Question: Options: 1: 2: 3: 4: 5: Previous question as mentioned Task (following on from the previous part): Assume that the fund may borrow or lend

Options:

1:

2:

3:

4:

5:

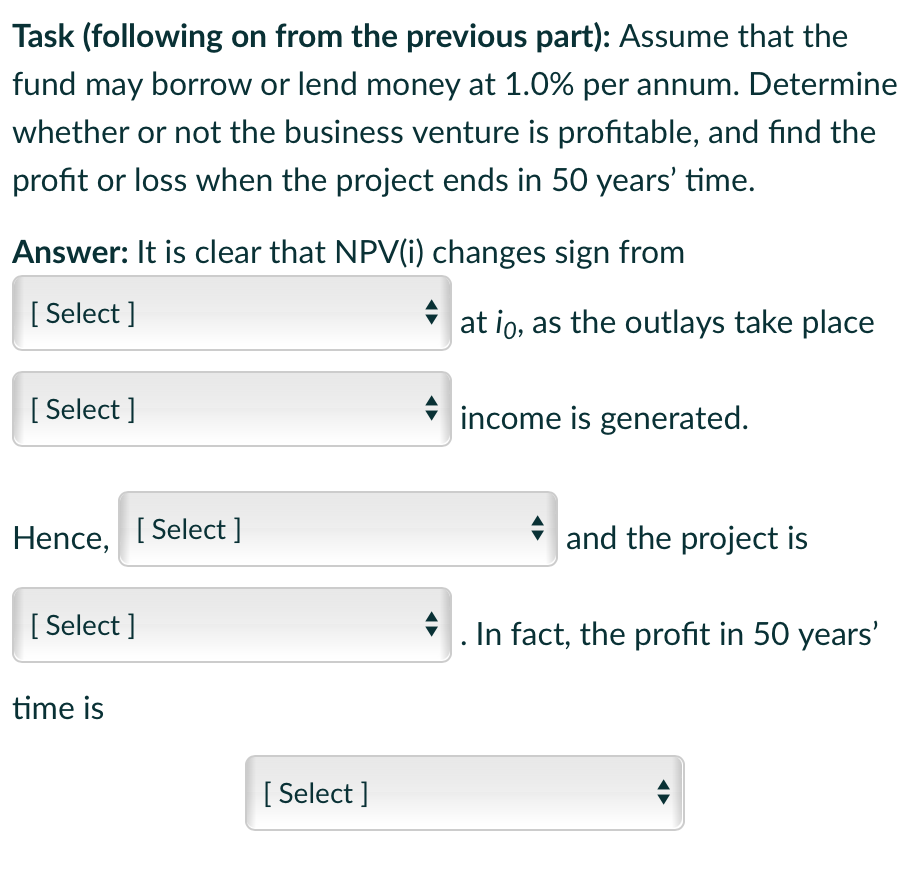

![changes sign from [ Select] at io, as the outlays take place](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ecaf2dcb57a_37366ecaf2d6dbd2.jpg)

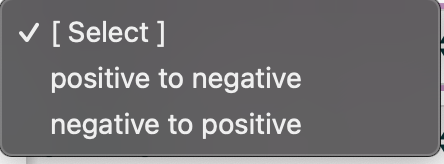

![[ Select] income is generated. Hence, [Select ] and the project is](https://dsd5zvtm8ll6.cloudfront.net/si.experts.images/questions/2024/09/66ecaf2e5f42f_37466ecaf2e04460.jpg)

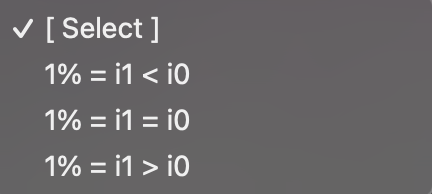

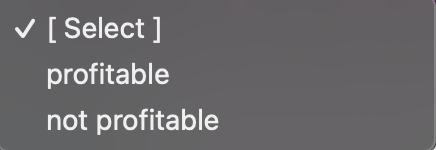

Task (following on from the previous part): Assume that the fund may borrow or lend money at 1.0% per annum. Determine whether or not the business venture is profitable, and find the profit or loss when the project ends in 50 years' time. Answer: It is clear that NPV(i) changes sign from [ Select] at io, as the outlays take place [ Select] income is generated. Hence, [Select ] and the project is [ Select ] . In fact, the profit in 50 years' time is [ Select] [Select ] positive to negative negative to positive [Select ] before after [Select ] 1% = i1

Step by Step Solution

There are 3 Steps involved in it

To determine if the business venture is profitable and find the profit or loss in 50 years time we n... View full answer

Get step-by-step solutions from verified subject matter experts