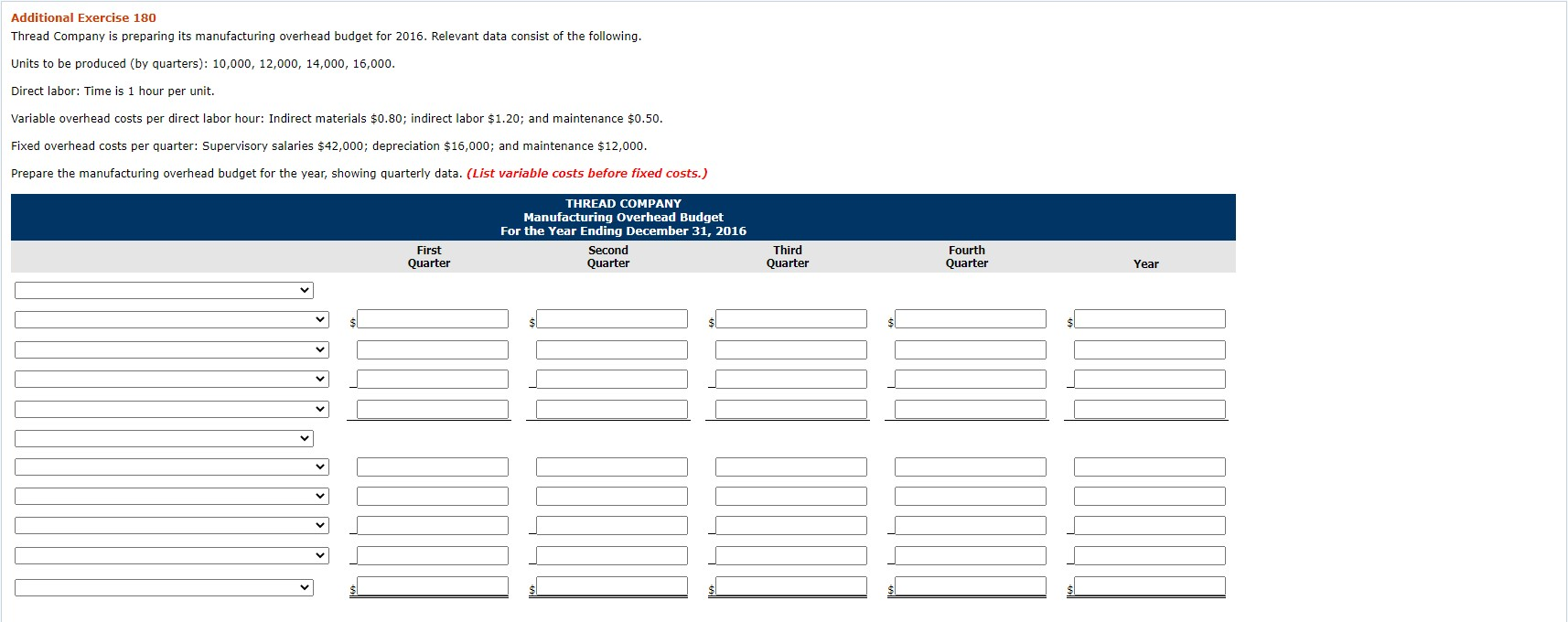

Question: Options Depreciation Indirect materials Indirect labor manufacturing overhead total variable costs fixed costs variable costs total variable costs supervisory salaries indirect labor total fixed costs

Options

Depreciation

Indirect materials

Indirect labor

manufacturing overhead

total variable costs

fixed costs

variable costs

total variable costs

supervisory salaries

indirect labor

total fixed costs

total manufacturing overhead

direct labor hours

manufacturing overhead rate per hour per direct labor hour

Additional Exercise 180 Thread Company is preparing its manufacturing overhead budget for 2016. Relevant data consist of the following. Units to be produced by quarters): 10,000, 12,000, 14,000, 16,000. Direct labor: Time is 1 hour per unit. Variable overhead costs per direct labor hour: Indirect materials $0.80; indirect labor $1.20; and maintenance $0.50. Fixed overhead costs per quarter: Supervisory salaries $42,000; depreciation $16,000; and maintenance $12,000. Prepare the manufacturing overhead budget for the year, showing quarterly data. (List variable costs before fixed costs.) THREAD COMPANY Manufacturing Overhead Budget For the Year Ending December 31, 2016 Second Quarter Third First Quarter Quarter Fourth Quarter Year V s s > > > >

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts