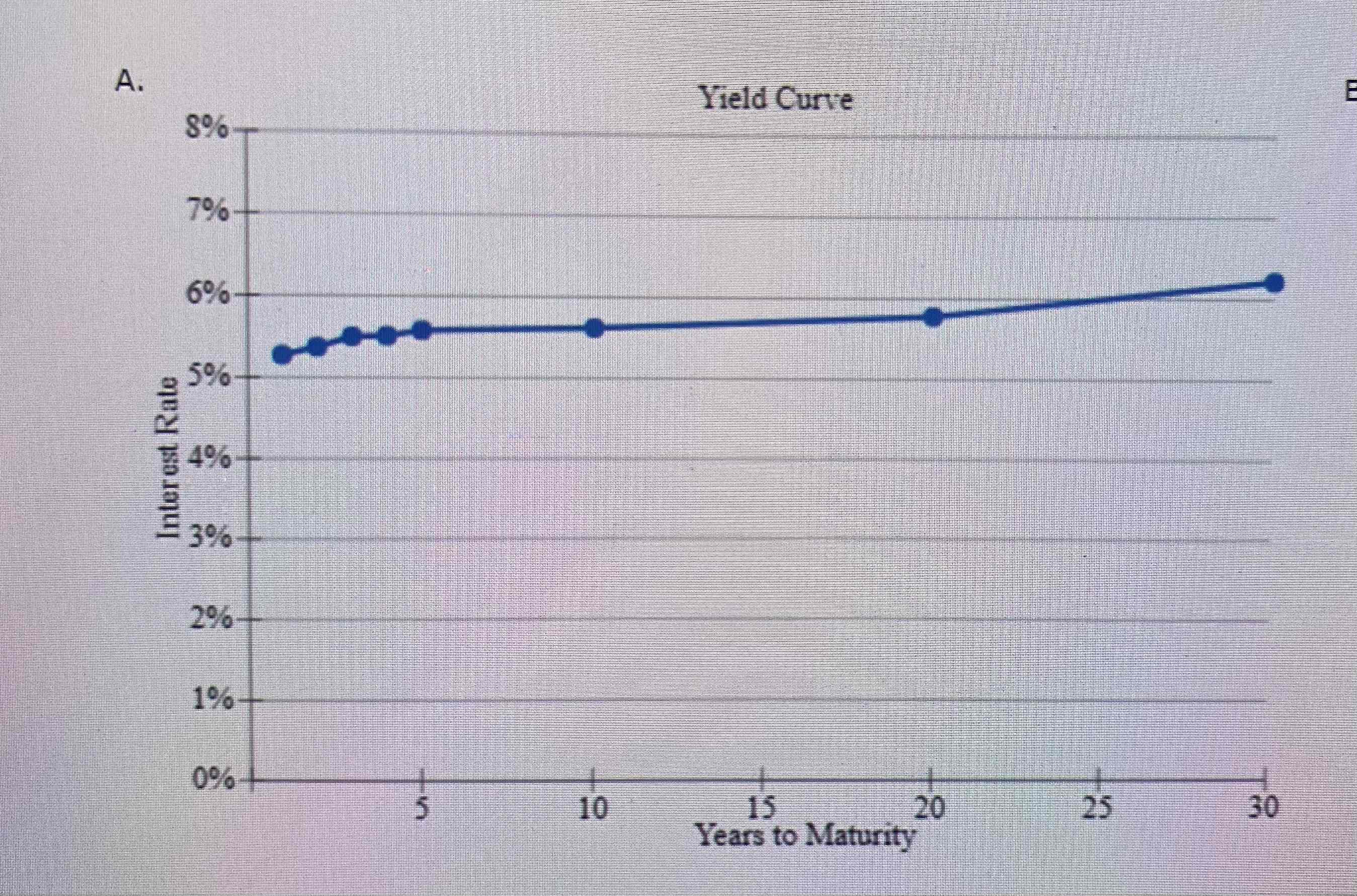

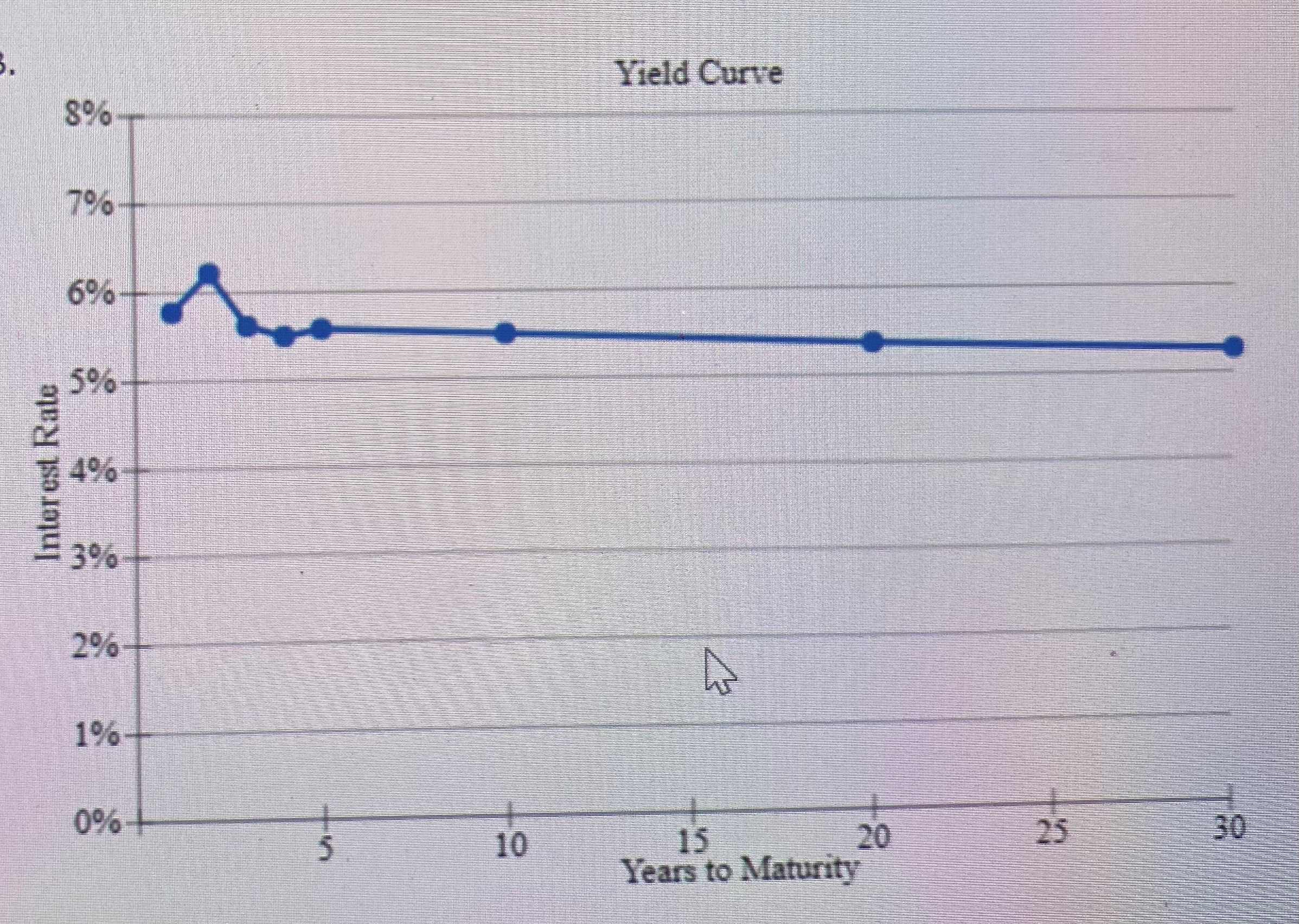

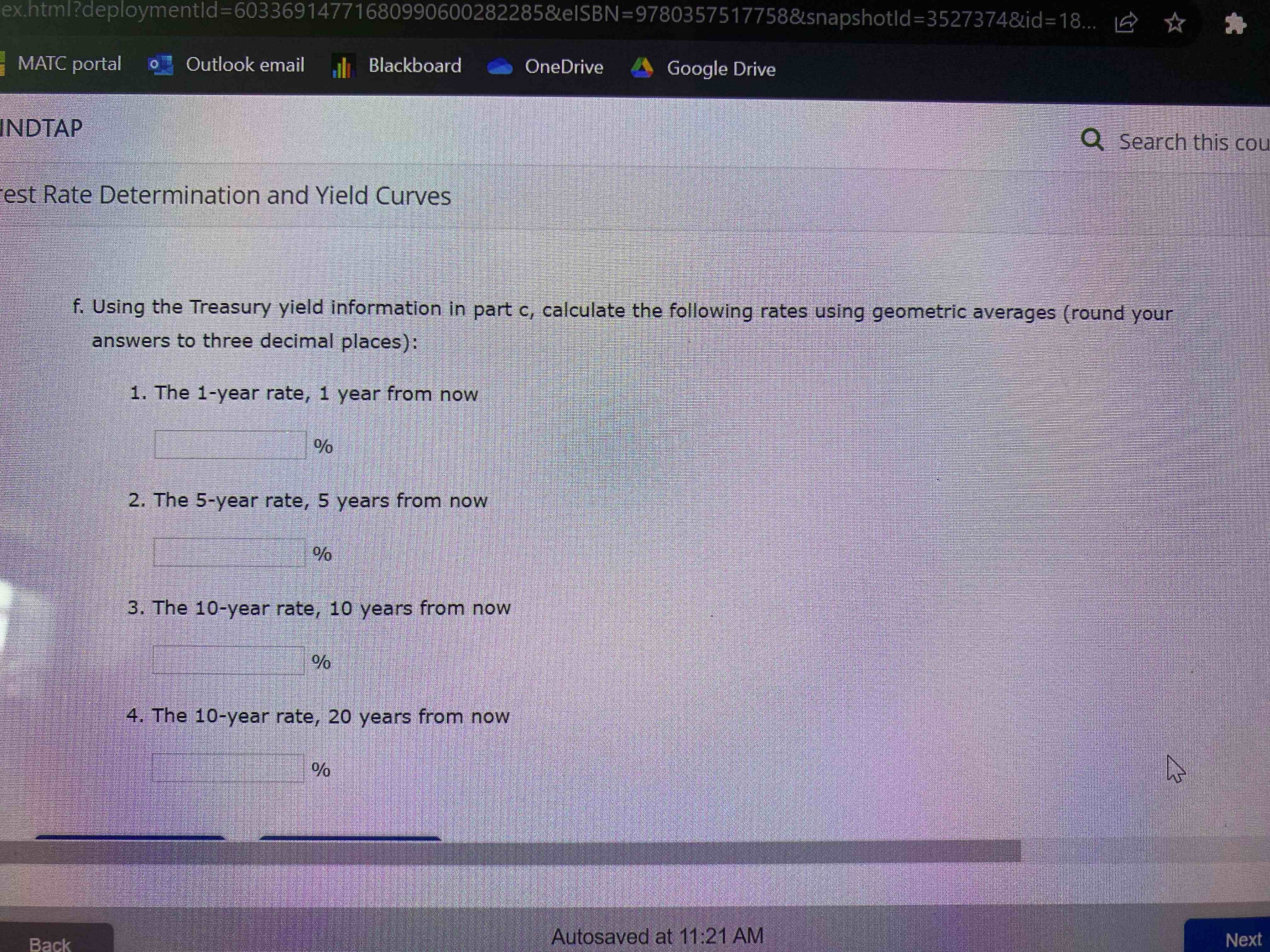

D. suppose you are consiaerng two possidie Investment opportunities: a 1L-year Ireasury Dona ana a 1 -year, AA-ratea corporate bond. The current real risk-free rate is 3\%, and inflation is expected to be 3% for the next 2 years, 4% for the following 4 years, and 5% thereafter. The maturity risk premium is estimated by this formula: MRP =0.03(t1)%. The liquidity premium (LP) for the corporate bond is estimated to be 0.2%. You may determine the default risk premium (DRP), given the company's bond rating, from the following table. Remember to subtract the bond's LP from the corporate spread given in the table to arrive at the bond's DRP. c. Given the following Treasury bond yield information, construct a graph of the yield curve. Choose the correct graph. The correct graph is c. Yield Curve A. Yield Curve

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts