Question: Options: When projects involve certain, or constant, cash flows, the capital budgeting analysis that can be conducted is very simple and straightforward. Unfortunately, this type

Options:

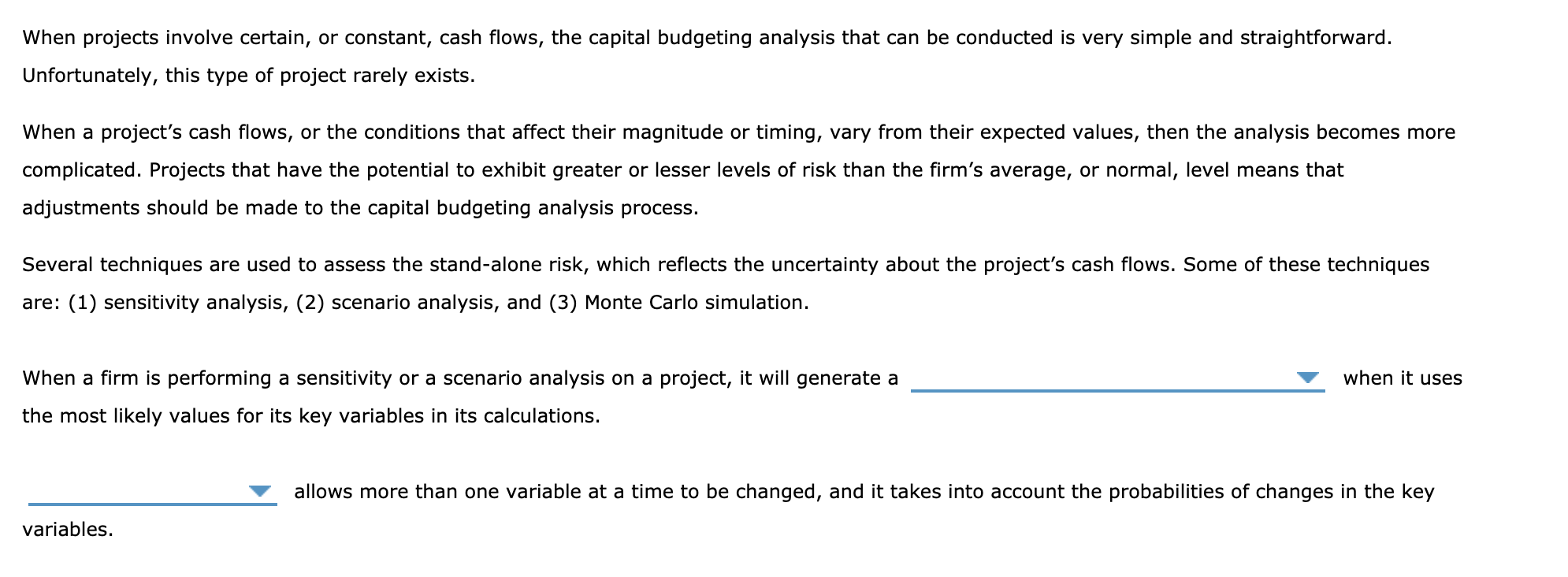

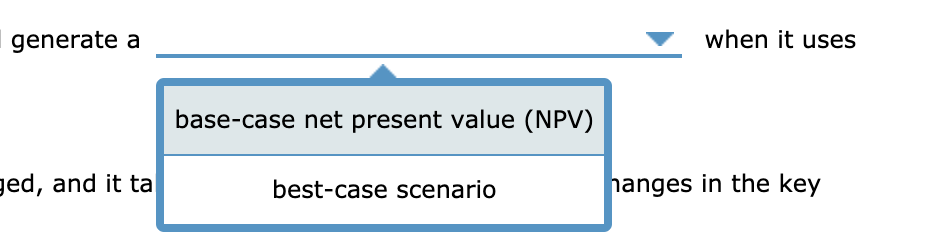

When projects involve certain, or constant, cash flows, the capital budgeting analysis that can be conducted is very simple and straightforward. Unfortunately, this type of project rarely exists. When a project's cash flows, or the conditions that affect their magnitude or timing, vary from their expected values, then the analysis becomes more complicated. Projects that have the potential to exhibit greater or lesser levels of risk than the firm's average, or normal, level means that adjustments should be made to the capital budgeting analysis process. Several techniques are used to assess the stand-alone risk, which reflects the uncertainty about the project's cash flows. Some of these techniques are: (1) sensitivity analysis, (2) scenario analysis, and (3) Monte Carlo simulation. when it uses When a firm is performing a sensitivity or a scenario analysis on a project, it will generate a the most likely values for its key variables in its calculations. allows more than one variable at a time to be changed, and it takes into account the probabilities of changes in the key variables. generate a when it uses base-case net present value (NPV) ged, and it ta best-case scenario hanges in the key Sensitivity analysis hing a sensitivity or a scenario analysis on a pre for its key variables in its calculations. Scenario analysis t allows more than one variable at a time variables

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts