Question: Orange Tech (OT) is a software company that provides a suite of programs that are essential to everyday business computing. OT has just enhanced its

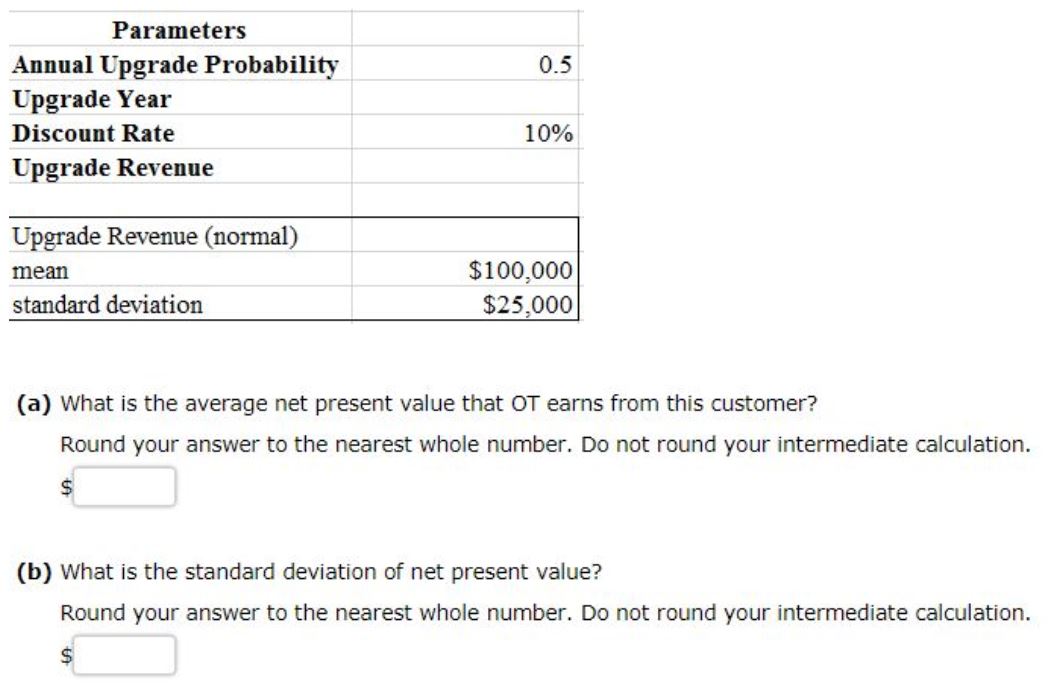

Orange Tech (OT) is a software company that provides a suite of programs that are essential to everyday business computing. OT has just enhanced its software and released a new version of its programs. For financial planning purposes, OT needs to forecast its revenue over the next few years. To begin this analysis, OT is considering one of its largest customers. Over the planning horizon, assume that this customer will upgrade at most once to the newest software version, but the number of years that pass before the customer purchases an upgrade varies. Up to the year that the customer actually upgrades, assume there is a 0.50 probability that the customer upgrades in any particular year. In other words, the upgrade year of the customer is a random variable. Assume that the revenue from an upgrade obeys a normal distribution with a mean of $100,000 and a standard deviation of $25,000. Help me simulate a model that analyzes the net present value of the revenue from the customer upgrade. Use an annual discount rate of 10%.

\f

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts