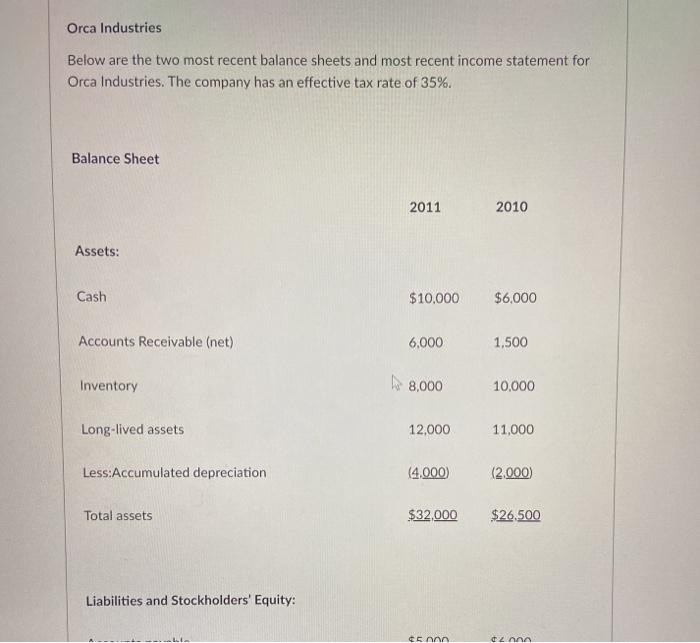

Question: Orca Industries Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate

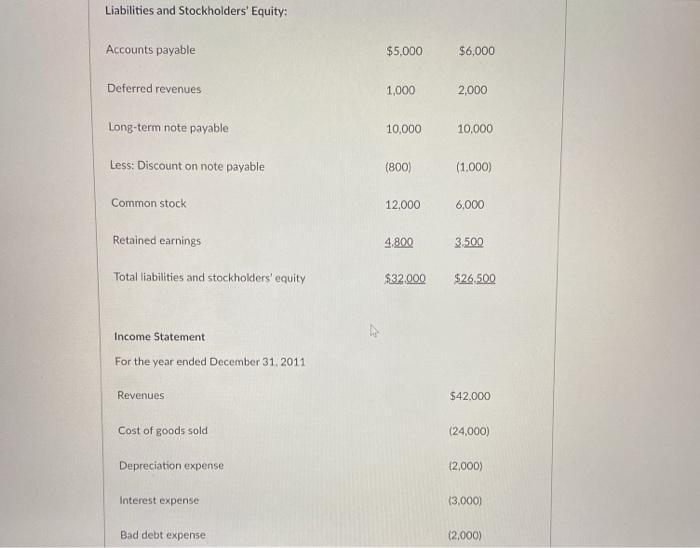

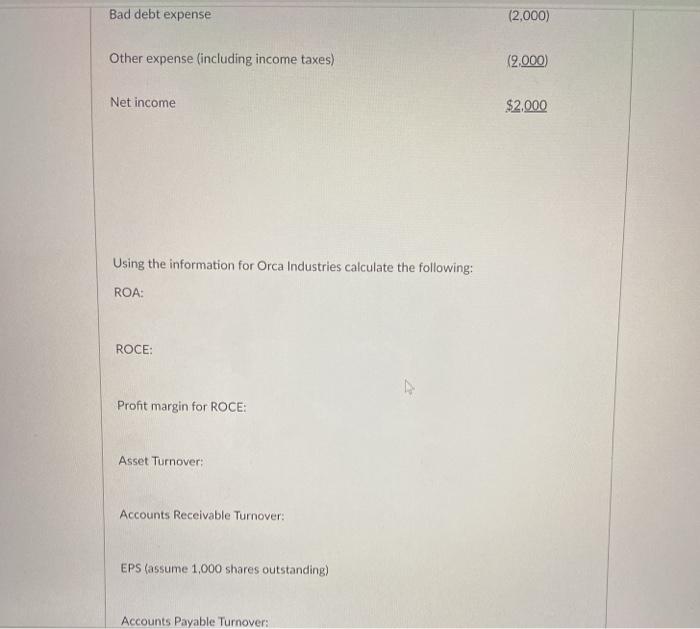

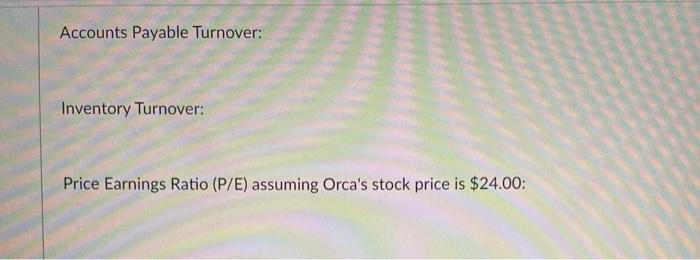

Orca Industries Below are the two most recent balance sheets and most recent income statement for Orca Industries. The company has an effective tax rate of 35%. Balance Sheet 2011 2010 Assets: Cash $10,000 $6,000 Accounts Receivable (net) 6,000 1,500 Inventory h 8,000 10,000 Long-lived assets 12,000 11,000 Less:Accumulated depreciation (4,000 (2.000) Total assets $32.000 $26.500 Liabilities and Stockholders' Equity: Conn 2 Liabilities and Stockholders' Equity: Accounts payable $5,000 $6,000 Deferred revenues 1,000 2,000 Long-term note payable 10,000 10,000 Less: Discount on note payable (800) (1.000) Common stock 12,000 6,000 Retained earnings 4.800 3500 Total liabilities and stockholders' equity $32.000 $26.500 Income Statement For the year ended December 31, 2011 Revenues $42.000 Cost of goods sold (24,000) Depreciation expense (2.000) Interest expense (3.000) Bad debt expense (2.000) Bad debt expense (2.000) Other expense (including income taxes) (2.000) Net income $2.000 Using the information for Orca Industries calculate the following: ROA: ROCE: Profit margin for ROCE: Asset Turnover: Accounts Receivable Turnover: EPS (assume 1,000 shares outstanding) Accounts Payable Turnover: Accounts Payable Turnover: Inventory Turnover: Price Earnings Ratio (P/E) assuming Orca's stock price is $24.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts