Question: Options & Derivatives: Can someone explain why the loan ($980 * 1.02 = $1000) is included in the payoff but not cost? Question - Table

Options & Derivatives: Can someone explain why the loan ($980 * 1.02 = $1000) is included in the payoff but not cost?

Question -

Table 3.1 -

Solution -

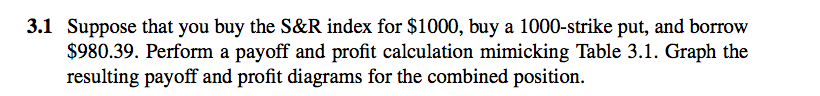

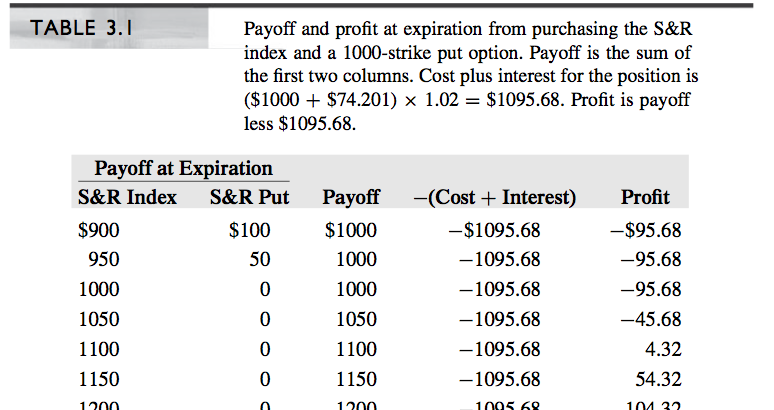

3.1 Suppose that you buy the S&R index for $1000, buy a 1000-strike put, and borrow $980.39. Perform a payoff and profit calculation mimicking Table 3.1. Graph the resulting payoff and profit diagrams for the combined position. TABLE 3.I Payoff and profit at expiration from purchasing the S&R index and a 1000-strike put option. Payoff is the sum of the first two columns. Cost plus interest for the position is ($1000 + $74.201) x 1.02 - $1095.68. Profit is payoff less $1095.68. Pavoff at Expiration S&R Index S&R Put $900 Payoff $1000 1000 1000 1050 1100 1150 -(Cost + Interest) Profit $100 50 0 950 1000 1050 1100 1150 1200 $1095.68 1095.68 1095.68 1095.68 1095.68 1095.68 1005 69 $95.68 95.68 95.68 45.68 4.32 54.32 104 32 0 Question 3.1 This question is a direct application of the Put-Call-Parity [equation (3.1)] of the textbook. Mimicking Table 3.1., we have: Payoff-(Cost+Interest) Profit -95.68 -95.68 -95.68 -45.68 4.32 54.32 104.32 S&R Index S&R Put 900.00 950.00 1,000.00 1,050.00 1,100.00 1,150.00 1,200.00 Loan 1,000.00 1,000.00 1,000.00 1,000.00 1,000.00100.00 1,000.00150.00 1,000.00200.00 0.00 0.00 0.00 50.00 -95.68 -95.68 -95.68 -95.68 -95.68 -95.68 -95.68 100.00 50.00 0.00 0.00 0.00 0.00 0.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts