Question: or (2) wait until you are 42 to start saving and then save $11,250 per year for the next 10 years. Assume you will earn

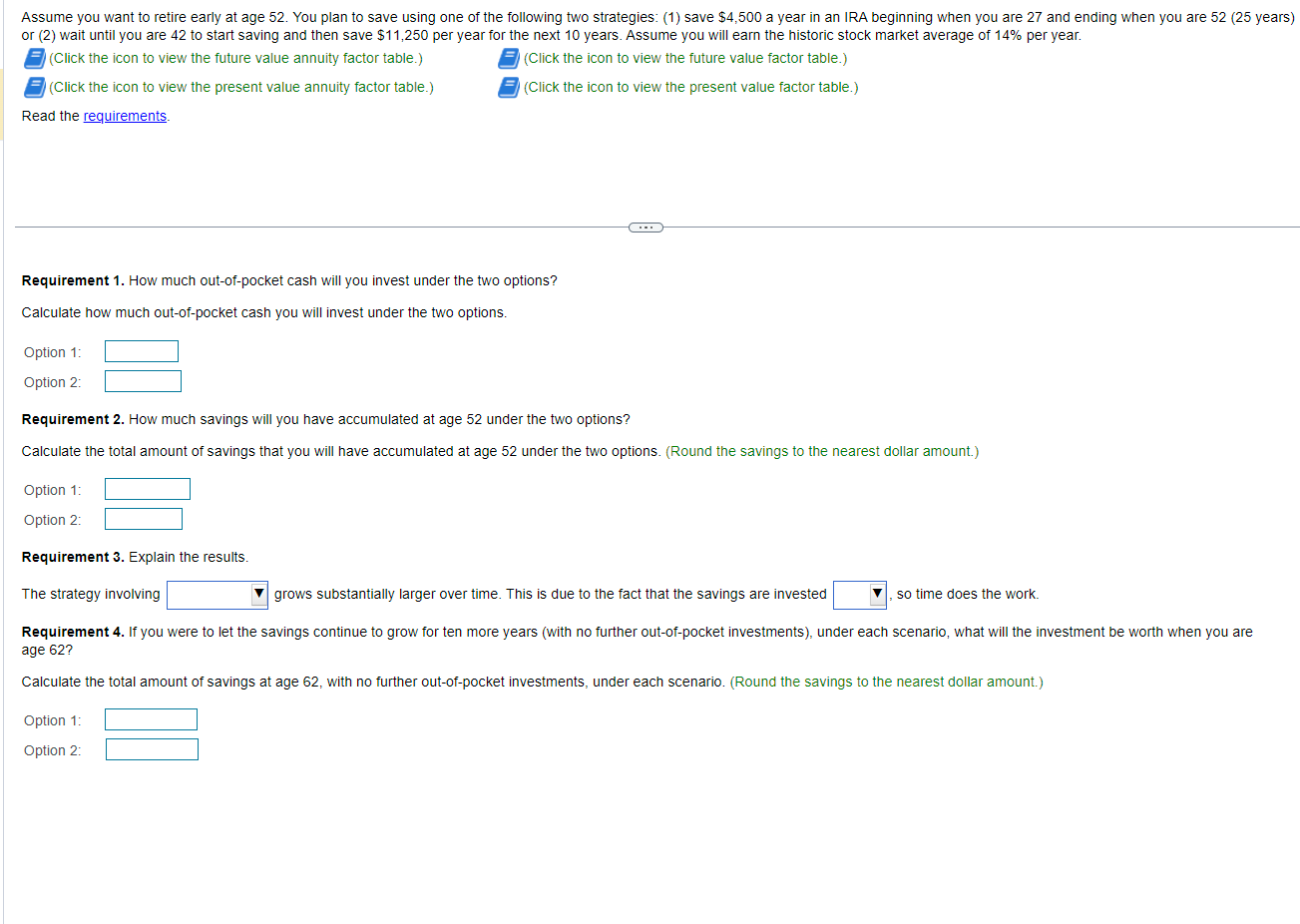

or (2) wait until you are 42 to start saving and then save $11,250 per year for the next 10 years. Assume you will earn the historic stock market average of 14% per year. (Click the icon to view the future value annuity factor table.) (Click the icon to view the future value factor table.) (Click the icon to view the present value annuity factor table.) (Click the icon to view the present value factor table.) Read the requirements. Requirement 1. How much out-of-pocket cash will you invest under the two options? Calculate how much out-of-pocket cash you will invest under the two options. Option 1: Option 2: Requirement 2. How much savings will you have accumulated at age 52 under the two options? Calculate the total amount of savings that you will have accumulated at age 52 under the two options. (Round the savings to the nearest dollar amount.) Option 1: Option 2: Requirement 3 . Explain the results. The strategy involving grows substantially larger over time. This is due to the fact that the savings are invested so time does the work. age 62? Calculate the total amount of savings at age 62 , with no further out-of-pocket investments, under each scenario. (Round the savings to the nearest dollar amount.) Option 1: Option 2: Requirement 3 . Explain the results. The strategy involving Requirement 4. If you age 62? Calculate the total amo Option 1: Option 2: grows substantially larger over time. This is due to the fact that the savings are invested tinue to grow for ten more years (with no further out-of-pocket investments), under each scenario, what will the investment be worth when you are ith no further out-of-pocket investments, under each scenario. (Round the savings to the nearest dollar amount.) Requirement 3 . Explain the results. The strategy involving grows substantially larger over time. This is due to the fact that the savings are invested so time does the work. Requirement 4. If you were to let the savings continue to grow for ten more years (with no further out-of-pocket investments), ur what will the investment be worth when you are age 62? Calculate the total amount of savings at age 62 , with no further out-of-pocket investments, under each scenario. (Round the savi ollar amount.) Option 1: Option 2

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts