Question: Options for (...) is (are) worth pursuing: A. Project A B. Project B C. Both Projects D. None of the projects Refer to two projects

Options for (...) is (are) worth pursuing:

A. Project A

B. Project B

C. Both Projects

D. None of the projects

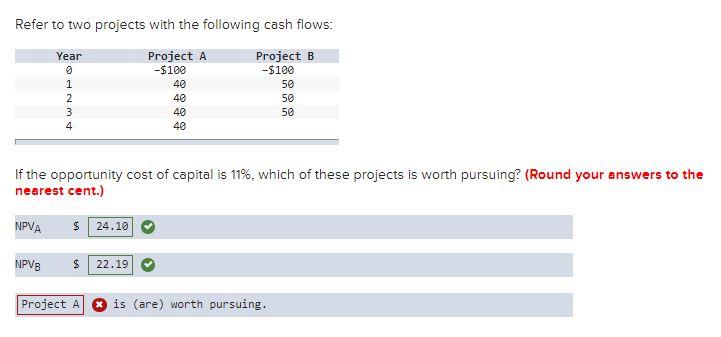

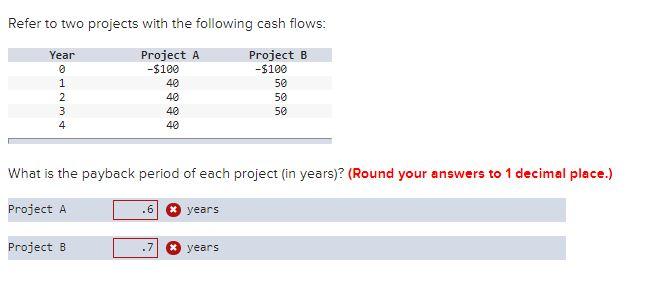

Refer to two projects with the following cash flows: Year Project B -$100 Project A -$100 40 40 40 40 1 2 3 4 5e 50 50 If the opportunity cost of capital is 11%, which of these projects is worth pursuing? (Round your answers to the nearest cent.) NPVA $ 24.10 NPVB $ 22.19 Project A is (are) worth pursuing. Refer to two projects with the following cash flows: Year 1 2 3 4 Project A -$180 40 40 40 40 Project B -$100 50 50 50 What is the payback period of each project (in years)? (Round your answers to 1 decimal place.) Project A years Project B years What is the profitability index of a project that costs $10,000 and provides cash flows of $3,000 in years 1 and 2 and $5,000 in years 3 and 4? The discount rate is 10%. (Round your answer to 4 decimal places.) Profitability index 1.2378

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts