Question: Options are: AMT Subchapter K Cafeteria Plan Free Transferability LLC Small Tax Case Division C Corporation Consolidated Tax Return Stock Option Bargain Element Expatriates US

Options are:

AMT

Subchapter K

Cafeteria Plan

Free Transferability

LLC

Small Tax Case Division

C Corporation

Consolidated Tax Return

Stock Option

Bargain Element

Expatriates

US District Court or US Court of Federal Claims

US Tax Court

LLP

Constructive Dividend

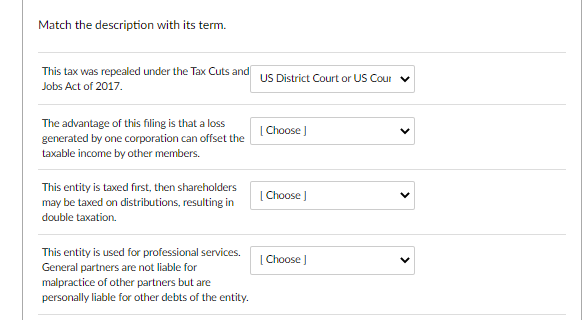

Match the description with its term. This tax was repealed under the Tax Cuts and Jobs Act of 2017 US District Court or US Coun | Choose] The advantage of this filing is that a loss generated by one corporation can offset the taxable income by other members. This entity is taxed first, then shareholders may be taxed on distributions, resulting in double taxation [Choose Choose This entity is used for professional services. General partners are not liable for malpractice of other partners but are personally liable for other debts of the entity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts