Question: Option prices: Determine the option types that you will consider based on the exchange rate quotes provided by your bank. Remember we will long or

Option prices:

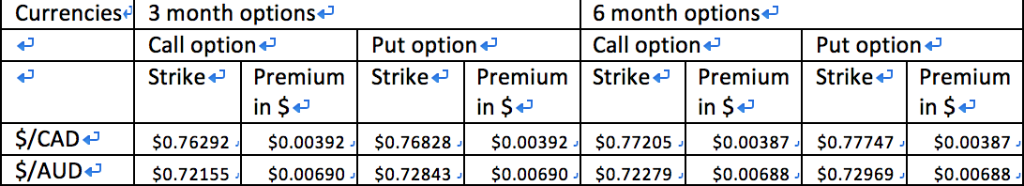

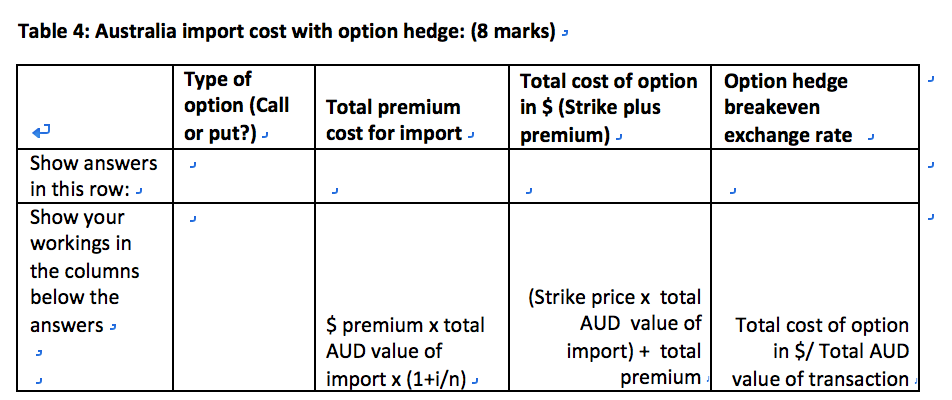

Determine the option types that you will consider based on the exchange rate quotes provided by your bank. Remember we will long or short the base currencies (in this case study the currencies that are not $) and the FV of premium cost is based on the borrowing cost of $ for the time period of the option. For example if it is a 3 month option, then the interest rate that should be applied is United States 3 month borrowing rate of 2.687%/4 = 0.67175%). Calculate the total cost of using options as hedging instrument for the import from Australia (Complete Table 4 on the separate answer sheet)

Determine the option types that you will consider based on the exchange rate quotes provided by your bank. Remember we will long or short the base currencies (in this case study the currencies that are not $) and the FV of premium cost is based on the borrowing cost of $ for the time period of the option. For example if it is a 3 month option, then the interest rate that should be applied is United States 3 month borrowing rate of 2.687%/4 = 0.67175%). Calculate the total cost of using options as hedging instrument for the import from Australia (Complete Table 4 on the separate answer sheet)

Currencies 3 month options 6 month options Call option Call option Put option+ Put option+^ Strike+' | Premium | Strike | Premium | Strike+' | Premium | Strike+' | Premium in $-' in $+' in $-^ in $ S/CAD^$0.76292 S/AUD+ $s0.72843$0.00690s0.72279 $0.00688$0.72969 $0.00392J$0.76828$0.00392$0.77205$0.00387 s0.77747J$0.00387 9$0.00688 S0.72155$ Table 4: Australia import cost with option hedge: (8 marks) Type of option (Call Total premiumin $ (Strike plus breakeven or put?)_ Total cost of option Option hedge cost for importpremium) exchange rate > Show answers | in this row: Show your workings in the columns below the answers (Strike price x total AUD value of Total cost of option in $/ Total AUD premiumvalue of transaction $ premium x total AUD value of import)+ totalin$/ import x (1+i)J Currencies 3 month options 6 month options Call option Call option Put option+ Put option+^ Strike+' | Premium | Strike | Premium | Strike+' | Premium | Strike+' | Premium in $-' in $+' in $-^ in $ S/CAD^$0.76292 S/AUD+ $s0.72843$0.00690s0.72279 $0.00688$0.72969 $0.00392J$0.76828$0.00392$0.77205$0.00387 s0.77747J$0.00387 9$0.00688 S0.72155$ Table 4: Australia import cost with option hedge: (8 marks) Type of option (Call Total premiumin $ (Strike plus breakeven or put?)_ Total cost of option Option hedge cost for importpremium) exchange rate > Show answers | in this row: Show your workings in the columns below the answers (Strike price x total AUD value of Total cost of option in $/ Total AUD premiumvalue of transaction $ premium x total AUD value of import)+ totalin$/ import x (1+i)J

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts