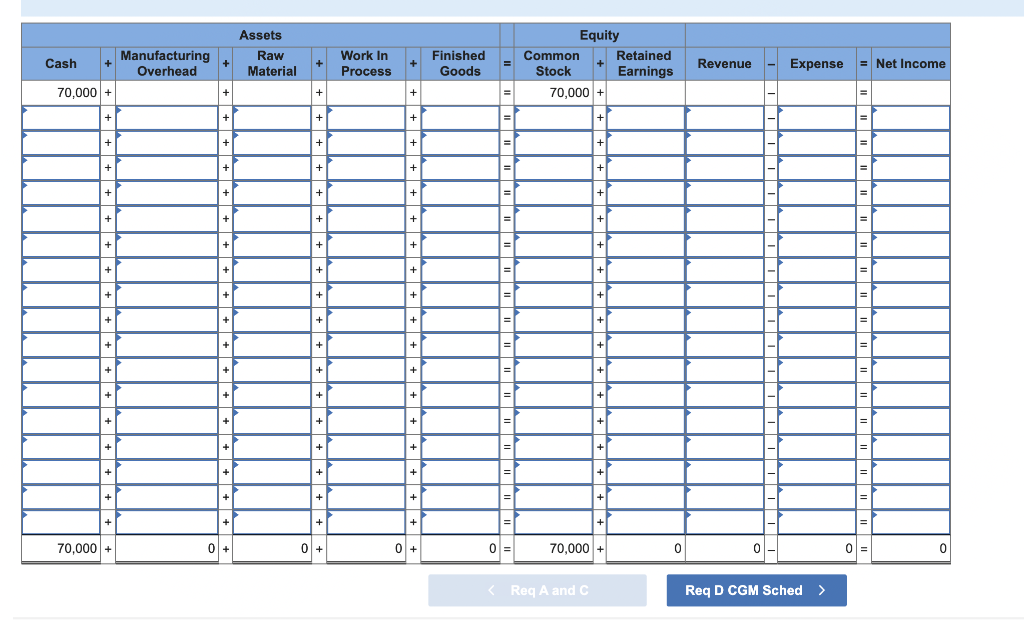

Question: OPTIONS - Beginning finished goods Beginning raw materials inventory Beginning work in process inventory Ending finished goods Ending raw materials inventory Ending work in process

OPTIONS -

OPTIONS -

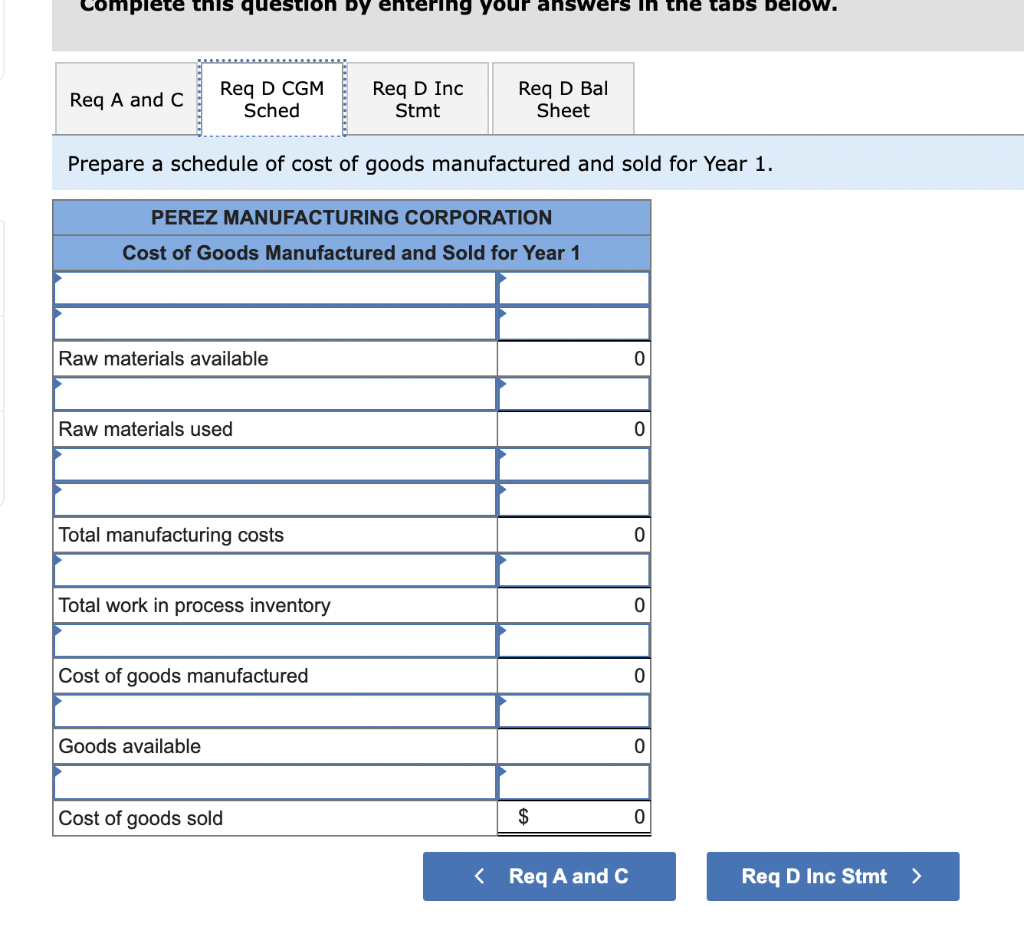

Beginning finished goods

Beginning raw materials inventory

Beginning work in process inventory

Ending finished goods

Ending raw materials inventory

Ending work in process inventory

Labor

Manufacturing overhead

Purchases

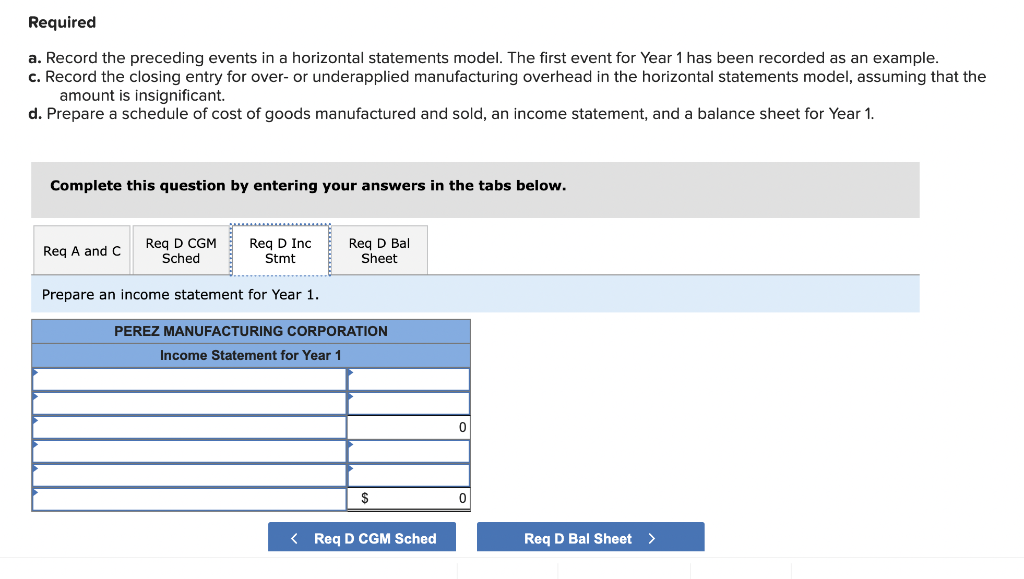

OPTIONS -

OPTIONS -

Cost of goods sold

Operating expenses

Rent expenses

Sales revenue

Selling and administrative expenses

OPTIONS -

OPTIONS -

Cash

Common stock

Finished goods inventory

Raw material inventory

Retained earnings

Work in process inventory

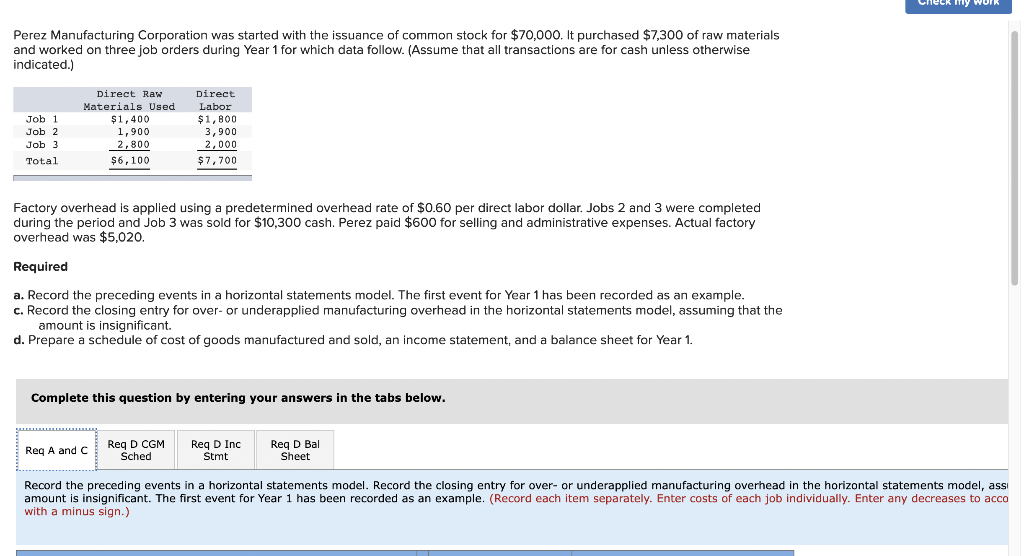

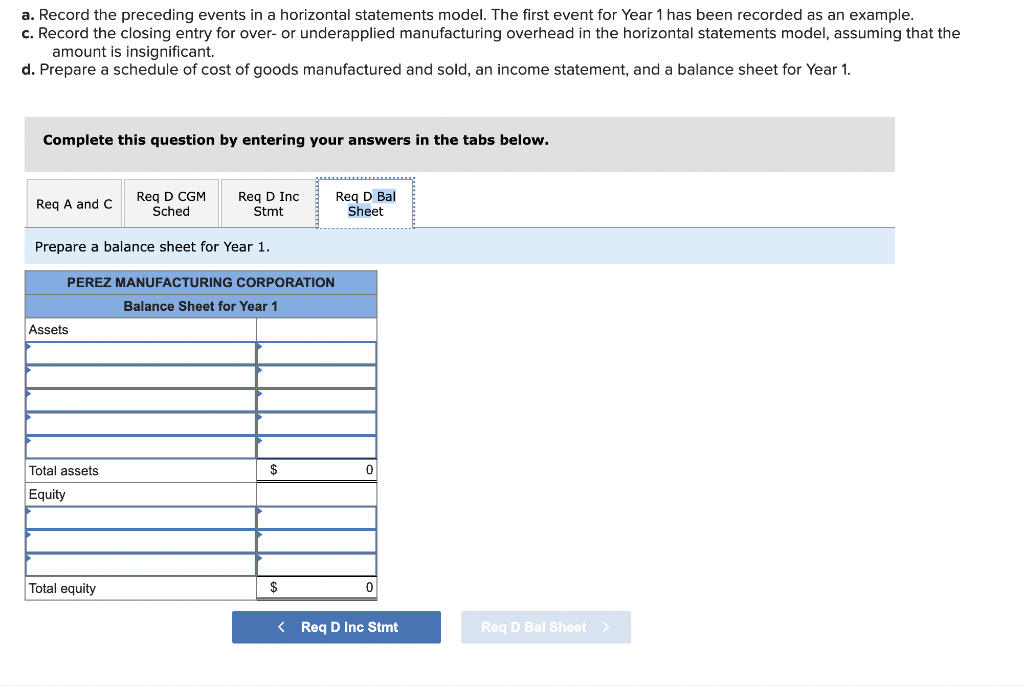

Perez Manufacturing Corporation was started with the issuance of common stock for $70,000. It purchased $7,300 of raw materials and worked on three job orders during Year 1 for which data follow. (Assume that all transactions are for cash unless otherwise indicated.) Factory overhead is applied using a predetermined overhead rate of $0.60 per direct labor dollar. Jobs 2 and 3 were completed during the period and Job 3 was sold for $10,300 cash. Perez paid $600 for selling and administrative expenses. Actual factory overhead was $5,020. Required a. Record the preceding events in a horizontal statements model. The first event for Year 1 has been recorded as an example. c. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assuming that the amount is insignificant. d. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet for Year 1. Complete this question by entering your answers in the tabs below. Record the preceding events in a horizontal statements model. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assi amount is insignificant. The first event for Year 1 has been recorded as an example. (Record each item separately. Enter costs of each job individually. Enter any decreases to acco with a minus sign.) Prepare a schedule of cost of goods manufactured and sold for Year 1. Required a. Record the preceding events in a horizontal statements model. The first event for Year 1 has been recorded as an example. c. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assuming that the amount is insignificant. d. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet for Year 1. Complete this question by entering your answers in the tabs below. Prepare an income statement for Year 1. a. Record the preceding events in a horizontal statements model. The first event for Year 1 has been recorded as an example. c. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assuming that the amount is insignificant. d. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet for Year 1. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Year 1. Perez Manufacturing Corporation was started with the issuance of common stock for $70,000. It purchased $7,300 of raw materials and worked on three job orders during Year 1 for which data follow. (Assume that all transactions are for cash unless otherwise indicated.) Factory overhead is applied using a predetermined overhead rate of $0.60 per direct labor dollar. Jobs 2 and 3 were completed during the period and Job 3 was sold for $10,300 cash. Perez paid $600 for selling and administrative expenses. Actual factory overhead was $5,020. Required a. Record the preceding events in a horizontal statements model. The first event for Year 1 has been recorded as an example. c. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assuming that the amount is insignificant. d. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet for Year 1. Complete this question by entering your answers in the tabs below. Record the preceding events in a horizontal statements model. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assi amount is insignificant. The first event for Year 1 has been recorded as an example. (Record each item separately. Enter costs of each job individually. Enter any decreases to acco with a minus sign.) Prepare a schedule of cost of goods manufactured and sold for Year 1. Required a. Record the preceding events in a horizontal statements model. The first event for Year 1 has been recorded as an example. c. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assuming that the amount is insignificant. d. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet for Year 1. Complete this question by entering your answers in the tabs below. Prepare an income statement for Year 1. a. Record the preceding events in a horizontal statements model. The first event for Year 1 has been recorded as an example. c. Record the closing entry for over- or underapplied manufacturing overhead in the horizontal statements model, assuming that the amount is insignificant. d. Prepare a schedule of cost of goods manufactured and sold, an income statement, and a balance sheet for Year 1. Complete this question by entering your answers in the tabs below. Prepare a balance sheet for Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts