Question: Options for Requirement 3 1. does not provide / provides / reduces 2. is lower when the accelerated method is used / is lower when

Options for Requirement 3

Options for Requirement 3

1. does not provide / provides / reduces

2. is lower when the accelerated method is used / is lower when the straight-line method is used / the same, regardless of which depreciation method is used.

3. does / does not

4. determines / does not determine

5. does / does not

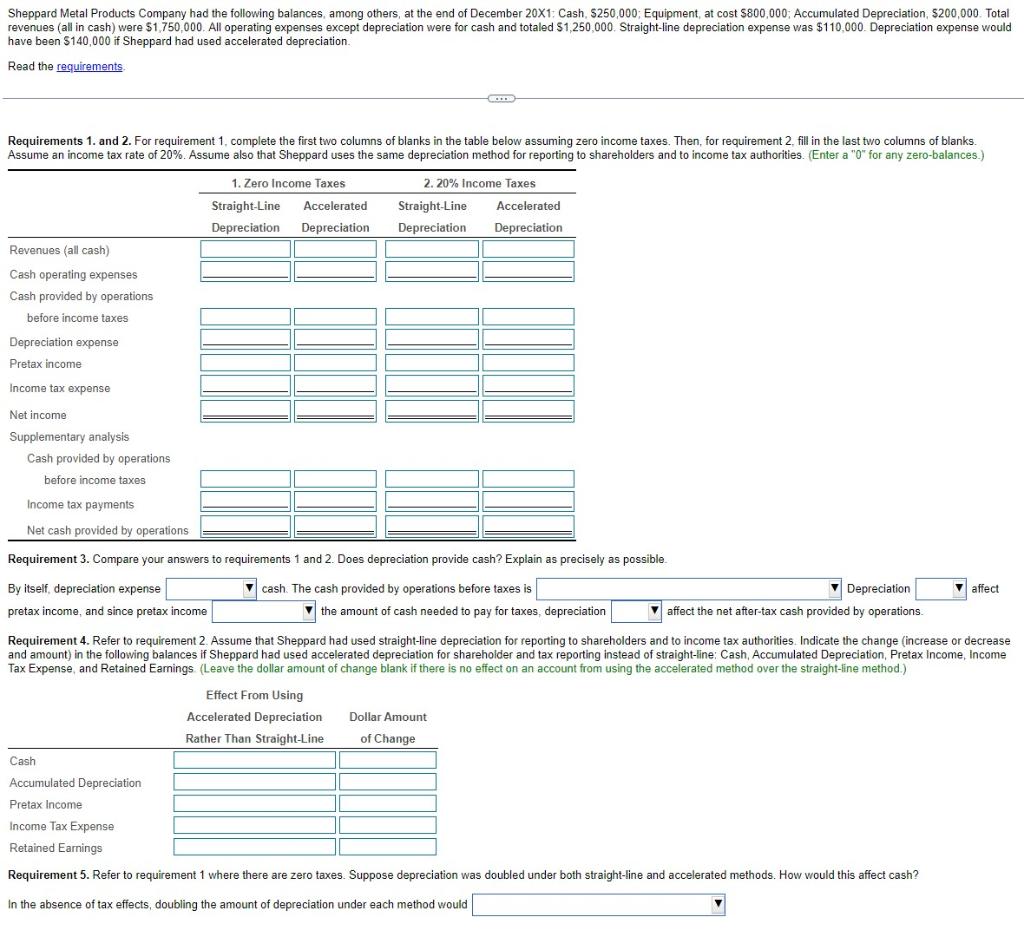

Sheppard Metal Products Company had the following balances among others, at the end of December 20X1: Cash, S250,000; Equipment, at cost $800,000 Accumulated Depreciation, $200,000. Total revenues (all in cash) were $1,750,000. All operating expenses except depreciation were for cash and totaled $1,250,000. Straight-line depreciation expense was $110,000 Depreciation expense would have been $140,000 if Sheppard had used accelerated depreciation Read the requirements Requirements 1 and 2. For requirement 1. complete the first two columns of blanks in the table below assuming zero income taxes. Then, for requirement 2 fill in the last two columns of blanks. Assume an income tax rate of 20%. Assume also that Sheppard uses the same depreciation method for reporting to shareholders and to income tax authorities. (Enter a "O" for any zero-balances.) 1. Zero Income Taxes Straight-Line Depreciation Accelerated Depreciation 2. 20% Income Taxes Straight-Line Accelerated Depreciation Depreciation Revenues (all cash) Cash operating expenses Cash provided by operations before income taxes Depreciation expense Pretax income Income tax expense Net income Supplementary analysis Cash provided by operations before income taxes Income tax payments Net cash provided by operations Requirement 3. Compare your answers By itself depreciation expense pretax income, and since pretax income requirements 1 and 2. Does depreciation provide cash? Explain as precisely as possible cash. The cash provided by operations before taxes is Depreciation the amount of cash needed to pay for taxes, depreciation affect the net after-tax cash provided by operations. affect Requirement 4. Refer to requirement 2. Assume that Sheppard had used straight-line depreciation for reporting to shareholders and to income tax authorities. Indicate the change increase or decrease and amount) in the following balances if Sheppard had used accelerated depreciation for shareholder and tax reporting instead of straight-line: Cash Accumulated Depreciation Pretax Income, Income Tax Expense and Retained Earnings (Leave the dollar amount of change blank if there is no effect on an account from using the accelerated method over the straight-line method.) Effect From Using Accelerated Depreciation Rather Than Straight-Line Dollar Amount of Change Cash Accumulated Depreciation Pretax Income Income Tax Expense Retained Earnings Requirement 5. to requirement 1 where there are zero taxes. Suppose depreciation was doubled under both straight-line and accelerat methods. How would this affect ca In the absence of tax effects, doubling the amount of depreciation under each method would

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts