Question: Options to select for answer.Automatic StabilizersBalanced budget Balanced surplus Budget deficit Budget functionDiscretionary fiscal policies Disposable income(YD)Fiscal austerity Fiscal policy Government budget Government expenditure (G)Net

Options to select for answer.Automatic StabilizersBalanced budget Balanced surplus Budget deficit Budget functionDiscretionary fiscal policies Disposable income(YD)Fiscal austerity Fiscal policy Government budget Government expenditure (G)Net TaxesPublic debt(PD)Public debt ratio(PD/Y)Structural budget balance (SSB)

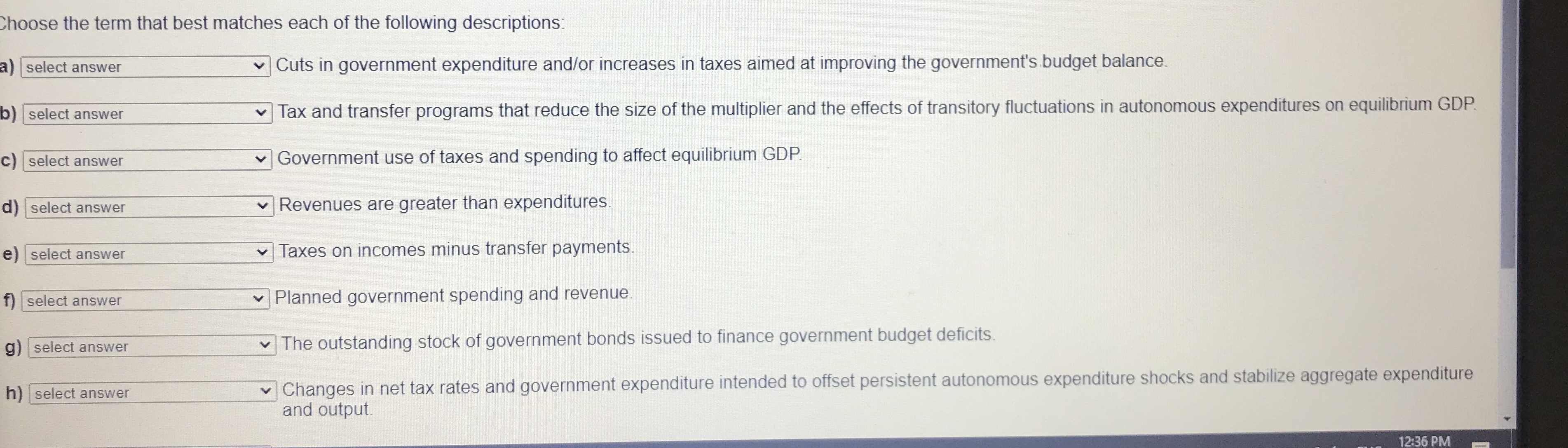

Choose the term that best matches each of the following descriptions select answer Cuts in government expenditure and/or increases in taxes aimed at improving the government's budget balance. b) select answer Tax and transfer programs that reduce the size of the multiplier and the effects of transitory fluctuations in autonomous expenditures on equilibrium GDP. C) select answer Government use of taxes and spending to affect equilibrium GDP. d) select answer Revenues are greater than expenditures. e) select answer Taxes on incomes minus transfer payments f) select answer |Planned government spending and revenue g) select answer The outstanding stock of government bonds issued to finance government budget deficits. h) select answer |Changes in net tax rates and government expenditure intended to offset persistent autonomous expenditure shocks and stabilize aggregate expenditure and output. 12:36 PM

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts