Question: Options for 1st dropdown: deteriorated or improved Options for 2nd: recovery or worsening a. Current ratio Enter the formula on the first line, then calculate

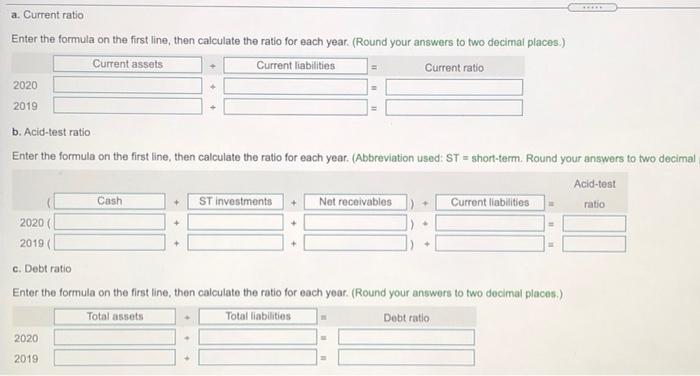

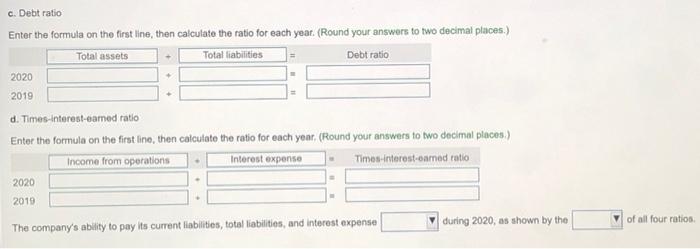

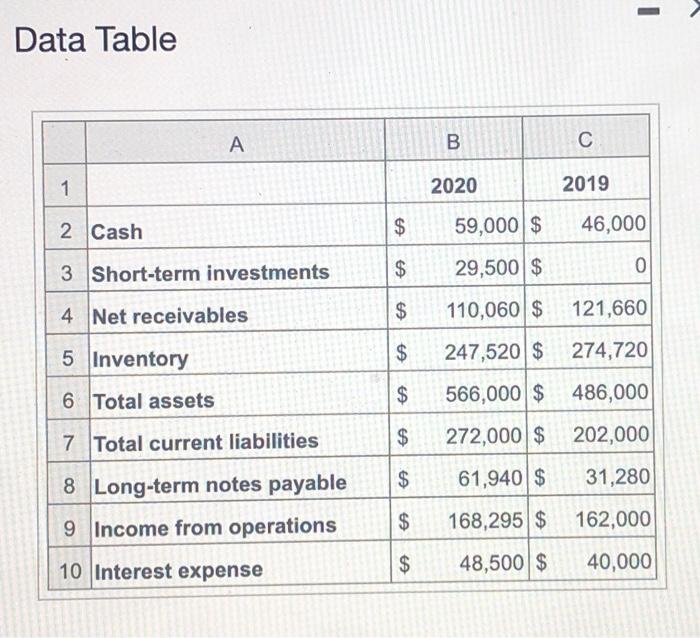

a. Current ratio Enter the formula on the first line, then calculate the ratio for each year. (Round your answers to two decimal places.) Current assets Current liabilities Current ratio 2020 2019 b. Acid-test ratio Enter the formula on the first line, then calculate the ratio for each year. (Abbreviation used: ST = short-term. Round your answers to two decimal Acid-test Cash ST investments Net receivables Current liabilities ratio 2020 + 2019 c. Debt ratio Enter the formula on the first line, then calculate the ratio for each year. (Round your answers to two decimal places) Total assets Total liabilities Debt ratio 2020 2019 c. Debt ratio Enter the formula on the first line, then calculate the ratio for each year. (Round your answers to two decimal places.) Total assets Total liabilities Debt ratio 2020 2019 d. Times-interest eamed ratio Enter the formula on the first lino, then calculate the ratio for each year, (Round your answers to two decimal places) Income from operations Interest expense Times-interesteamed ratio 2020 2019 The company's ability to pay its current liabilities, total liabilities, and interest expense during 2020, as shown by the of all four ratios Data Table . B. 1 2020 2019 2 Cash $ 59,000 $ 46,000 $ 3 Short-term investments 0 29,500 $ 4 Net receivables $ 110,060 $ 121,660 5 Inventory 247,520 $ 274,720 6 Total assets $ $ $ 566,000 $ 486,000 7 Total current liabilities 272,000 $ 202,000 $ 31,280 8 Long-term notes payable 61,940 $ 9 Income from operations $ 168,295 $ 162,000 10 Interest expense $ 48,500 $ 40,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts