Question: options No Journal Entry Required Accrued interest payable Allowance for Uncollectible Current Taxes Allowance for Uncollectible Delinquent Taxes Appropriations Assessments ReceivableCurrent Assessments ReceivableUnavailable Bonds Payable

options

- No Journal Entry Required

- Accrued interest payable

- Allowance for Uncollectible Current Taxes

- Allowance for Uncollectible Delinquent Taxes

- Appropriations

- Assessments ReceivableCurrent

- Assessments ReceivableUnavailable

- Bonds Payable

- Budgetary Fund Balance

- Building

- Capital Lease Obligations Payable

- Cash

- Construction Expenditures

- Construction Work in Progress

- Contracts Payable

- Contracts Payable - Retained Percentage

- Deferred Inflow of Resources

- Encumbrances

- Encumbrances Outstanding

- Estimated Other Financing Sources

- Estimated Revenues

- ExpendituresInterest

- ExpendituresPrincipal

- ExpensesInterest on Capital Lease

- ExpensesInterest on Long-term debt

- ExpensesInterest on Special Assessment debt

- Fund BalanceRestricted

- Fund BalanceUnassigned

- General revenues - investment earnings

- General RevenuesProperty Taxes

- Improvements other than Buildings

- Interest Payable

- Investments

- Other Financing SourcesInterfund Transfers In

- Other Financing SourcesInterfund Transfers Out

- Other Financing SourcesPremium on Bonds Payable

- Other Financing SourcesProceeds of Bonds

- Other Financing SourcesProceeds of Special Assessment Bonds

- Other Financing UsesProceeds of Refunding Bonds

- Other Financing UsesRefunded Bonds

- Premium on Bonds Payable

- Program RevenuesGeneral Government

- Revenues

- RevenuesChange in Fair Value of Investments

- RevenuesInvestment Earnings

- Serial Bonds Payable

- Special Assessment Debt with Governmental Commitment

- Taxes ReceivableCurrent

- Taxes ReceivableDelinquent

- Term Bonds Payable

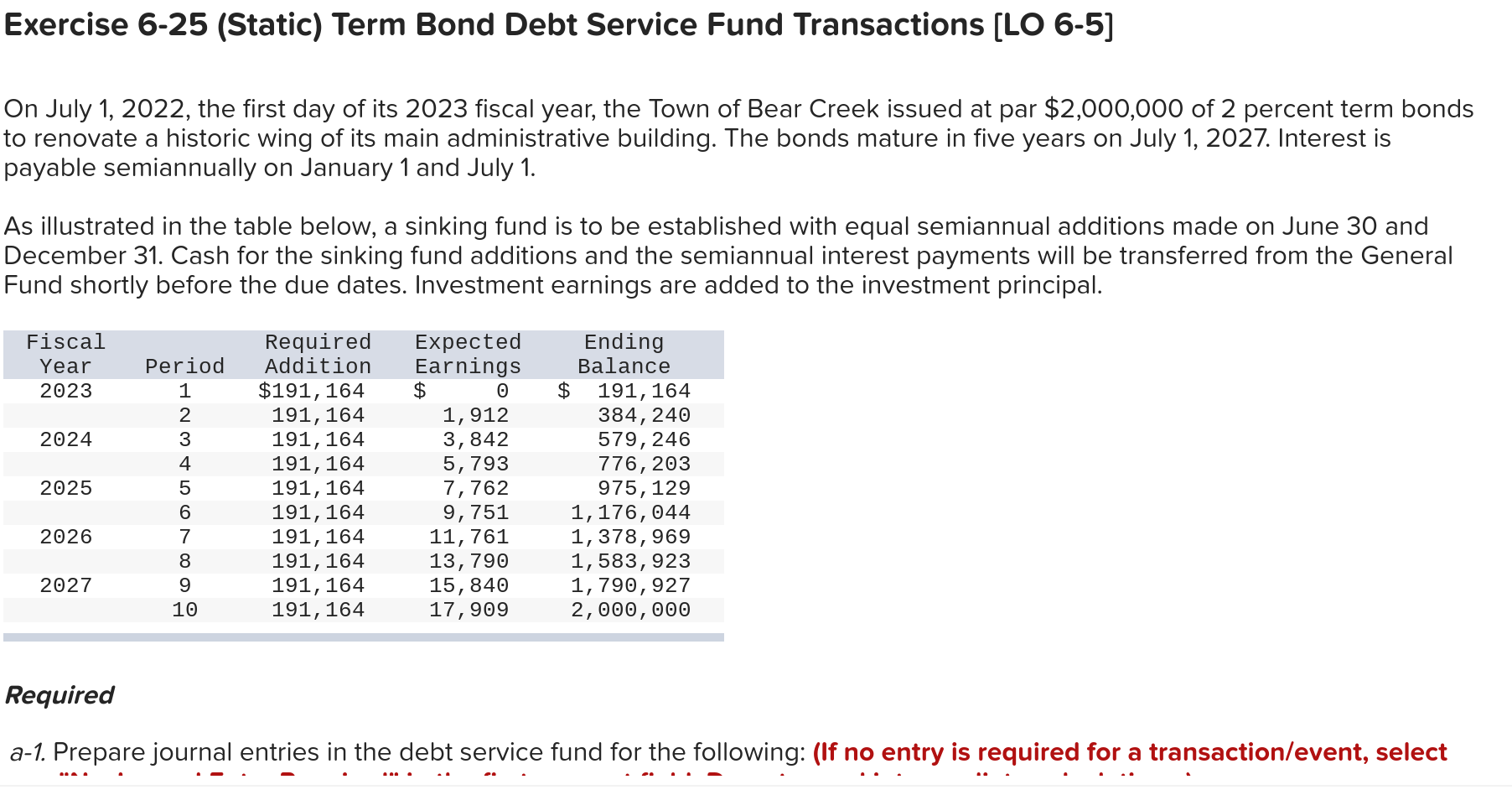

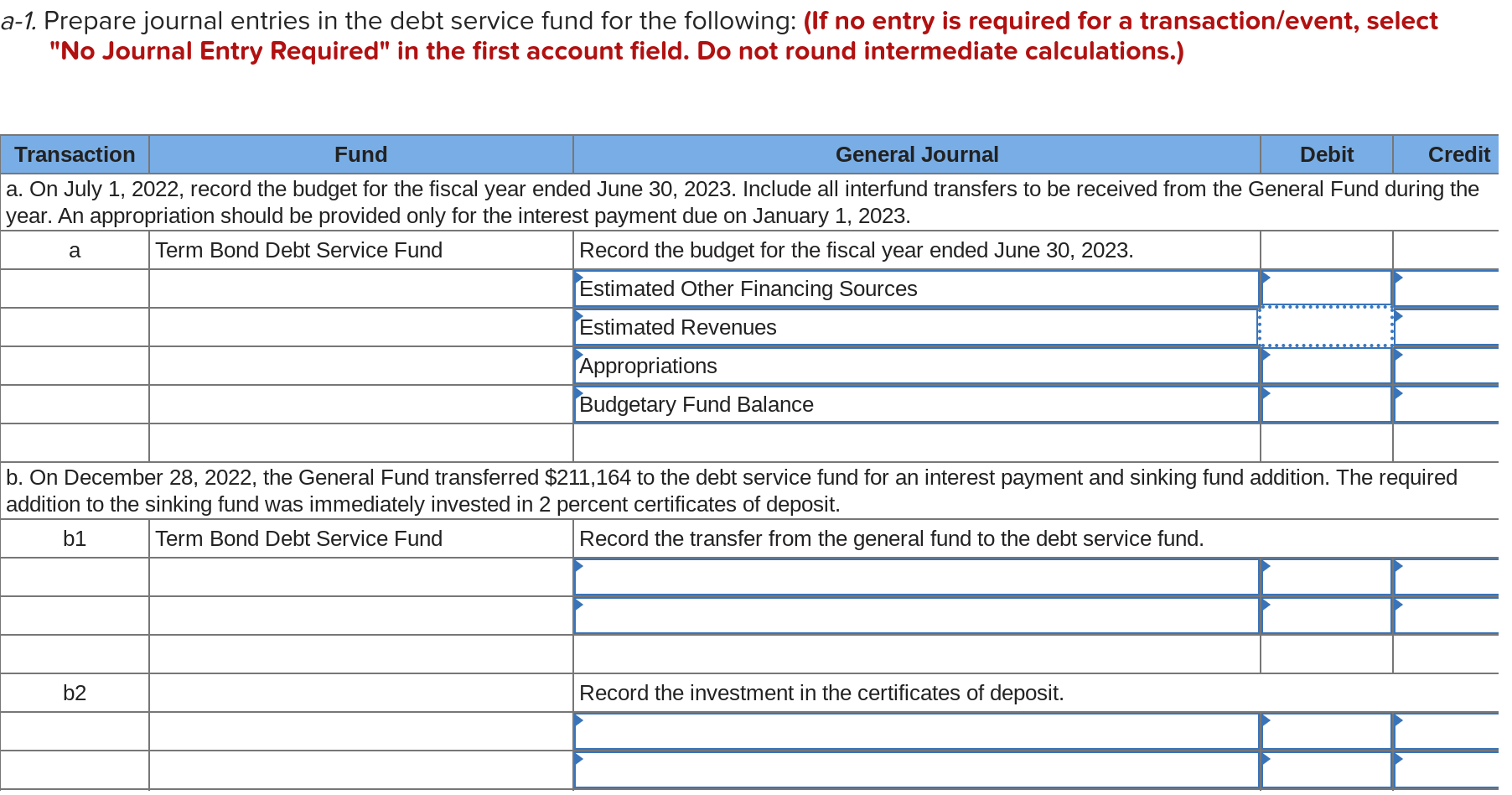

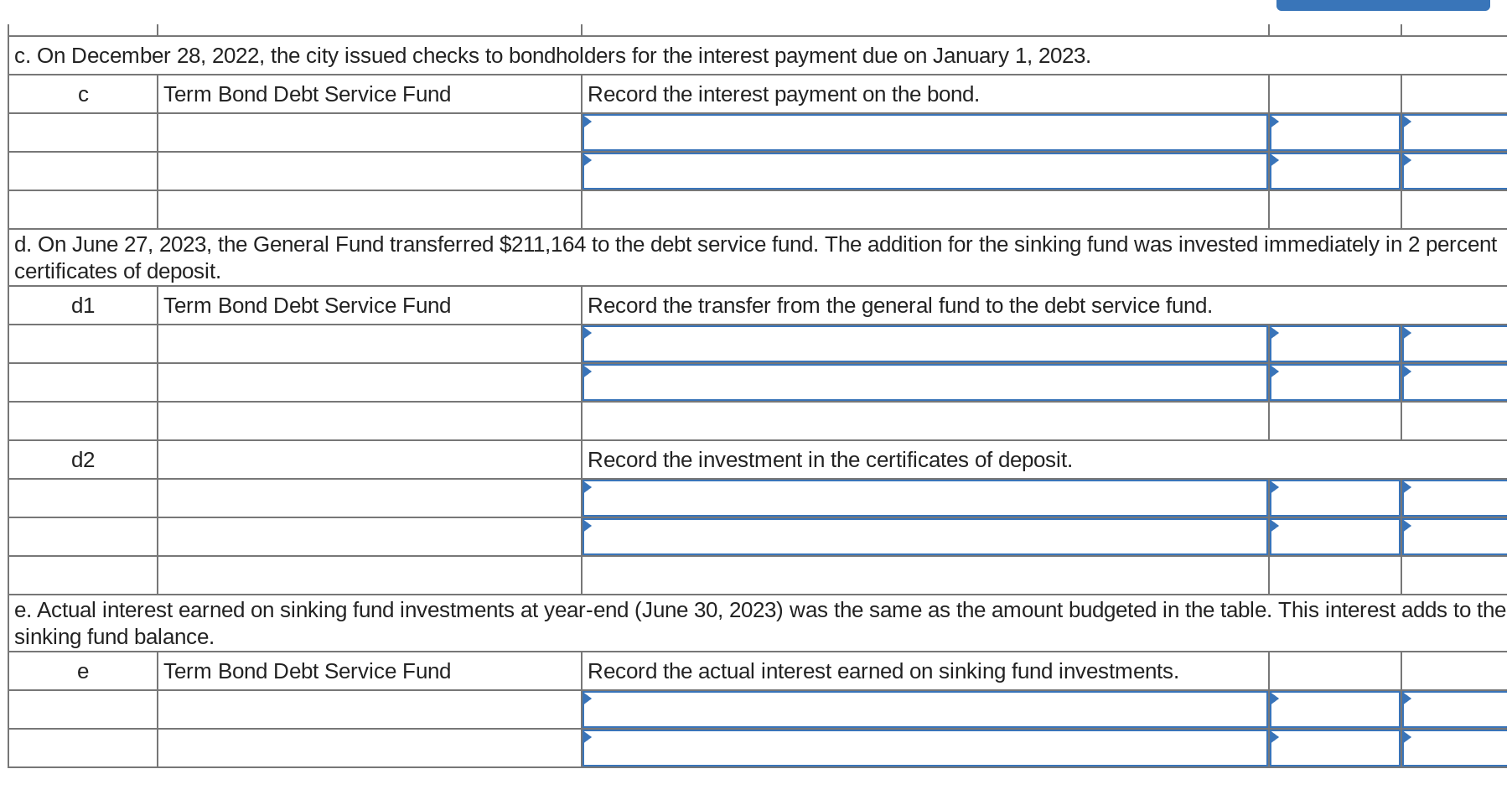

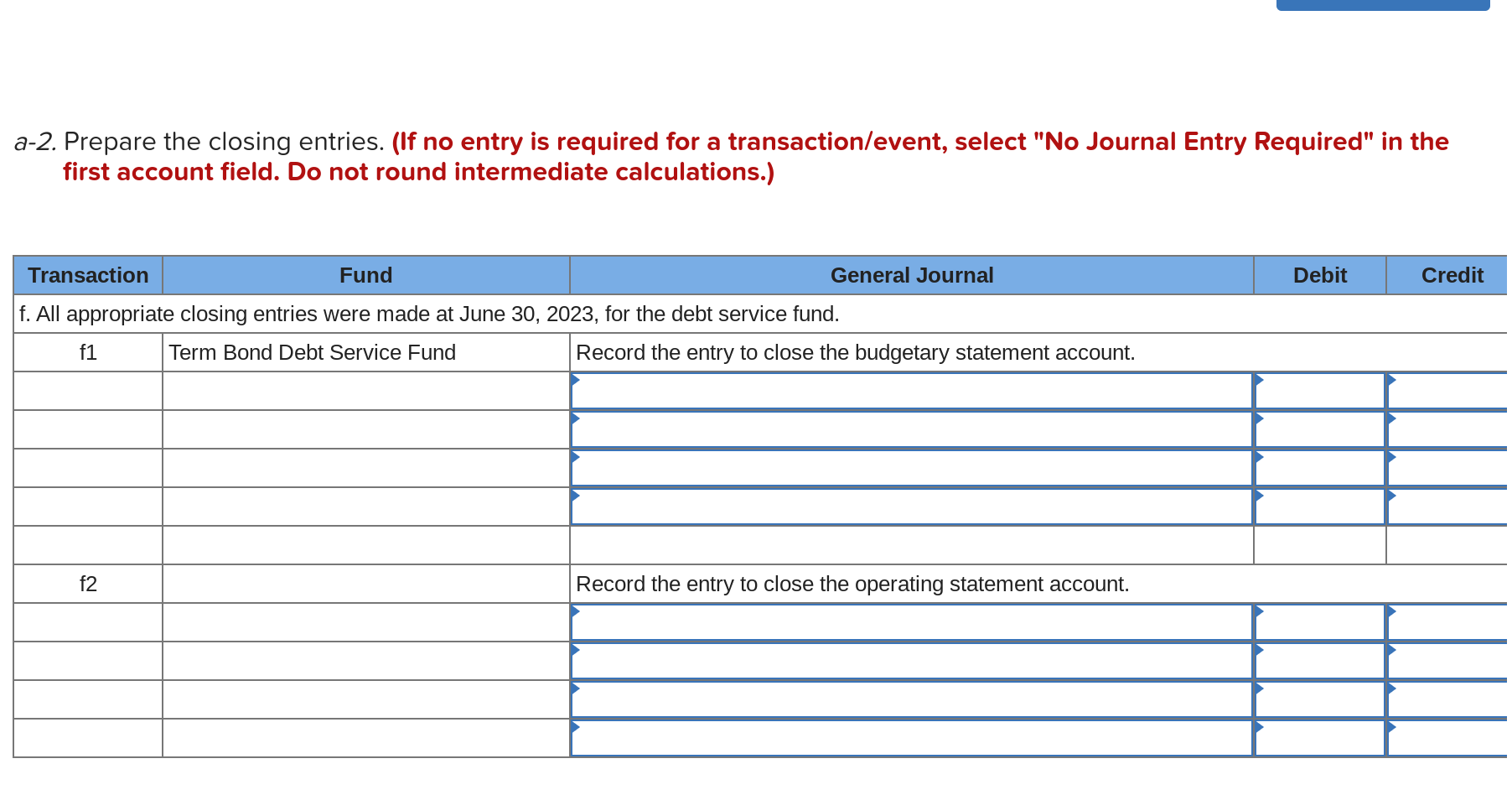

Exercise 6-25 (Static) Term Bond Debt Service Fund Transactions [LO 6-5] On July 1, 2022, the first day of its 2023 fiscal year, the Town of Bear Creek issued at par $2,000,000 of 2 percent term bonds to renovate a historic wing of its main administrative building. The bonds mature in five years on July 1,2027 . Interest is payable semiannually on January 1 and July 1. As illustrated in the table below, a sinking fund is to be established with equal semiannual additions made on June 30 and December 31. Cash for the sinking fund additions and the semiannual interest payments will be transferred from the General Fund shortly before the due dates. Investment earnings are added to the investment principal. Required a-1. Prepare journal entries in the debt service fund for the following: (If no entry is required for a transaction/event, select 1. Prepare journal entries in the debt service fund for the following: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) \begin{tabular}{|c|l|l|l} \hline \multicolumn{2}{|l|}{} & \multicolumn{2}{l}{} \\ \hline \multicolumn{2}{|c|}{ c. On December 28, 2022, the city issued checks to bondholders for the interest payment due on January \( 1,2023} \). \\ \hline c & Term Bond Debt Service Fund & Record the interest payment on the bond. \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} d. On June 27, 2023, the General Fund transferred \$211,164 to the debt service fund. The addition for the sinking fund was invested immediately in 2 percent certificates of deposit. \begin{tabular}{|c|l|l} \hline d1 & Term Bond Debt Service Fund & Record the transfer from the general fund to the debt service fund. \\ \hline & & \\ \hline & & \\ \hline d2 & & Record the investment in the certificates of deposit. \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} e. Actual interest earned on sinking fund investments at year-end (June 30,2023) was the same as the amount budgeted in the table. This interest adds to the sinking fund balance. \begin{tabular}{|c|l|l|l} \hline e & Term Bond Debt Service Fund & Record the actual interest earned on sinking fund investments. \\ \hline & & & \\ \hline & & \\ \hline \end{tabular} a-2. Prepare the closing entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) Exercise 6-25 (Static) Term Bond Debt Service Fund Transactions [LO 6-5] On July 1, 2022, the first day of its 2023 fiscal year, the Town of Bear Creek issued at par $2,000,000 of 2 percent term bonds to renovate a historic wing of its main administrative building. The bonds mature in five years on July 1,2027 . Interest is payable semiannually on January 1 and July 1. As illustrated in the table below, a sinking fund is to be established with equal semiannual additions made on June 30 and December 31. Cash for the sinking fund additions and the semiannual interest payments will be transferred from the General Fund shortly before the due dates. Investment earnings are added to the investment principal. Required a-1. Prepare journal entries in the debt service fund for the following: (If no entry is required for a transaction/event, select 1. Prepare journal entries in the debt service fund for the following: (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.) \begin{tabular}{|c|l|l|l} \hline \multicolumn{2}{|l|}{} & \multicolumn{2}{l}{} \\ \hline \multicolumn{2}{|c|}{ c. On December 28, 2022, the city issued checks to bondholders for the interest payment due on January \( 1,2023} \). \\ \hline c & Term Bond Debt Service Fund & Record the interest payment on the bond. \\ \hline & & & \\ \hline & & & \\ \hline \end{tabular} d. On June 27, 2023, the General Fund transferred \$211,164 to the debt service fund. The addition for the sinking fund was invested immediately in 2 percent certificates of deposit. \begin{tabular}{|c|l|l} \hline d1 & Term Bond Debt Service Fund & Record the transfer from the general fund to the debt service fund. \\ \hline & & \\ \hline & & \\ \hline d2 & & Record the investment in the certificates of deposit. \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} e. Actual interest earned on sinking fund investments at year-end (June 30,2023) was the same as the amount budgeted in the table. This interest adds to the sinking fund balance. \begin{tabular}{|c|l|l|l} \hline e & Term Bond Debt Service Fund & Record the actual interest earned on sinking fund investments. \\ \hline & & & \\ \hline & & \\ \hline \end{tabular} a-2. Prepare the closing entries. (If no entry is required for a transaction/event, select "No Journal Entry Required" in the first account field. Do not round intermediate calculations.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts