Question: Options assignment. You are to complete the following using the attached WTI option chain from cmegroup. 1. Generate a payoff profile (table and graph) of

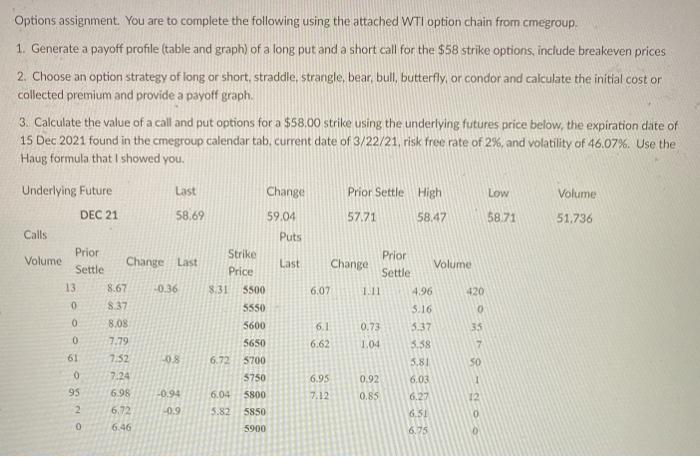

Options assignment. You are to complete the following using the attached WTI option chain from cmegroup. 1. Generate a payoff profile (table and graph) of a long put and a short call for the $58 strike options, include breakeven prices 2. Choose an option strategy of long or short, straddle, strangle, bear, bull, butterfly, or condor and calculate the initial cost or collected premium and provide a payoff graph, 3. Calculate the value of a call and put options for a $58.00 strike using the underlying futures price below, the expiration date of 15 Dec 2021 found in the cmegroup calendar tab. current date of 3/22/21, risk free rate of 2%, and volatility of 46.07%. Use the Haug formula that I showed you. Volume 51.736 Underlying Future Last Change Prior Settle High Low DEC 21 58.69 59.04 57.71 58.47 58.71 Calls Puts Prior Volume Strike Prior Settle Change Last Last Price Volume Change Settle 13 8.67 -0.36 8.31 5500 6.07 1.11 4.96 420 0 8.37 5550 5.16 0 0 8.08 5600 6.1 0.73 337 33 0 7.79 5650 6.62 1.04 3.38 7 61 7.52 08 6.72 5700 5.81 50 0 7.24 5750 6.95 0.92 6.03 1 95 6.98 -0.94 6.04 5800 7.12 0.85 6.27 12 2 6.72 -0.9 5.82 5850 6.51 0 6.46 5900 6.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts