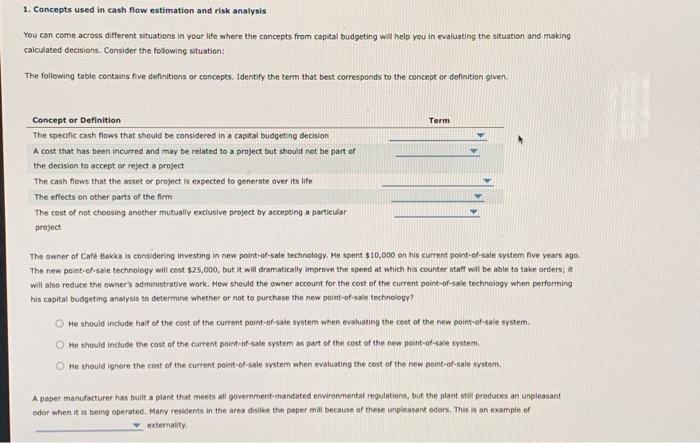

Question: options for the first drop down 1. Current cash flows 2. Positive cash flow 3. Negative cash flows 4 relevant cash flows Options for second

1. Concepts used in cash flow estimation and risk analysis You can come across different situations in your life where the concepts from capital budgeting will help you in evaluating the situation and making calculated decisions. Consider the following situation: The following table contains five deflitions or concepts. Identify the term that best corresponds to the concept or definition given. The owner of Cafe Bakke is consdering investing in new point-ot-sale technology. He spent $10,000 on his current point-of-sale system five years ago. The new point-of-saie technology will cost \$25,000, but it will dramatically improve the speed at which his counter staff will be able to take orders; it will also reduce the owner's administrative work. How sheuld the owner account for the cost of the current point-of-sale technolagy when performing his capital budgeting analysis to determine whether or not to purchase the new point-of-sale technology? He should indlude haif of the cost of the current point-of-sale system when evaluating the cott of the new point-of-sale system. We should include the cost of the current poirt-of-sale system as part of the cost of the new point-of-sale system. He should ignore the cost of the current point-of-sale system when evaluating the cost of the new point-of-sale svatem. A paper manufacturer has built a plant that meets all government-mandated emironmental regulations, but the plant stali produces an unpleasant odor when it is being operatedi Many residents in the ares disake the poper mill because of these unpleasank odors. This is an example of extemality

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts