Question: (options for drop down options) (Drop down options) Question 2 For each of the following items, indicate by appropriate terms. Decrease in accounts payable during

(options for drop down options)

(Drop down options)

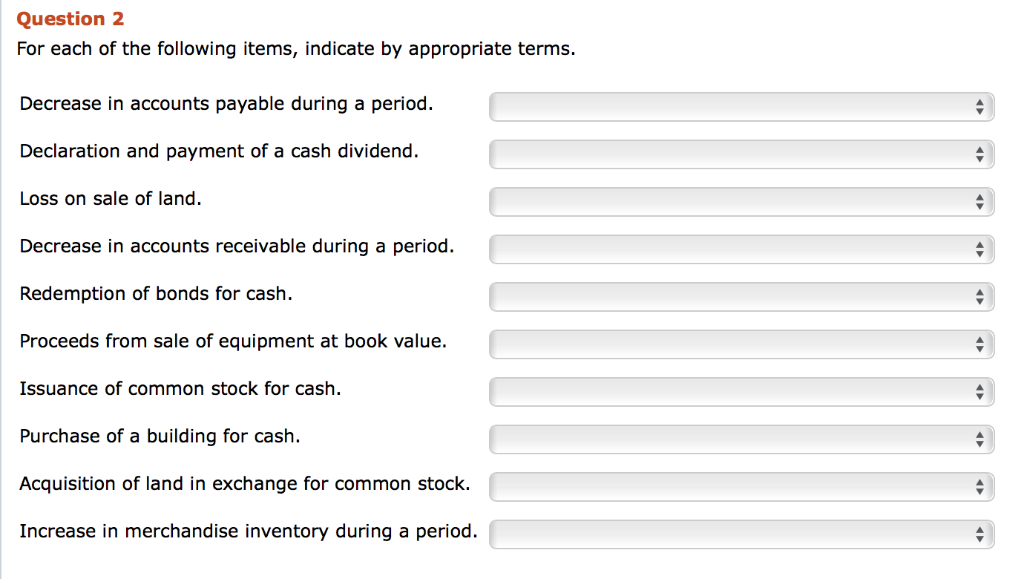

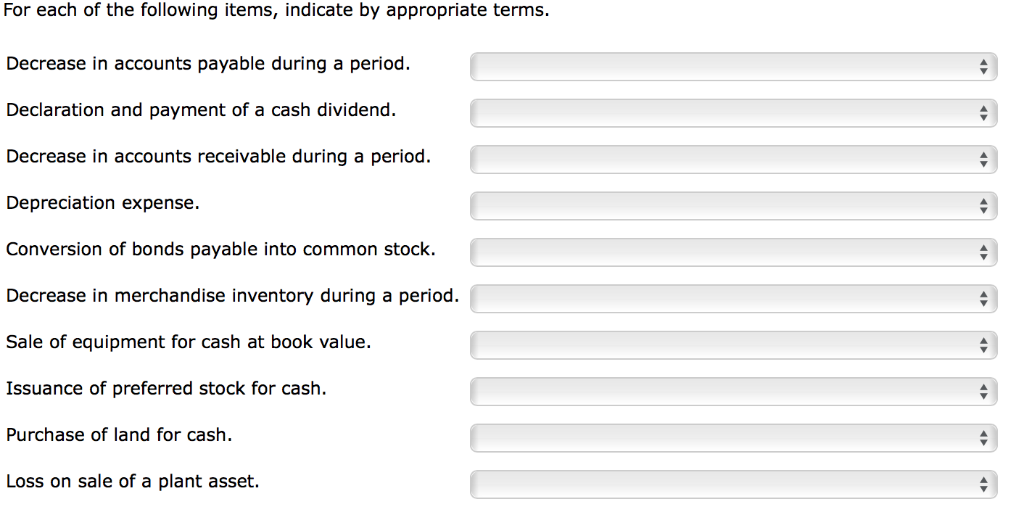

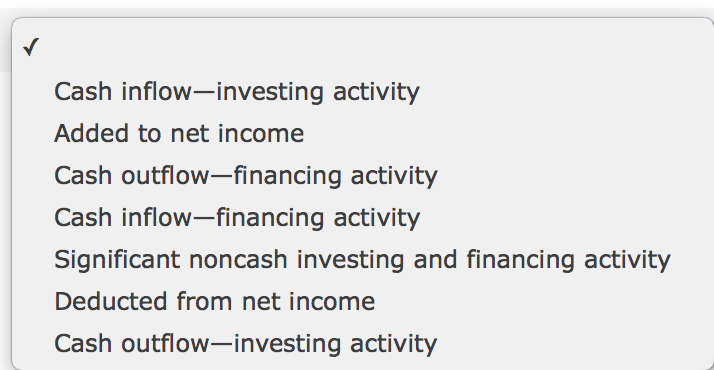

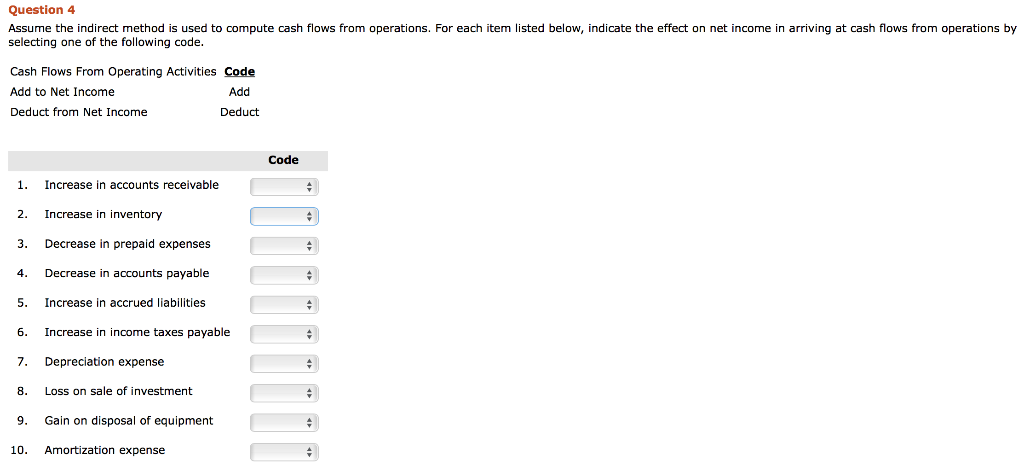

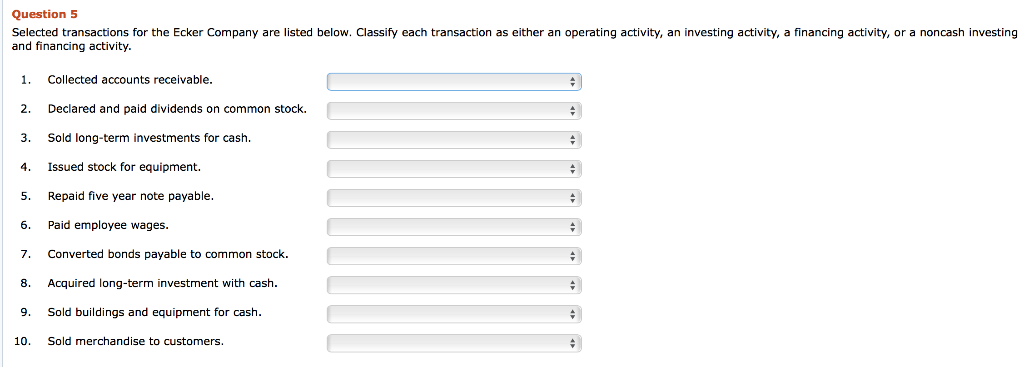

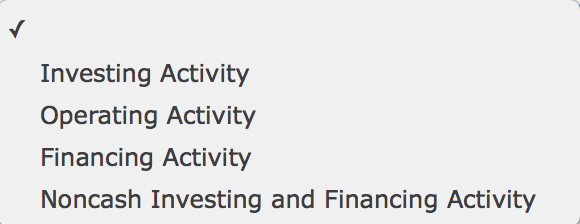

Question 2 For each of the following items, indicate by appropriate terms. Decrease in accounts payable during a period. Declaration and payment of a cash dividend. Loss on sale of land. Decrease in accounts receivable during a period. Redemption of bonds for cash. Proceeds from sale of equipment at book value. Issuance of common stock for cash. Purchase of a building for cash. Acquisition of land in exchange for common stock. Increase in merchandise inventory during a period. Cash inflow-investing activity Added to net income Cash outflow-financing activity Cash inflow-financing activity Significant noncash investing and financing activity Deducted from net income Cash outflow-investing activity Question 4 Assume the indirect method is used to compute cash flows from operations. For each item listed below, indicate the effect on net income in arriving at cash flows from operations by selecting one of the following code. Cash Flows From Operating Activities Code Add to Net Income Deduct from Net Income Add Deduct Code 1. Increase in accounts receivablee 2. Increase in inventory 3. Decrease in prepaid expenses 4. Decrease in accounts payable 5. Increase in accrued liabilities 6. Increase in income taxes payable 7. Depreciation expense 8 Loss on sale of investment 9. Gain on disposal of equipment 10. Amortization expense Investing Activity Operating Activity Financing Activity Noncash Investing and Financing Activity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts