Question: options for blank #1 : options for blank #2 : The following table shows projected free cash flows for the next four years for Quick

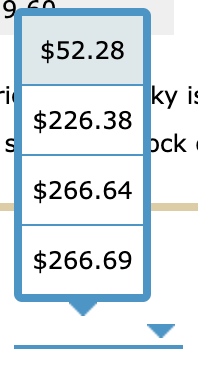

options for blank #1 :

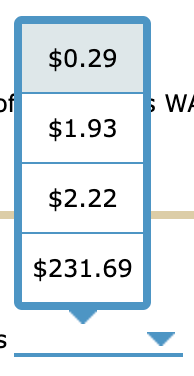

options for blank #2 :

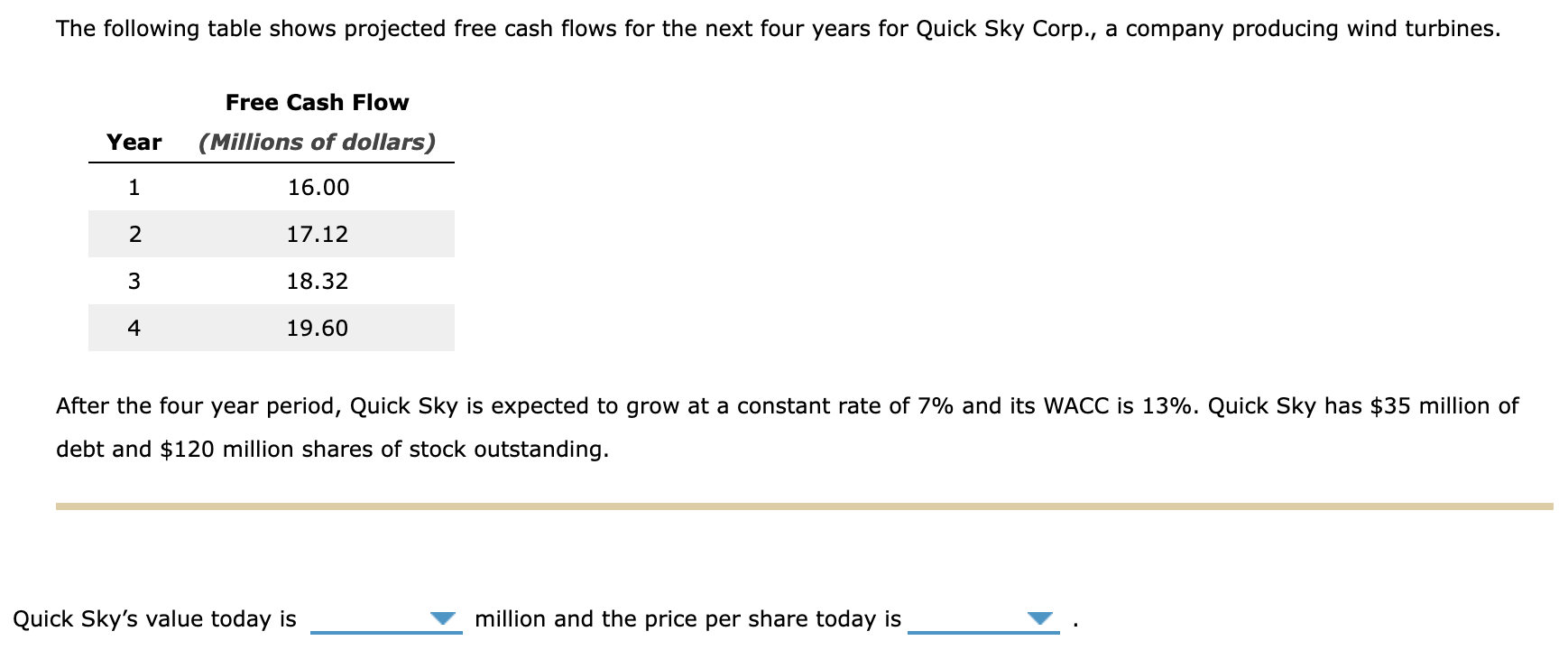

The following table shows projected free cash flows for the next four years for Quick Sky Corp., a company producing wind turbines. Free Cash Flow Year (Millions of dollars) 1 16.00 2 17.12 3 18.32 4 19.60 After the four year period, Quick Sky is expected to grow at a constant rate of 7% and its WACC is 13%. Quick Sky has $35 million of debt and $120 million shares of stock outstanding. Quick Sky's value today is million and the price per share today is 9 $52.28 id ky is $226.38 bck $266.64 s $266.69 $0.29 of SWA $1.93 $2.22 $231.69 5

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts