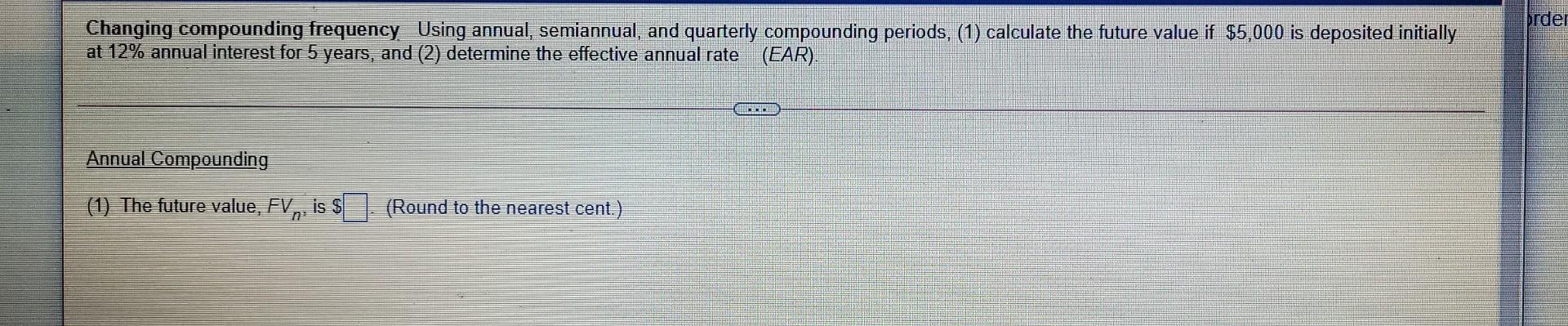

Question: order Changing compounding frequency. Using annual, semiannual, and quarterly compounding periods, (1) calculate the future value if $5,000 is deposited initially at 12% annual interest

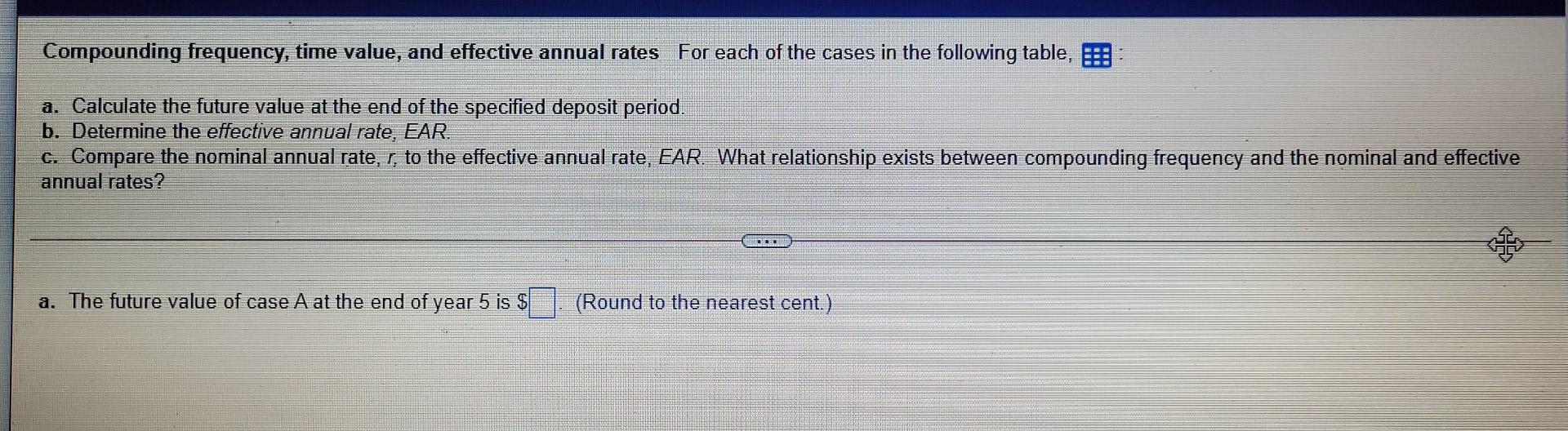

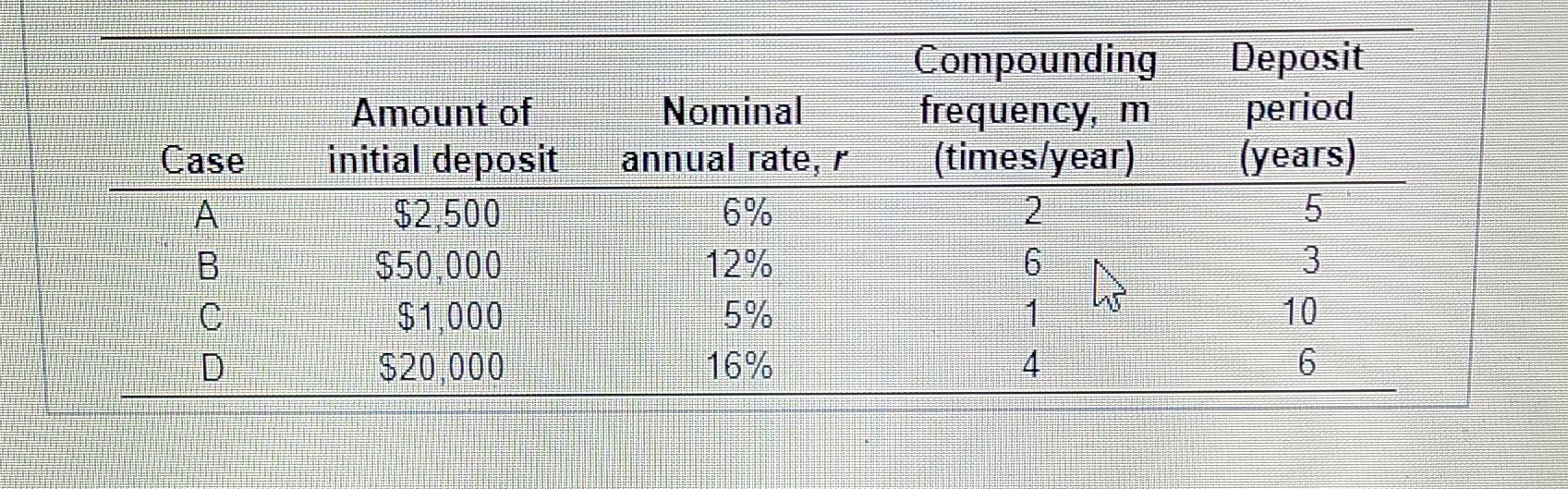

order Changing compounding frequency. Using annual, semiannual, and quarterly compounding periods, (1) calculate the future value if $5,000 is deposited initially at 12% annual interest for 5 years, and (2) determine the effective annual rate (EAR) RA Annual Compounding (1) The future value, FV, is $ (Round to the nearest cent.) Compounding frequency, time value, and effective annual rates For each of the cases in the following table, a. Calculate the future value at the end of the specified deposit period. b. Determine the effective annual rate, EAR. C. Compare the nominal annual rate, r, to the effective annual rate, EAR. What relationship exists between compounding frequency and the nominal and effective annual rates? a. The future value of case A at the end of year 5 is $ (Round to the nearest cent.) Compounding frequency, m (times/year) 2 Case Amount of initial deposit $2.500 $50.000 $1,000 $20,000 Nominal annual rate, r 6% 12% 5% 16% Deposit period (years) 5 3 6 B C 1 D 4 6

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts