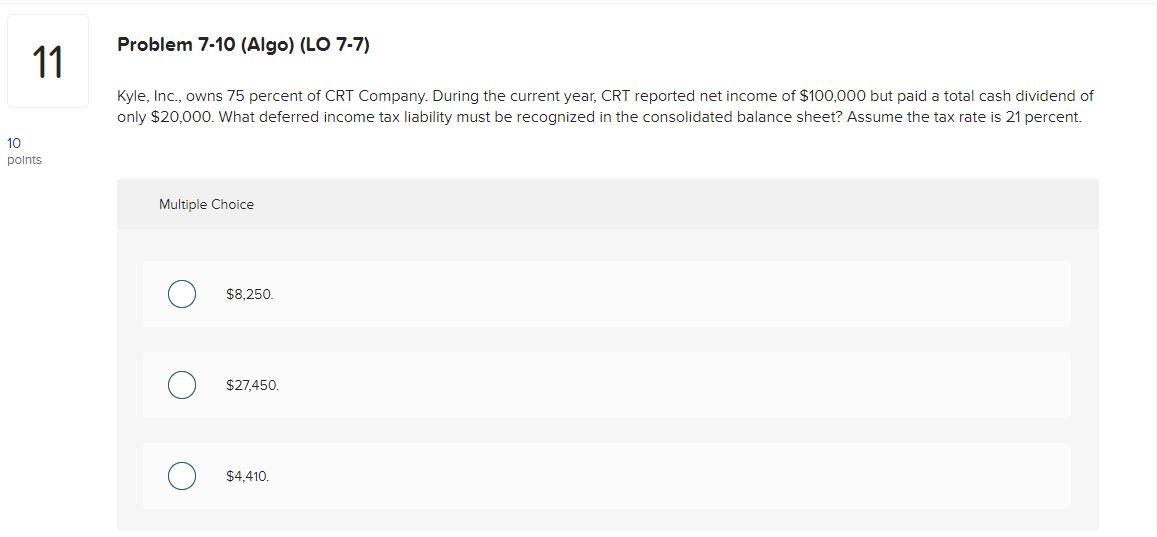

Question: Option D is $11,490 Problem 7-10 (Algo) (LO 7-7) 11 Kyle, Inc., owns 75 percent of CRT Company. During the current year, CRT reported net

Option D is $11,490

Problem 7-10 (Algo) (LO 7-7) 11 Kyle, Inc., owns 75 percent of CRT Company. During the current year, CRT reported net income of $100,000 but paid a total cash dividend of only $20,000. What deferred income tax liability must be recognized in the consolidated balance sheet? Assume the tax rate is 21 percent. 10 points Multiple Choice $8,250. O O O O $27,450 O O $4,410

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts